Region:Asia

Author(s):Rebecca

Product Code:KRAC3867

Pages:95

Published On:October 2025

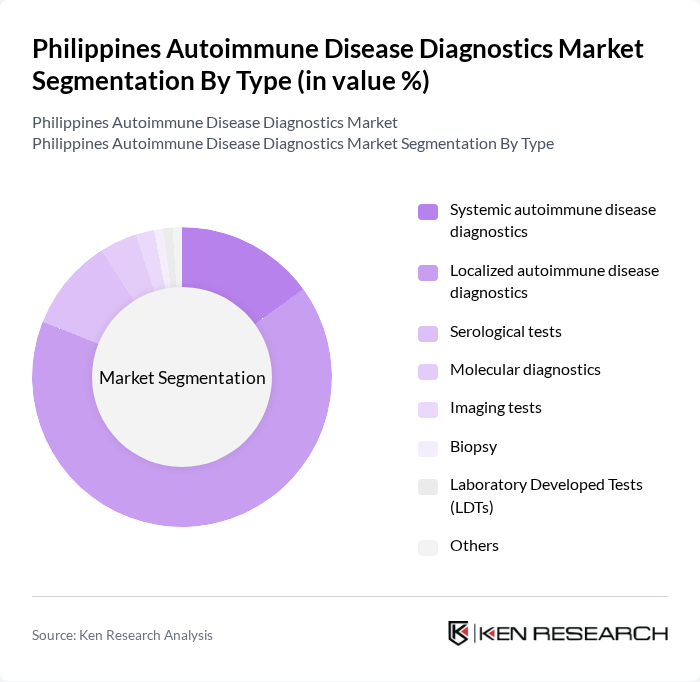

By Type:The market is segmented into systemic autoimmune disease diagnostics, localized autoimmune disease diagnostics, serological tests, molecular diagnostics, imaging tests, biopsy, laboratory developed tests (LDTs), and others. Localized autoimmune disease diagnostics currently hold the largest market share, reflecting their widespread use in identifying conditions such as Graves’ disease and Hashimoto’s thyroiditis. Serological tests remain highly adopted in hospitals and laboratories due to their accuracy and efficiency in detecting disorders like rheumatoid arthritis and lupus. The market is further shaped by the increasing use of molecular diagnostics and laboratory developed tests, which support more precise and personalized approaches to autoimmune disease detection .

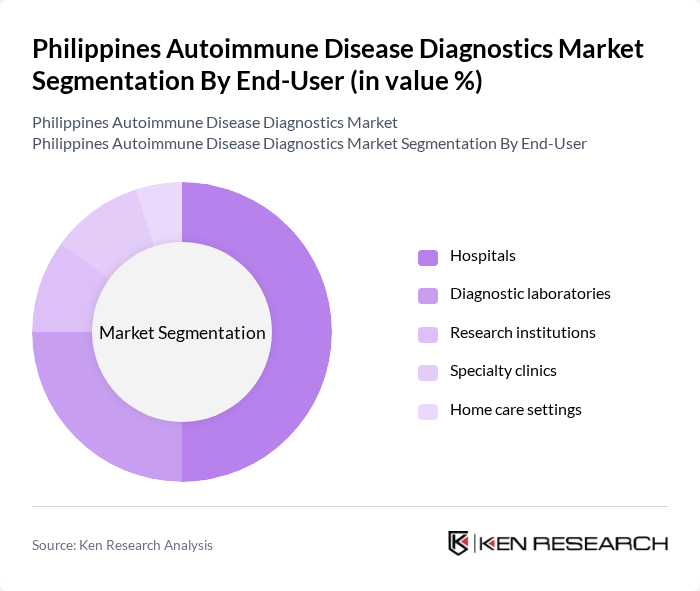

By End-User:The end-user segmentation includes hospitals, diagnostic laboratories, research institutions, specialty clinics, and home care settings. Hospitals are the leading end-user segment, driven by their comprehensive facilities, advanced diagnostic technologies, and the increasing number of patients seeking diagnosis and treatment for autoimmune diseases. Diagnostic laboratories are also experiencing significant growth, supported by rising demand for specialized testing and integration of automation technologies. Specialty clinics and research institutions contribute to market expansion through focused expertise and ongoing research, while home care settings remain a niche segment .

The Philippines Autoimmune Disease Diagnostics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Roche Diagnostics, Abbott Laboratories, Siemens Healthineers, Thermo Fisher Scientific, Bio-Rad Laboratories, Ortho Clinical Diagnostics, Quest Diagnostics, Beckman Coulter, Fujirebio, BD (Becton, Dickinson and Company), Trinity Biotech, BioMérieux, PerkinElmer, DiaSorin, and Mindray contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Philippines autoimmune disease diagnostics market appears promising, driven by technological advancements and increased healthcare investments. The integration of artificial intelligence in diagnostics is expected to enhance accuracy and efficiency, while the expansion of telemedicine services will improve access to care, especially in underserved areas. As healthcare infrastructure continues to develop, the market is likely to witness a surge in innovative diagnostic solutions tailored to meet the growing demand for autoimmune disease testing.

| Segment | Sub-Segments |

|---|---|

| By Type | Systemic autoimmune disease diagnostics Localized autoimmune disease diagnostics Serological tests Molecular diagnostics Imaging tests Biopsy Laboratory Developed Tests (LDTs) Others |

| By End-User | Hospitals Diagnostic laboratories Research institutions Specialty clinics Home care settings |

| By Application | Rheumatoid arthritis Systemic lupus erythematosus Multiple sclerosis Hashimoto's thyroiditis Celiac disease Others |

| By Distribution Channel | Direct sales Online sales Distributors Others |

| By Region | Luzon Visayas Mindanao Others |

| By Pricing Strategy | Premium pricing Competitive pricing Value-based pricing |

| By Technology | Automated systems Manual testing Hybrid systems Digital/AI-enabled diagnostics Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Professionals | 100 | Rheumatologists, Immunologists, General Practitioners |

| Diagnostic Laboratories | 60 | Laboratory Managers, Technicians, Quality Control Officers |

| Patients with Autoimmune Diseases | 80 | Individuals diagnosed with lupus, rheumatoid arthritis, and other autoimmune conditions |

| Healthcare Policy Makers | 40 | Health Department Officials, Insurance Company Representatives |

| Diagnostic Equipment Suppliers | 40 | Sales Managers, Product Development Specialists |

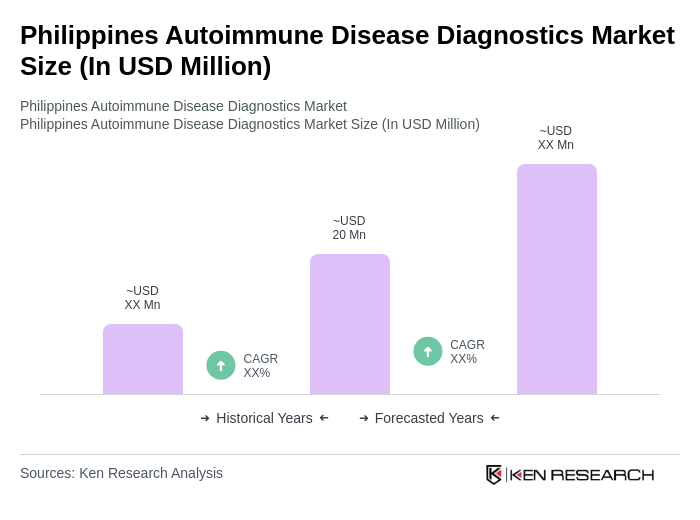

The Philippines Autoimmune Disease Diagnostics Market is valued at approximately USD 20 million, reflecting a five-year historical analysis. This market is growing due to the increasing prevalence of autoimmune diseases and advancements in diagnostic technologies.