Region:Asia

Author(s):Rebecca

Product Code:KRAD7497

Pages:96

Published On:December 2025

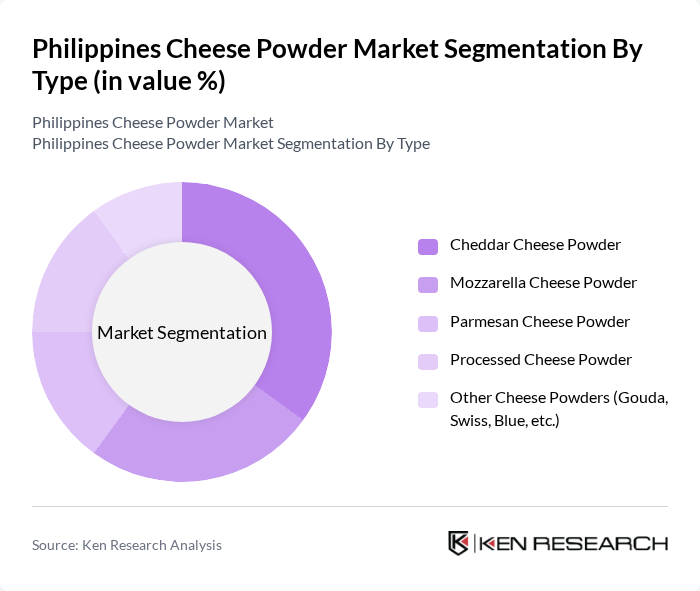

By Type:The cheese powder market can be segmented into various types, including Cheddar Cheese Powder, Mozzarella Cheese Powder, Parmesan Cheese Powder, Processed Cheese Powder, and Other Cheese Powders (Gouda, Swiss, Blue, etc.). Each type serves different culinary applications and consumer preferences.

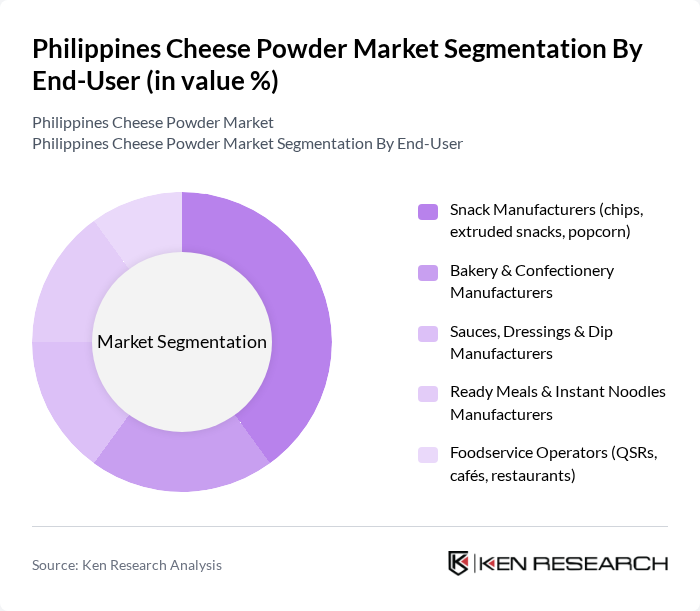

By End-User:The end-user segmentation includes Snack Manufacturers, Bakery & Confectionery Manufacturers, Sauces, Dressings & Dip Manufacturers, Ready Meals & Instant Noodles Manufacturers, and Foodservice Operators. Each segment utilizes cheese powder in various applications, catering to diverse consumer tastes.

The Philippines Cheese Powder Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mondelez Philippines Inc. (Eden, Cheez Whiz), Fonterra Brands Philippines Inc. (Anchor Food Professionals), FrieslandCampina Ingredients, Arla Foods Ingredients Group P/S, Lactalis Group, Kerry Group plc, Ornua Co-operative Limited (Kerrygold, Ornua Ingredients), Savoury Systems Philippines / Local Seasoning Blenders, Cargill Philippines Inc., Dairygold Co-Operative Society, Land O'Lakes, Inc., Saputo Inc., Schreiber Foods Inc., Emmi Group, Parmalat (Lactalis Parmalat) contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines cheese powder market is poised for significant growth, driven by evolving consumer preferences towards convenience and flavor enhancement in food products. As the food processing industry continues to expand, innovations in cheese powder formulations and packaging will likely emerge. Additionally, the increasing trend of online food retailing will facilitate broader distribution channels, allowing manufacturers to reach a wider audience and capitalize on the growing demand for cheese-flavored products in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Cheddar Cheese Powder Mozzarella Cheese Powder Parmesan Cheese Powder Processed Cheese Powder Other Cheese Powders (Gouda, Swiss, Blue, etc.) |

| By End-User | Snack Manufacturers (chips, extruded snacks, popcorn) Bakery & Confectionery Manufacturers Sauces, Dressings & Dip Manufacturers Ready Meals & Instant Noodles Manufacturers Foodservice Operators (QSRs, cafés, restaurants) |

| By Distribution Channel | B2B Direct Sales to Food Manufacturers Food Ingredient Distributors Cash & Carry / Wholesale Stores Online B2B Platforms Retail Channels (supermarkets, groceries) |

| By Packaging Type | Bulk Industrial Packs (10–25 kg bags) HoReCa Packs (1–5 kg) Retail Packs (?1 kg sachets, pouches, jars) Sustainable / Eco-friendly Packaging Formats |

| By Application | Snacks Seasoning (chips, extruded snacks, popcorn) Bakery & Pizza Toppings Sauces, Soups and Dressings Ready-to-Eat & Ready-to-Cook Meals Instant Noodles, Pasta and Rice Dishes |

| By Region | Luzon (including Metro Manila) Visayas Mindanao Other Emerging Urban Centers |

| By Consumer Demographics | Household vs Institutional Consumption Income Level (Low, Middle, High) Urban vs Rural Age Group (Children, Youth, Adults) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Service Sector | 100 | Restaurant Owners, Catering Managers |

| Retail Distribution | 80 | Supermarket Buyers, Convenience Store Managers |

| Manufacturing Sector | 70 | Production Managers, Quality Control Officers |

| Consumer Insights | 120 | Household Consumers, Health-Conscious Shoppers |

| Export Market Analysis | 60 | Export Managers, Trade Analysts |

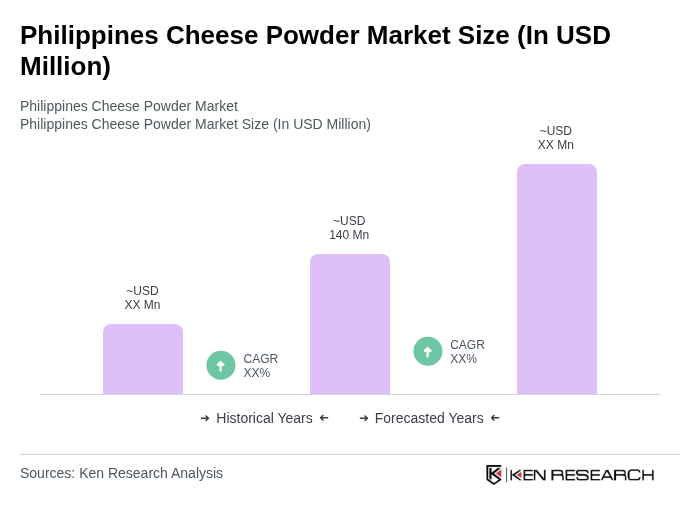

The Philippines Cheese Powder Market is valued at approximately USD 140 million, reflecting significant growth driven by increasing demand for convenience foods, snack culture, and the expansion of the food processing industry.