APAC Equine Healthcare Market Overview

- The APAC Equine Healthcare Market is valued at USD 743 million, based on a five-year historical analysis. This growth is primarily driven by increasing awareness of equine health, rising disposable incomes among horse owners, and advancements in veterinary medicine. The demand for high-quality healthcare products and services for horses has surged, reflecting a growing commitment to animal welfare and performance enhancement. Notably, the market is witnessing robust adoption of advanced diagnostics, regenerative therapies, and digital monitoring systems, alongside rising investments in equine sports and racing infrastructure, which further fuel market expansion .

- Countries such as Japan, Australia, and China dominate the APAC Equine Healthcare Market due to their robust equestrian culture, significant investments in horse racing, and a high number of equine facilities. These nations have established strong veterinary services and a growing market for equine pharmaceuticals and supplements, contributing to their leadership in the sector. Additionally, regional initiatives such as education and training programs for stable managers in China and regulatory improvements in Australia are elevating standards of care and supporting market growth .

- In 2023, the Australian government implemented regulations mandating the registration of all veterinary medicines used in equine healthcare. This regulatory framework is governed by the Agricultural and Veterinary Chemicals Code Act 1994, administered by the Australian Pesticides and Veterinary Medicines Authority (APVMA). The regulation requires that all veterinary chemical products, including those for equine use, be registered and evaluated for safety, efficacy, and quality before market authorization. This ensures the safety and efficacy of treatments administered to horses, thereby enhancing the overall quality of equine healthcare services and products available in the market .

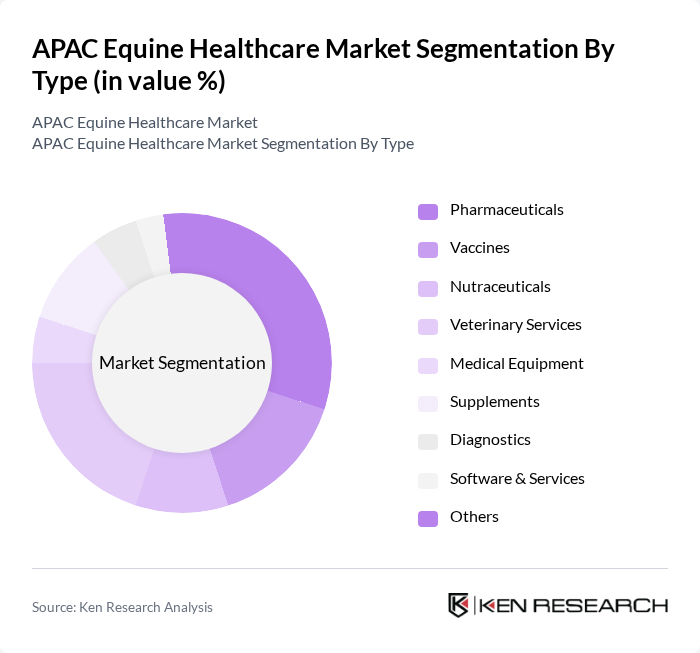

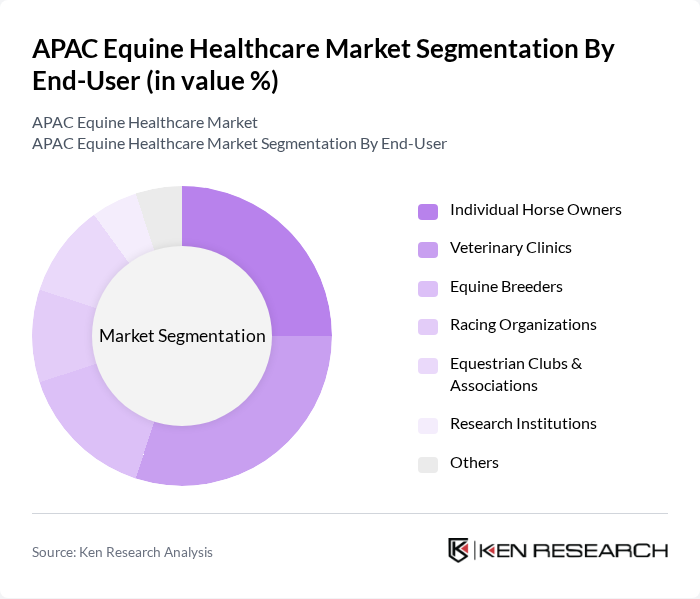

APAC Equine Healthcare Market Segmentation

By Type:The market is segmented into various types, including Pharmaceuticals, Vaccines, Nutraceuticals, Veterinary Services, Medical Equipment, Supplements, Diagnostics, Software & Services, and Others. Each of these segments plays a crucial role in the overall healthcare of equines, with specific products and services tailored to meet the diverse needs of horse owners and veterinary professionals. Pharmaceuticals remain the largest revenue-generating segment, driven by the demand for advanced therapeutics and preventive care, while Software & Services is the fastest-growing segment due to increasing adoption of digital health solutions and management platforms .

By End-User:The end-user segmentation includes Individual Horse Owners, Veterinary Clinics, Equine Breeders, Racing Organizations, Equestrian Clubs & Associations, Research Institutions, and Others. Each segment represents a unique consumer base with specific needs and preferences, influencing the types of products and services they seek in the equine healthcare market. Veterinary clinics account for the largest share, reflecting the growing reliance on professional veterinary services for preventive care, diagnostics, and advanced treatments .

APAC Equine Healthcare Market Competitive Landscape

The APAC Equine Healthcare Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zoetis Inc., Merck Animal Health, Boehringer Ingelheim, Elanco Animal Health, Ceva Santé Animale, Virbac, IDEXX Laboratories, Neogen Corporation, Vetoquinol SA, Kemin Industries, Alltech, Dechra Pharmaceuticals, Parnell Pharmaceuticals, Hallmarq Veterinary Imaging, Trouw Nutrition, Sound Technologies, Esaote S.p.A. contribute to innovation, geographic expansion, and service delivery in this space .

APAC Equine Healthcare Market Industry Analysis

Growth Drivers

- Increasing Awareness of Equine Health:The APAC region has seen a significant rise in equine health awareness, with over 60% of horse owners now prioritizing regular veterinary check-ups. This shift is supported by the increasing number of equine health seminars and workshops, which have grown by 30% since 2020. Additionally, the World Organization for Animal Health reported that equine health initiatives have led to a 25% increase in preventive care practices among horse owners, reflecting a growing commitment to equine well-being.

- Rising Demand for Equine Sports and Recreation:The equine sports sector in APAC is expanding rapidly, with participation in equestrian events increasing by 40% over the past five years. Countries like Australia and Japan are leading this trend, hosting over 200 equine competitions annually. This surge in recreational activities has driven demand for specialized veterinary services, with the equine sports market projected to contribute approximately $1.6 billion to the overall equine healthcare sector in future, enhancing the need for comprehensive healthcare solutions.

- Advancements in Veterinary Medicine:The APAC equine healthcare market is benefiting from significant advancements in veterinary medicine, including the introduction of innovative diagnostic tools and treatments. For instance, the use of regenerative medicine in equine care has increased by 35% since 2021, improving recovery rates for injuries. Furthermore, the veterinary pharmaceuticals market is projected to reach $850 million in future, driven by the development of new vaccines and therapeutics tailored for equine health, enhancing overall care quality.

Market Challenges

- High Cost of Veterinary Services:One of the primary challenges facing the APAC equine healthcare market is the high cost of veterinary services, which can exceed $1,200 for specialized treatments. This financial barrier limits access for many horse owners, particularly in rural areas where average household incomes are below $35,000 annually. As a result, many owners may delay necessary treatments, leading to worsened health outcomes for their horses and increased long-term costs.

- Limited Access to Specialized Care:Access to specialized equine veterinary care remains a significant challenge in the APAC region, particularly in developing countries. Approximately 40% of horse owners report difficulties in finding qualified veterinarians, with only 15% of veterinary schools offering specialized equine programs. This shortage of expertise can lead to inadequate care, resulting in higher mortality rates and increased healthcare costs, ultimately hindering market growth and equine welfare.

APAC Equine Healthcare Market Future Outlook

The future of the APAC equine healthcare market appears promising, driven by ongoing advancements in veterinary technology and a growing emphasis on preventive care. As telemedicine becomes more prevalent, it is expected to enhance access to veterinary services, particularly in remote areas. Additionally, the integration of artificial intelligence in diagnostics and treatment planning is likely to improve care efficiency and outcomes, fostering a more robust healthcare ecosystem for equines across the region.

Market Opportunities

- Expansion of Telemedicine in Veterinary Care:The rise of telemedicine presents a significant opportunity for the equine healthcare market, with an estimated 30% of veterinary consultations expected to transition online in future. This shift can enhance access to care, particularly for rural horse owners, reducing travel costs and time while improving overall health monitoring and management for equines.

- Development of Innovative Healthcare Products:There is a growing demand for innovative healthcare products tailored for equines, including supplements and advanced medical devices. The market for equine supplements alone is projected to reach $600 million in future, driven by increased awareness of nutrition and preventive health. This trend offers substantial opportunities for companies to develop and market new products that cater to the evolving needs of horse owners.