Region:Asia

Author(s):Rebecca

Product Code:KRAC8499

Pages:83

Published On:November 2025

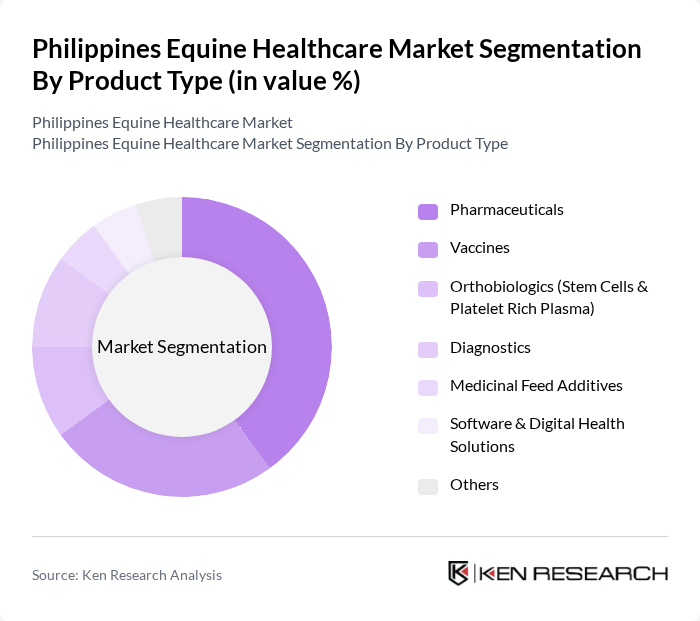

By Product Type:The product type segmentation includes Pharmaceuticals, Vaccines, Orthobiologics (Stem Cells & Platelet Rich Plasma), Diagnostics, Medicinal Feed Additives, Software & Digital Health Solutions, and Others. Among these, Pharmaceuticals dominate the market due to the increasing prevalence of equine diseases and the growing demand for effective treatment options. The trend towards preventive healthcare is also driving the demand for vaccines and diagnostics, as horse owners seek to maintain the health and performance of their animals.

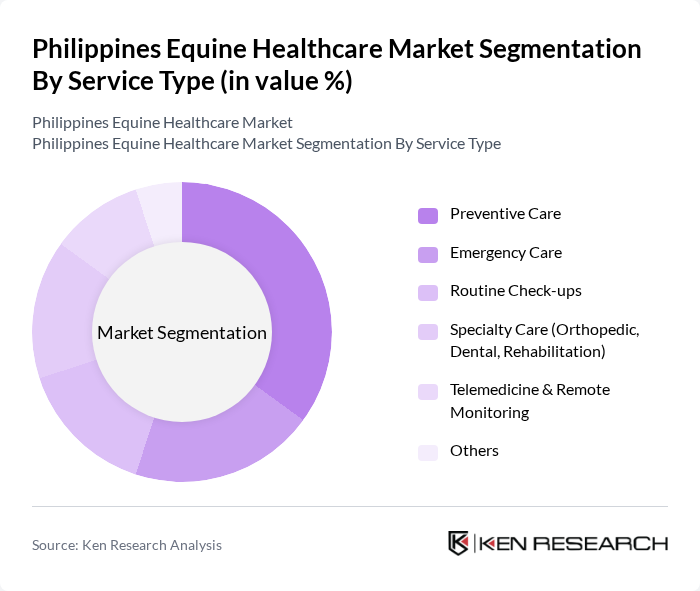

By Service Type:The service type segmentation includes Preventive Care, Emergency Care, Routine Check-ups, Specialty Care (Orthopedic, Dental, Rehabilitation), Telemedicine & Remote Monitoring, and Others. Preventive Care is the leading service type, driven by the increasing focus on maintaining horse health and preventing diseases. The rise of telemedicine and remote monitoring services is also notable, as they provide convenient access to veterinary care, especially in remote areas.

The Philippines Equine Healthcare Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zoetis Philippines, Inc., Merck Animal Health Philippines, Elanco Animal Health Philippines, Boehringer Ingelheim Animal Health, Bayer Animal Health Philippines, Vetoquinol SA, CEVA Inc., Virbac SA, IDEXX Laboratories Inc., Norbrook Laboratories, Indian Immunologicals Limited, Neogen Corporation, Alltech Inc., Intervet (MSD Animal Health), Local Philippine Veterinary Suppliers & Distributors contribute to innovation, geographic expansion, and service delivery in this space.

The future of the equine healthcare market in the Philippines appears promising, driven by increasing investments in veterinary services and technology. As awareness of equine health continues to grow, coupled with the rise in equestrian activities, the demand for comprehensive healthcare solutions is expected to expand. Additionally, the integration of telemedicine and preventive care products will likely enhance service accessibility, ensuring that horse owners can provide better health management for their animals, ultimately benefiting the entire industry.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Pharmaceuticals Vaccines Orthobiologics (Stem Cells & Platelet Rich Plasma) Diagnostics Medicinal Feed Additives Software & Digital Health Solutions Others |

| By Service Type | Preventive Care Emergency Care Routine Check-ups Specialty Care (Orthopedic, Dental, Rehabilitation) Telemedicine & Remote Monitoring Others |

| By End-User | Individual Horse Owners Equestrian Centers & Stables Veterinary Clinics Racing Organizations Breeding Facilities Government Agencies |

| By Distribution Channel | Veterinary Clinics & Hospitals Online Retail Platforms Direct Sales (Manufacturer to End-User) Pharmacies & Drug Stores Feed & Agricultural Retailers |

| By Region | Luzon (Metro Manila, Calabarzon, Cagayan Valley) Visayas (Cebu, Iloilo, Bacolod) Mindanao (Davao, Cagayan de Oro) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Veterinary Clinics Specializing in Equine Care | 60 | Veterinarians, Clinic Owners |

| Horse Owners and Equestrian Facility Managers | 100 | Horse Owners, Stable Managers |

| Equine Health Product Suppliers | 50 | Product Managers, Sales Representatives |

| Equine Sports Organizations | 40 | Event Organizers, Coaches |

| Regulatory Bodies and Animal Welfare Organizations | 40 | Policy Makers, Animal Welfare Advocates |

The Philippines Equine Healthcare Market is valued at approximately USD 85 million, reflecting a significant growth trend driven by increased awareness of equine health, rising disposable incomes among horse owners, and the expansion of the equestrian sports industry.