Region:Asia

Author(s):Geetanshi

Product Code:KRAB4642

Pages:95

Published On:October 2025

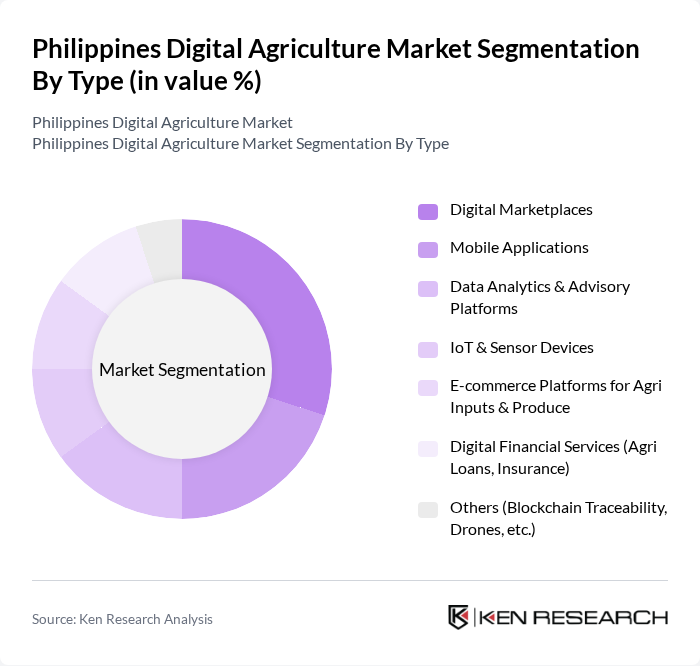

By Type:The digital agriculture market can be segmented into various types, including Digital Marketplaces, Mobile Applications, Data Analytics & Advisory Platforms, IoT & Sensor Devices, E-commerce Platforms for Agri Inputs & Produce, Digital Financial Services (Agri Loans, Insurance), and Others (Blockchain Traceability, Drones, etc.). Each of these segments plays a crucial role in enhancing agricultural efficiency and market access .

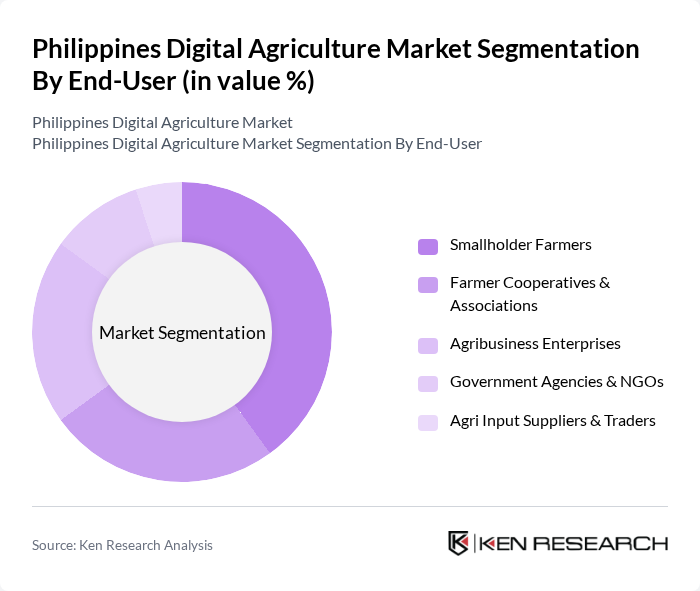

By End-User:The end-users of digital agriculture solutions include Smallholder Farmers, Farmer Cooperatives & Associations, Agribusiness Enterprises, Government Agencies & NGOs, and Agri Input Suppliers & Traders. Each of these user groups has distinct needs and benefits from digital solutions tailored to their specific requirements .

The Philippines Digital Agriculture Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mayani, Cropital, FarmOn.ph, AgriPinoy, Farm2Market, AgriKonek, Farmonaut, GCash Farmers, e-Magsasaka, Agrabah, RiceUp, Bayan-Anihan, Krops, AgroDigital PH, Digital Green contribute to innovation, geographic expansion, and service delivery in this space.

The future of the digital agriculture market in the Philippines appears promising, driven by increasing technological adoption and government support. As internet connectivity improves and digital literacy programs expand, more farmers are expected to embrace innovative solutions. Additionally, the growing consumer demand for sustainable and locally sourced products will likely encourage further investment in digital agriculture technologies, fostering a more resilient agricultural ecosystem that can adapt to changing market dynamics and environmental challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | Digital Marketplaces Mobile Applications Data Analytics & Advisory Platforms IoT & Sensor Devices E-commerce Platforms for Agri Inputs & Produce Digital Financial Services (Agri Loans, Insurance) Others (Blockchain Traceability, Drones, etc.) |

| By End-User | Smallholder Farmers Farmer Cooperatives & Associations Agribusiness Enterprises Government Agencies & NGOs Agri Input Suppliers & Traders |

| By Application | Crop Management & Advisory Livestock & Aquaculture Management Supply Chain & Logistics Optimization Market Access & Price Discovery Financial Inclusion & Risk Management |

| By Distribution Channel | Direct Digital Sales (Web/App) Partnerships with Cooperatives/NGOs Agri Retailers & Input Dealers Government Extension Programs |

| By Investment Source | Private Investments & Venture Capital Government Grants & Subsidies International Development Aid |

| By Policy Support | Subsidies for Digital Tools & Platforms Tax Incentives for AgriTech Startups Capacity Building & Digital Literacy Programs |

| By Technology Adoption | Early Adopters Mainstream Users Late Adopters |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smallholder Farmers | 120 | Farmers using digital tools, Agricultural Cooperatives |

| Agritech Startups | 60 | Founders, Product Managers, Technology Developers |

| Government Agricultural Agencies | 40 | Policy Makers, Agricultural Extension Officers |

| Research Institutions | 40 | Researchers, Academics in Agricultural Technology |

| Farm Management Software Users | 50 | Farm Managers, IT Specialists in Agriculture |

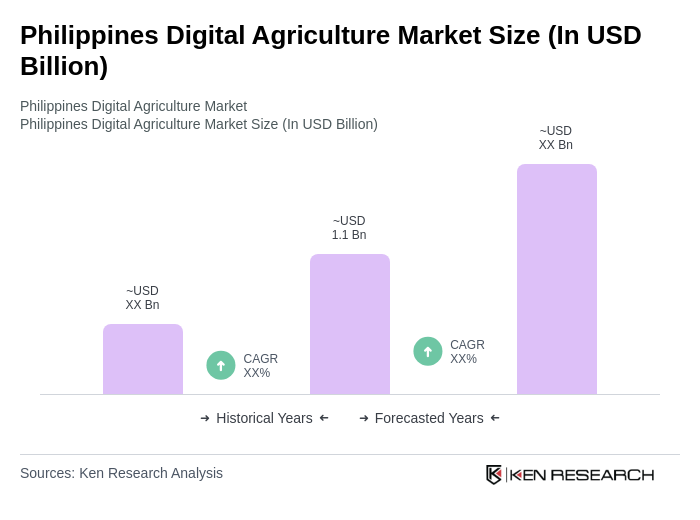

The Philippines Digital Agriculture Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by technology adoption, government initiatives, and the demand for efficient supply chain management in agriculture.