Region:Asia

Author(s):Dev

Product Code:KRAD5298

Pages:91

Published On:December 2025

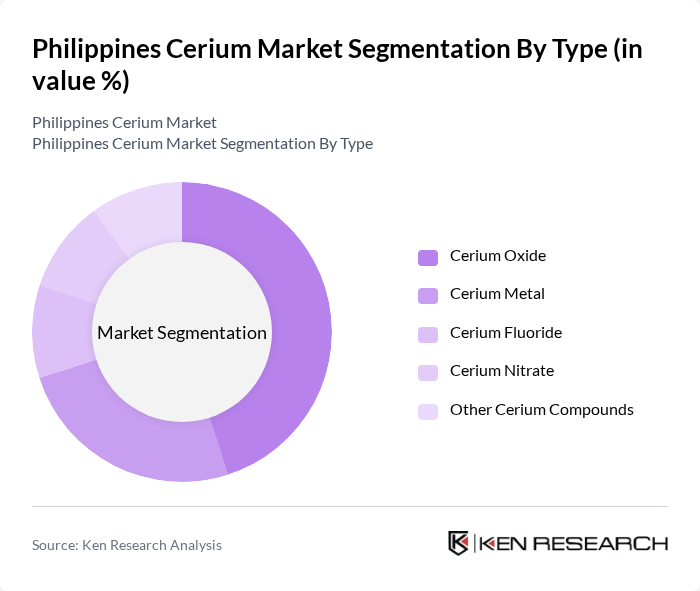

By Type:The cerium market can be segmented into various types, including Cerium Oxide, Cerium Metal, Cerium Fluoride, Cerium Nitrate, and Other Cerium Compounds. Among these, Cerium Oxide is the most dominant sub-segment due to its extensive use in glass polishing and catalytic converters. The increasing demand for high-quality glass products and stringent emission regulations in the automotive sector are driving the growth of this sub-segment.

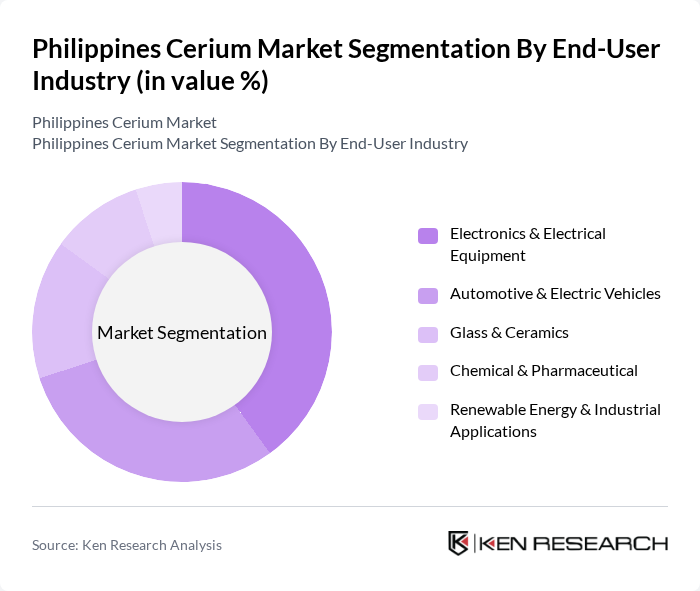

By End-User Industry:The cerium market is segmented by end-user industries, including Electronics & Electrical Equipment, Automotive & Electric Vehicles, Glass & Ceramics, Chemical & Pharmaceutical, and Renewable Energy & Industrial Applications. The Electronics & Electrical Equipment sector is the leading segment, driven by the increasing demand for high-performance materials in electronic devices and components.

The Philippines Cerium Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lynas Rare Earths Ltd., China Northern Rare Earth (Group) High-Tech Co., Ltd., Neo Performance Materials Inc., MP Materials Corp., Iluka Resources Limited, Energy Fuels Inc., Shenghe Resources Holding Co., Ltd., Ganzhou Hongjin Rare Earth Co., Ltd., Sinosteel Corporation (Rare Earth Division), Philippine Phosphate Fertilizer Corp. (PHILPHOS) – Cerium-Using Industrial End-User, Pilipinas Shell Petroleum Corporation – Cerium-Based Catalyst End-User, First Philippine Industrial Park, Inc. – Cerium Demand Cluster (Electronics & Automotive Tenants), 6Wresearch / Local Market Intelligence Partners – Cerium Market Data Providers, Local Chemical Distributors (e.g., KemTrend Industrial Chemical Supply, Chemrez Technologies Inc.), Other Regional Rare Earth Producers Supplying the Philippines contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines cerium market is expected to evolve significantly, driven by technological advancements and a growing emphasis on sustainability. As industries increasingly adopt cerium-based solutions, particularly in renewable energy and electronics, the demand is likely to rise. Furthermore, strategic partnerships with global players could enhance local production capabilities, addressing supply chain issues. The focus on environmental regulations will also push for cleaner production methods, fostering innovation and potentially increasing cerium's market share in various applications.

| Segment | Sub-Segments |

|---|---|

| By Type | Cerium Oxide Cerium Metal Cerium Fluoride Cerium Nitrate Other Cerium Compounds |

| By End-User Industry | Electronics & Electrical Equipment Automotive & Electric Vehicles Glass & Ceramics Chemical & Pharmaceutical Renewable Energy & Industrial Applications |

| By Application | Glass Polishing Catalytic Converters & Emission Control Catalysts Glass Additives & UV-Absorbing Glass Ceramics & Pigments Metal Alloys & Other Specialty Applications |

| By Distribution Channel | Direct Sales to Industrial End-Users Local Chemical & Materials Distributors International Traders & Importers Online B2B Platforms Other Channels |

| By Geography | Luzon (including Metro Manila & CALABARZON industrial corridor) Visayas Mindanao Other Regions |

| By Product Form | Nanoparticles / Nano Powders Micronized Powder Solutions & Slurries Other Forms |

| By Customer Segment | Large Enterprises Small & Medium Enterprises (SMEs) Research Institutions & Universities |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cerium Oxide Production | 45 | Production Managers, Quality Control Supervisors |

| Electronics Manufacturing Sector | 40 | Product Development Engineers, Supply Chain Managers |

| Automotive Catalysts Market | 35 | Procurement Managers, R&D Directors |

| Renewable Energy Applications | 30 | Project Managers, Sustainability Officers |

| Research Institutions and Academia | 25 | Researchers, Professors in Material Science |

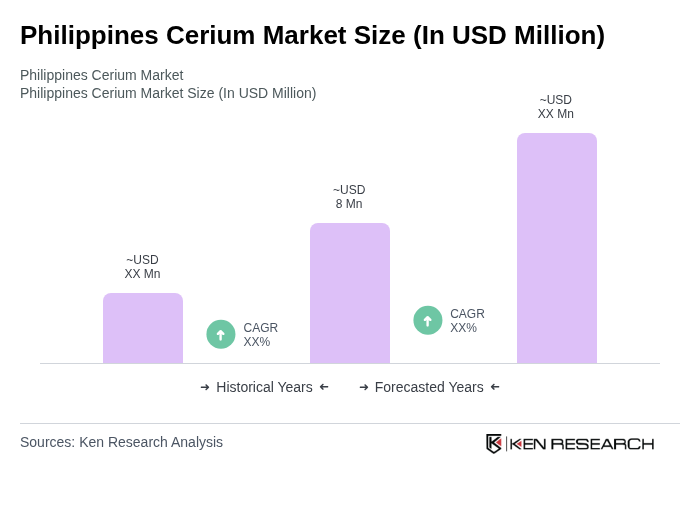

The Philippines Cerium Market is valued at approximately USD 8 million, driven by increasing demand across various sectors such as electronics, automotive, and renewable energy. This growth reflects a robust expansion influenced by technological advancements and industrial activities.