Region:Africa

Author(s):Shubham

Product Code:KRAB4459

Pages:92

Published On:October 2025

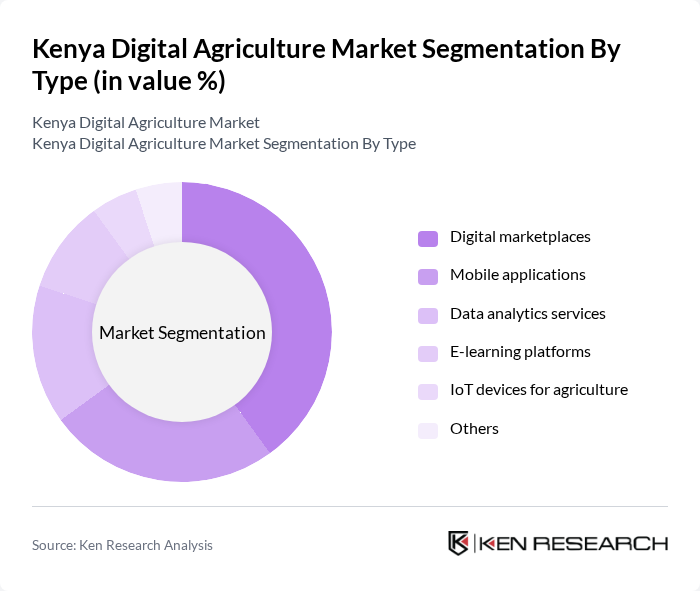

By Type:The segmentation by type includes various digital solutions that cater to the agricultural sector. The dominant sub-segment is digital marketplaces, which facilitate direct transactions between farmers and consumers, enhancing market access and reducing intermediaries. Mobile applications also play a significant role, providing farmers with essential information and services. Data analytics services are gaining traction as they help in decision-making processes, while IoT devices are increasingly being integrated for precision agriculture. E-learning platforms are emerging as vital tools for knowledge dissemination among farmers.

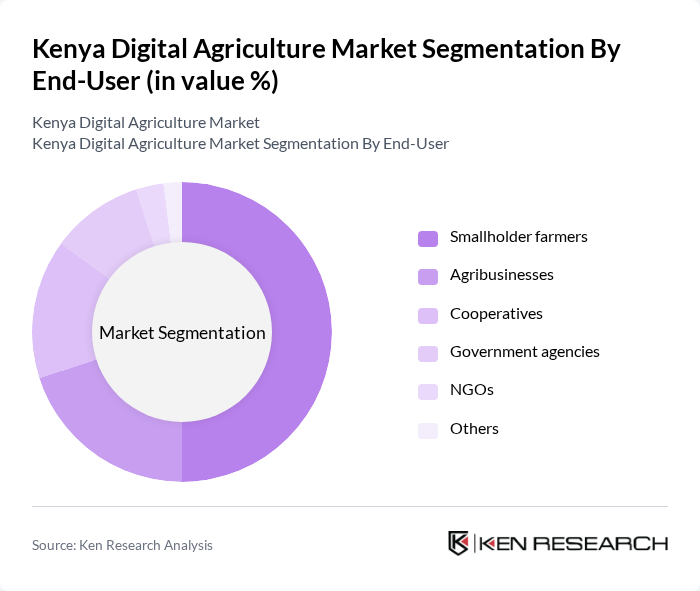

By End-User:The end-user segmentation highlights the various stakeholders in the digital agriculture ecosystem. Smallholder farmers represent the largest segment, as they are increasingly adopting digital solutions to enhance productivity and market access. Agribusinesses are also significant users, leveraging digital tools for supply chain management and efficiency. Cooperatives play a crucial role in aggregating resources and information for farmers, while government agencies and NGOs are involved in promoting digital agriculture initiatives. The diverse needs of these end-users drive the demand for tailored digital solutions.

The Kenya Digital Agriculture Market is characterized by a dynamic mix of regional and international players. Leading participants such as Twiga Foods, M-Farm, iCow, FarmDrive, Agri-wallet, Apollo Agriculture, Kenya Agricultural and Livestock Research Organization (KALRO), Digital Green, Hello Tractor, CropIn, AgroCenta, Sokopepe, FarmLink, Kytabu, GreenPath Food contribute to innovation, geographic expansion, and service delivery in this space.

The future of the digital agriculture market in Kenya appears promising, driven by technological advancements and increasing government support. As more farmers adopt digital tools, the efficiency of agricultural practices is expected to improve significantly. Additionally, the integration of artificial intelligence and machine learning will enhance decision-making processes. The focus on sustainable practices will likely lead to innovations that address climate change challenges, ensuring food security while promoting environmental stewardship in the agricultural sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Digital marketplaces Mobile applications Data analytics services E-learning platforms IoT devices for agriculture Others |

| By End-User | Smallholder farmers Agribusinesses Cooperatives Government agencies NGOs Others |

| By Application | Crop management Livestock management Supply chain management Market access solutions Financial services Others |

| By Distribution Channel | Online platforms Mobile networks Direct sales Partnerships with local vendors Others |

| By Investment Source | Private investments Government funding International aid Crowdfunding Others |

| By Policy Support | Government subsidies Tax incentives Grants for technology adoption Regulatory support for startups Others |

| By Technology | Mobile technology Cloud computing Big data analytics Artificial intelligence Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smallholder Farmers Using Digital Tools | 150 | Farmers, Agricultural Technicians |

| Agritech Startups and Service Providers | 100 | Founders, Product Managers |

| Government Agricultural Extension Officers | 80 | Extension Officers, Policy Makers |

| NGOs Involved in Agricultural Development | 70 | Project Managers, Field Coordinators |

| Investors in Agritech Solutions | 50 | Venture Capitalists, Angel Investors |

The Kenya Digital Agriculture Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the adoption of digital technologies, mobile connectivity, and government initiatives aimed at enhancing agricultural productivity.