Region:Global

Author(s):Rebecca

Product Code:KRAB2140

Pages:90

Published On:January 2026

By Product Type:The product type segmentation includes various categories such as Antimicrobials, Vaccines, Parasiticides, Anti-inflammatory agents, Nutritional products, and Other Pharmaceuticals. Antimicrobials remain a core therapy area because of their essential role in treating bacterial and other infectious diseases in both companion and production animals, although stewardship efforts and shifts in product portfolios are gradually reducing their relative share in favour of vaccines and parasiticides. The increasing prevalence of zoonotic diseases, biosecurity concerns in livestock production, and the need for effective disease management strategies have further propelled demand for these products. Vaccines also hold a significant share, driven by the rising focus on preventive healthcare in animals, mandatory or recommended vaccination programs for production animals, and growing emphasis on reducing antimicrobial usage through prevention.

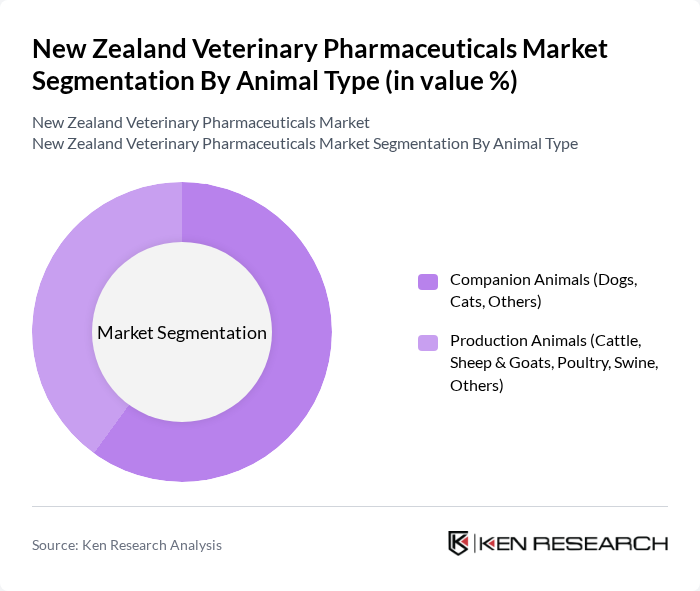

By Animal Type:This segmentation includes Companion Animals and Production Animals. Companion Animals, particularly dogs and cats, account for a growing share of veterinary medicine spending, supported by an increasing trend of pet ownership, humanisation of pets, and the growing willingness of owners to invest in preventive care, diagnostics, and chronic disease management for their animals. The rising awareness of preventive healthcare, greater access to advanced veterinary services, and the importance of regular veterinary check-ups have led to a surge in demand for pharmaceuticals tailored for companion animals, including vaccines, antiparasitics, and dermatology and pain-management products. Production Animals, including cattle, sheep, and poultry, also contribute significantly to the market, driven by the need for effective disease management in livestock, food safety and export requirements, and the economic importance of New Zealand’s pastoral farming sector.

The New Zealand Veterinary Pharmaceuticals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zoetis Inc., Merck Animal Health (MSD Animal Health), Elanco Animal Health, Boehringer Ingelheim Animal Health, Virbac New Zealand, Ceva Santé Animale, Vetoquinol, IDEXX Laboratories, Neogen Corporation, Phibro Animal Health Corporation, Alltech, Apiam Animal Health, Zoetis New Zealand Limited, Schering-Plough Animal Health New Zealand, Local / Regional Players (Stock & Station, Rural Merchants, etc.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the New Zealand veterinary pharmaceuticals market appears promising, driven by increasing pet ownership and advancements in veterinary medicine. The integration of technology in veterinary practices is expected to enhance service delivery and improve animal health outcomes. Furthermore, the growing trend towards preventive healthcare will likely lead to increased demand for innovative veterinary products, ensuring that the market remains dynamic and responsive to the needs of both pet and livestock owners in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Antimicrobials (Antibiotics, Anti-infectives) Vaccines & Immunologicals Parasiticides (Endoparasiticides, Ectoparasiticides) Anti-inflammatory & Analgesic Agents Nutritional & Metabolic Products / Nutraceuticals Other Pharmaceuticals (Sedatives, Reproduction, Specialty) |

| By Animal Type | Companion Animals (Dogs, Cats, Others) Production Animals (Cattle, Sheep & Goats, Poultry, Swine, Others) |

| By Route of Administration | Oral Parenteral / Injectable Topical Others (Implants, Intramammary, etc.) |

| By Distribution Channel | Veterinary Hospitals Veterinary Clinics Retail Pharmacies & Rural Merchants Online / Direct-to-Producer Channels |

| By Species | Dogs Cats Cattle & Dairy Sheep & Goats Poultry Swine Other Species (Equine, Aquaculture, etc.) |

| By Region | North Island South Island |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Companion Animal Pharmaceuticals | 120 | Veterinarians, Veterinary Technicians |

| Livestock Health Products | 110 | Farm Managers, Animal Health Advisors |

| Veterinary Distributors | 90 | Sales Managers, Distribution Coordinators |

| Regulatory Compliance in Veterinary Pharmaceuticals | 60 | Regulatory Affairs Specialists, Compliance Officers |

| Market Trends in Veterinary Services | 80 | Veterinary Practice Owners, Industry Analysts |

The New Zealand Veterinary Pharmaceuticals Market is valued at approximately USD 600 million, reflecting a robust growth driven by increasing pet ownership, advancements in veterinary medicine, and rising awareness of animal health among pet owners and livestock producers.