Region:Asia

Author(s):Geetanshi

Product Code:KRAE0684

Pages:86

Published On:December 2025

By Type:The market is segmented into various types of biometric technologies, including fingerprint recognition, facial recognition, iris recognition, voice recognition, palm recognition, behavioral biometrics, and others. Among these, fingerprint recognition is the most widely adopted due to its cost-effectiveness and ease of integration into existing systems. Facial recognition is gaining traction, especially in security and surveillance applications, driven by advancements in AI and machine learning.

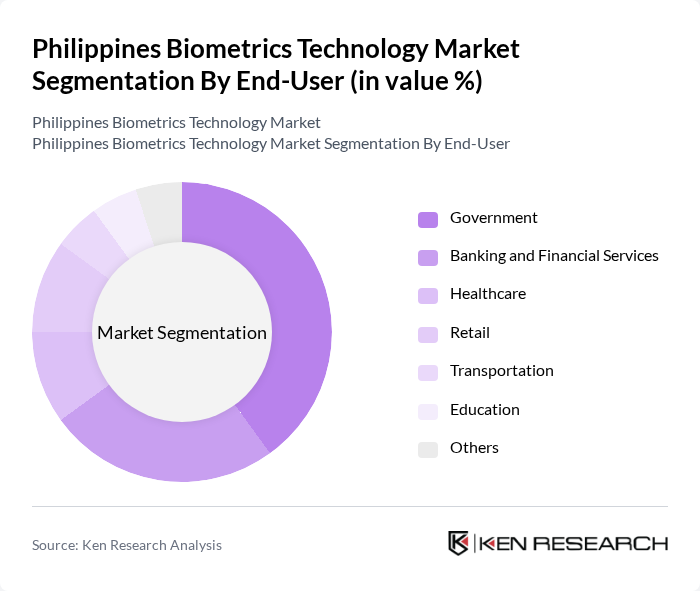

By End-User:The end-user segmentation includes government, banking and financial services, healthcare, retail, transportation, education, and others. The government sector is the largest end-user, driven by initiatives like the PhilSys, which require robust identity verification systems. The banking and financial services sector follows closely, as institutions seek to enhance security and streamline customer onboarding processes.

The Philippines Biometrics Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as NEC Corporation, Gemalto (Thales Group), HID Global, Suprema Inc., BioID AG, Aware, Inc., Crossmatch Technologies, ZKTeco, Innovatrics, IDEMIA, SecuGen Corporation, FaceFirst, Cognitec Systems, Vision-Box, SRI International contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines biometrics technology market is poised for substantial growth, driven by increasing security demands and government digital initiatives. As organizations across sectors adopt biometric solutions, the market will likely see innovations in contactless technologies and AI integration. Furthermore, the rise of mobile biometric applications will enhance accessibility and convenience, making these systems more appealing. Overall, the market is expected to evolve rapidly, addressing challenges while capitalizing on emerging opportunities in various industries.

| Segment | Sub-Segments |

|---|---|

| By Type | Fingerprint Recognition Facial Recognition Iris Recognition Voice Recognition Palm Recognition Behavioral Biometrics Others |

| By End-User | Government Banking and Financial Services Healthcare Retail Transportation Education Others |

| By Application | Access Control Time and Attendance Tracking Identity Verification Border Control Payment Processing Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid Others |

| By Technology | Optical Systems Capacitive Systems Thermal Systems Ultrasonic Systems Others |

| By Industry Vertical | Government and Defense Financial Services Healthcare Retail Transportation and Logistics Others |

| By Region | Luzon Visayas Mindanao Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Government Sector Biometric Implementation | 100 | IT Managers, Security Officers |

| Healthcare Biometric Solutions | 80 | Healthcare Administrators, IT Directors |

| Financial Services Biometric Applications | 90 | Compliance Officers, Risk Management Executives |

| Retail Biometric Systems | 70 | Store Managers, Loss Prevention Specialists |

| Education Sector Biometric Adoption | 60 | School Administrators, IT Coordinators |

The Philippines Biometrics Technology Market is valued at approximately USD 205 million. This growth is driven by increasing security threats and the demand for reliable authentication methods across various sectors, including finance, healthcare, and smart cities.