Region:Middle East

Author(s):Geetanshi

Product Code:KRAD8199

Pages:96

Published On:December 2025

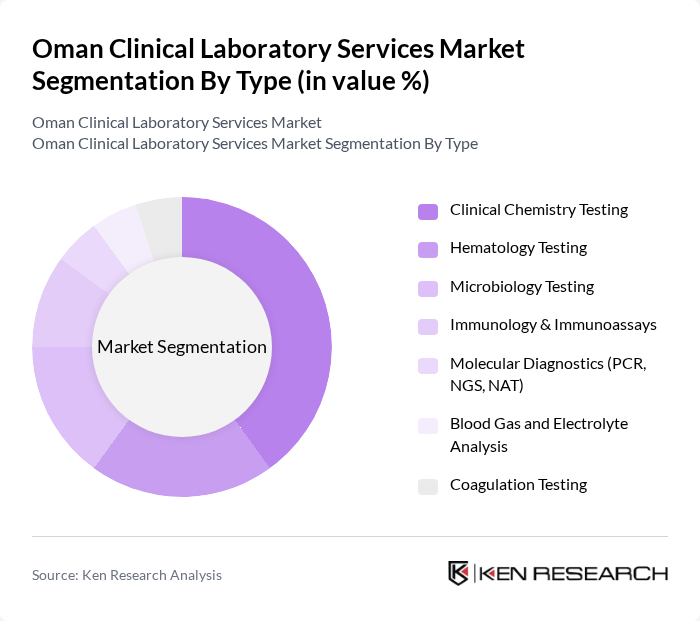

By Type:The market is segmented into various types of laboratory services, including Clinical Chemistry Testing, Hematology Testing, Microbiology Testing, Immunology & Immunoassays, Molecular Diagnostics (PCR, NGS, NAT), Blood Gas and Electrolyte Analysis, and Coagulation Testing. Among these, Clinical Chemistry Testing is the most dominant segment due to its extensive application in routine health check-ups and disease diagnosis. The increasing prevalence of metabolic disorders and the need for regular monitoring of patients contribute to its leading position in the market.

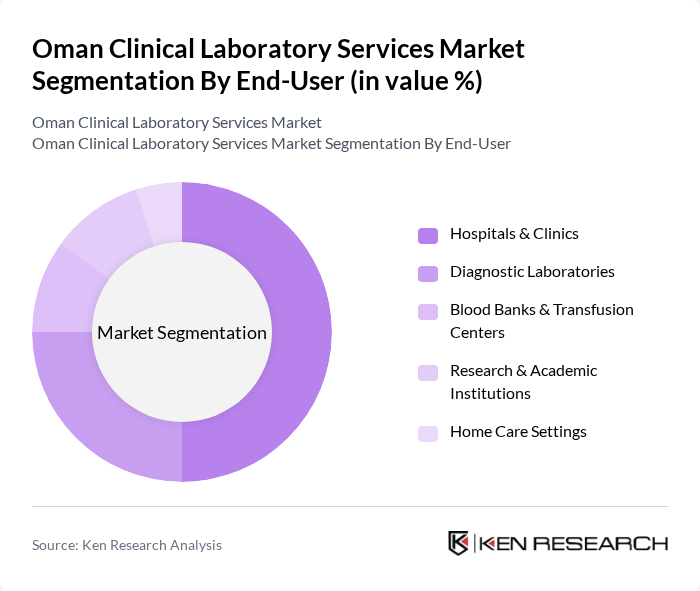

By End-User:The end-user segmentation includes Hospitals & Clinics, Diagnostic Laboratories, Blood Banks & Transfusion Centers, Research & Academic Institutions, and Home Care Settings. Hospitals & Clinics represent the largest share of the market, driven by the high volume of tests conducted for inpatients and outpatients. The increasing number of healthcare facilities and the growing focus on patient-centered care further enhance the demand for laboratory services in this segment.

The Oman Clinical Laboratory Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Ahlia Laboratory, Oman Medical Laboratory, Al Noor Hospital Laboratory Services, Sultan Qaboos University Hospital Laboratory, Aster DM Healthcare Oman, Dr. Sulaiman Al Habib Medical Group - Oman, Oman International Hospital Laboratory, Al Hayat Medical Laboratory, Al Jazeera Medical Laboratory, Al Shifa Medical Laboratory, Al Mufeed Medical Laboratory, Al Muna Medical Laboratory, Muscat Diagnostic Laboratory, Al Batinah Hospital Laboratory Services, Gulf Medical University Laboratory Services contribute to innovation, geographic expansion, and service delivery in this space.

The future of the clinical laboratory services market in Oman appears promising, driven by ongoing advancements in technology and a growing emphasis on preventive healthcare. As the healthcare sector continues to evolve, laboratories are expected to adopt more automated processes and integrate artificial intelligence to enhance diagnostic accuracy. Additionally, the increasing collaboration between laboratories and healthcare providers will likely foster innovation and improve patient care, positioning the market for sustainable growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Clinical Chemistry Testing Hematology Testing Microbiology Testing Immunology & Immunoassays Molecular Diagnostics (PCR, NGS, NAT) Blood Gas and Electrolyte Analysis Coagulation Testing |

| By End-User | Hospitals & Clinics Diagnostic Laboratories Blood Banks & Transfusion Centers Research & Academic Institutions Home Care Settings |

| By Service Type | Routine Testing Specialized Testing Point-of-Care Testing High-Throughput Testing |

| By Sample Type | Blood Samples Urine Samples Tissue Samples Saliva Samples Swab Samples |

| By Technology | Automated Analyzers Real-Time PCR & Digital PCR Sequencing Technologies Hybridization Techniques Microfluidics |

| By Geographic Distribution | Muscat Salalah Sohar Nizwa Other Regions |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Pharmacies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Diagnostic Laboratory Services | 100 | Laboratory Managers, Medical Technologists |

| Pathology Services | 80 | Pathologists, Clinical Laboratory Directors |

| Patient Experience in Labs | 75 | Patients, Healthcare Providers |

| Regulatory Compliance in Labs | 60 | Quality Assurance Officers, Compliance Managers |

| Emerging Technologies in Clinical Labs | 90 | IT Managers, R&D Specialists |

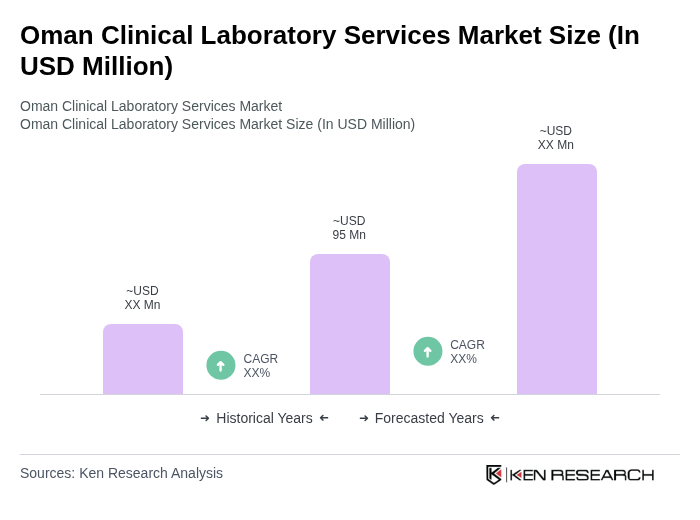

The Oman Clinical Laboratory Services Market is valued at approximately USD 95 million, reflecting a five-year historical analysis. This growth is driven by the increasing prevalence of chronic diseases and advancements in diagnostic technologies.