Region:Central and South America

Author(s):Shubham

Product Code:KRAB3217

Pages:83

Published On:October 2025

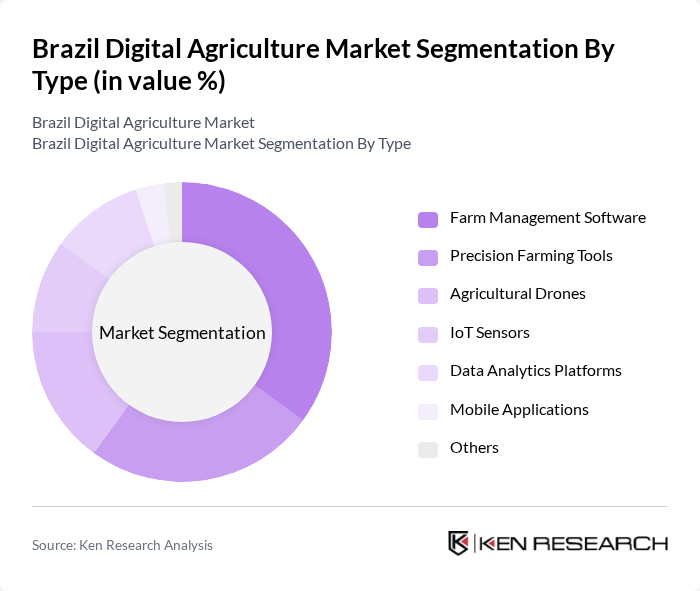

By Type:The market is segmented into various types, including Farm Management Software, Precision Farming Tools, Agricultural Drones, IoT Sensors, Data Analytics Platforms, Mobile Applications, and Others. Among these, Farm Management Software is currently the leading sub-segment due to its ability to streamline operations and improve decision-making for farmers. Precision Farming Tools and Agricultural Drones are also gaining traction as they offer innovative solutions for crop monitoring and resource management.

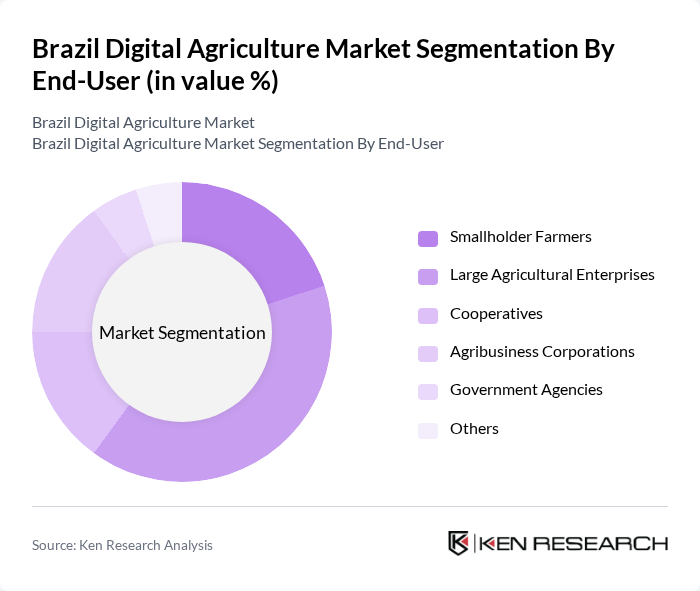

By End-User:The end-user segmentation includes Smallholder Farmers, Large Agricultural Enterprises, Cooperatives, Agribusiness Corporations, Government Agencies, and Others. Large Agricultural Enterprises dominate this segment due to their capacity to invest in advanced technologies and their need for efficient management systems. Smallholder Farmers are increasingly adopting digital solutions, supported by government initiatives aimed at enhancing their productivity.

The Brazil Digital Agriculture Market is characterized by a dynamic mix of regional and international players. Leading participants such as AgroSmart, Solinftec, Agrosmart, Cropwise, Strider, Embrapa, Taranis, Farmbox, Agronow, Aegro, AgriWebb, SmartFarm, AgriDigital, Ecorural, and Agrofy contribute to innovation, geographic expansion, and service delivery in this space.

The future of Brazil's digital agriculture market appears promising, driven by technological advancements and increasing awareness of sustainable practices. In the future, the integration of AI and machine learning in agriculture is expected to enhance decision-making processes, leading to improved crop management. Additionally, the rise of agritech startups is likely to foster innovation, creating a more competitive landscape. As farmers increasingly recognize the benefits of digital tools, the market is poised for significant transformation, enhancing productivity and sustainability across the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Farm Management Software Precision Farming Tools Agricultural Drones IoT Sensors Data Analytics Platforms Mobile Applications Others |

| By End-User | Smallholder Farmers Large Agricultural Enterprises Cooperatives Agribusiness Corporations Government Agencies Others |

| By Application | Crop Monitoring Livestock Management Supply Chain Management Market Access Solutions Others |

| By Sales Channel | Direct Sales Online Marketplaces Distributors Retail Outlets Others |

| By Distribution Mode | Online Distribution Offline Distribution Hybrid Distribution Others |

| By Investment Source | Private Investments Government Funding International Aid Venture Capital Others |

| By Policy Support | Subsidies for Digital Tools Tax Incentives for Agritech Grants for Research and Development Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| IoT Solutions in Agriculture | 100 | Agricultural Technologists, Farm Managers |

| Drones for Crop Monitoring | 80 | Precision Agriculture Specialists, Agronomists |

| Data Analytics for Yield Improvement | 70 | Data Scientists, Farm Owners |

| Mobile Applications for Farm Management | 90 | Farmers, Agricultural Consultants |

| Digital Marketplaces for Agricultural Products | 60 | E-commerce Managers, Supply Chain Coordinators |

The Brazil Digital Agriculture Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by technology adoption in agriculture, including precision farming and data analytics, which enhance productivity and efficiency.