Philippines Financial Brokerage & Trading Platforms Market Overview

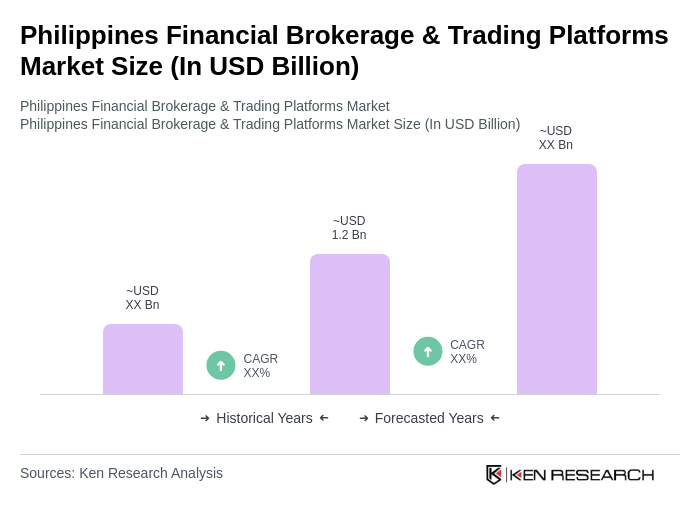

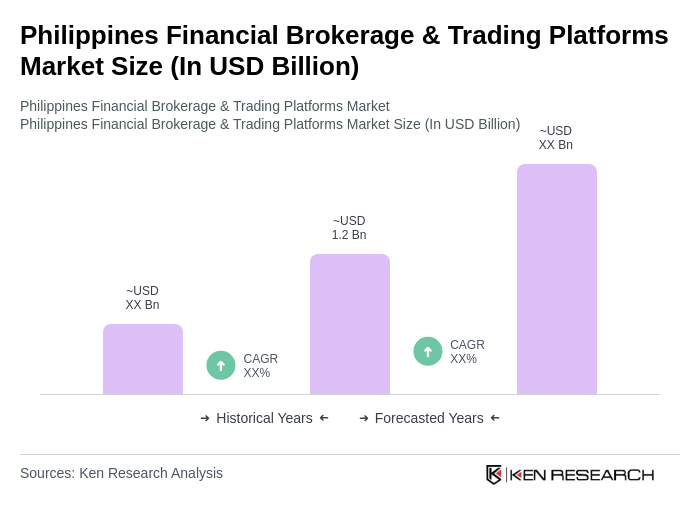

- The Philippines Financial Brokerage & Trading Platforms Market is valued at USD 1.2 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing participation of retail investors, technological advancements in trading platforms, and a growing awareness of investment opportunities among the population. The rise in disposable income and the shift towards digital financial services have further fueled market expansion.

- Metro Manila is the dominant region in the Philippines Financial Brokerage & Trading Platforms Market due to its status as the economic and financial hub of the country. The concentration of financial institutions, access to advanced technology, and a large pool of potential investors contribute to its market leadership. Other key cities include Cebu and Davao, which are emerging as significant players due to their growing economies and increasing investor interest.

- The Securities Regulation Code (Republic Act No. 8799) governs the operations of financial brokerage firms in the Philippines. This regulation aims to protect investors by ensuring transparency and fairness in the securities market. It mandates the registration of brokers and dealers, the disclosure of relevant information, and compliance with ethical standards, thereby fostering a more secure trading environment.

Philippines Financial Brokerage & Trading Platforms Market Segmentation

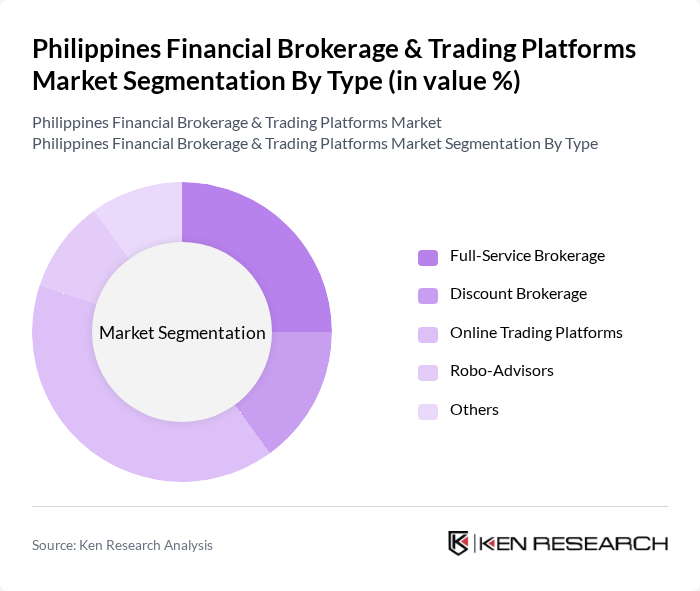

By Type:

The market is segmented into Full-Service Brokerage, Discount Brokerage, Online Trading Platforms, Robo-Advisors, and Others. Among these, Online Trading Platforms are leading the market due to their convenience, lower fees, and accessibility for retail investors. The increasing adoption of mobile trading applications and the growing trend of self-directed investing have significantly contributed to the dominance of this sub-segment. Full-Service Brokerage also holds a substantial share, catering to high-net-worth individuals seeking personalized investment advice.

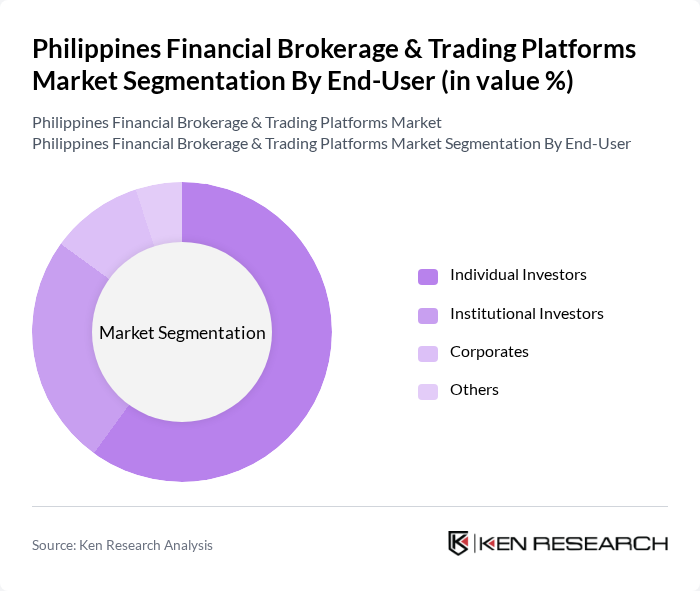

By End-User:

The end-user segmentation includes Individual Investors, Institutional Investors, Corporates, and Others. Individual Investors dominate the market, driven by the increasing number of retail investors entering the market, particularly through online platforms. The rise of financial literacy initiatives and the availability of user-friendly trading applications have empowered individuals to manage their investments actively. Institutional Investors also play a crucial role, contributing to significant trading volumes and market stability.

Philippines Financial Brokerage & Trading Platforms Market Competitive Landscape

The Philippines Financial Brokerage & Trading Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as BDO Securities Corporation, COL Financial Group, Inc., First Metro Securities Brokerage Corporation, Philstocks Financial, Inc., RCBC Securities, Inc., Abacus Securities Corporation, Unicapital Securities, Inc., Maybank ATR Kim Eng Securities, Inc., Sun Life Financial, Deutsche Bank AG, Citigroup Global Markets, Inc., HSBC Securities (Philippines) Inc., Standard Chartered Bank, CitisecOnline.com, Inc., AIA Group Limited contribute to innovation, geographic expansion, and service delivery in this space.

Philippines Financial Brokerage & Trading Platforms Market Industry Analysis

Growth Drivers

- Increasing Retail Investor Participation:The Philippines has seen a surge in retail investor participation, with the number of active trading accounts reaching approximately 1.5 million, a 20% increase from the previous year. This growth is driven by a younger demographic entering the market, with 60% of new investors aged between 18 and 35. The Philippine Stock Exchange (PSE) reported a 15% rise in trading volume, indicating heightened interest in equity markets, further supported by favorable economic conditions.

- Technological Advancements in Trading Platforms:The adoption of advanced trading technologies has transformed the brokerage landscape in the Philippines. Over 70% of brokerage firms offered mobile trading applications, enhancing accessibility for investors. The integration of features like real-time data analytics and automated trading has attracted tech-savvy investors. Additionally, the Philippine government’s push for digitalization, with a target of 50% of financial transactions being digital, supports this trend, fostering a more efficient trading environment.

- Regulatory Support for Financial Inclusion:The Philippine government has implemented several initiatives to promote financial inclusion, with the Bangko Sentral ng Pilipinas (BSP) aiming to increase the number of Filipinos with access to financial services to 70%. This includes the introduction of the Financial Inclusion Strategy, which encourages brokerage firms to offer low-cost investment options. As a result, the number of micro-investment platforms has increased, allowing more individuals to participate in the financial markets, thus driving overall market growth.

Market Challenges

- High Competition Among Brokerage Firms:The Philippine financial brokerage market is characterized by intense competition, with over 100 registered brokerage firms. This saturation leads to aggressive pricing strategies, which can erode profit margins. Additionally, firms are compelled to invest heavily in marketing and technology to differentiate themselves, resulting in increased operational costs. The competitive landscape is further complicated by the entry of fintech companies, which offer innovative solutions that challenge traditional brokerage models.

- Regulatory Compliance Costs:Compliance with regulatory requirements poses a significant challenge for brokerage firms in the Philippines. The implementation of the Securities Regulation Code and enhanced anti-money laundering regulations has increased compliance costs, which can reach up to 10% of a firm's operational budget. Smaller firms, in particular, struggle to meet these financial burdens, which can limit their ability to invest in growth initiatives. This regulatory environment necessitates ongoing investment in compliance infrastructure, diverting resources from core business activities.

Philippines Financial Brokerage & Trading Platforms Market Future Outlook

The future of the Philippines financial brokerage and trading platforms market appears promising, driven by technological innovations and increasing investor engagement. As digital trading solutions continue to evolve, more investors are expected to embrace online platforms, enhancing market liquidity. Furthermore, the growing trend of environmental, social, and governance (ESG) investments is likely to attract a new wave of socially conscious investors, creating opportunities for brokerage firms to develop tailored products that meet these emerging demands, thereby fostering sustainable growth in the sector.

Market Opportunities

- Expansion of Digital Trading Solutions:The rise of digital trading solutions presents a significant opportunity for brokerage firms. With the increasing smartphone penetration rate, projected to reach 80%, firms can leverage mobile platforms to enhance user experience and attract new clients. This shift towards digitalization is expected to streamline operations and reduce costs, allowing firms to offer competitive pricing and innovative services to a broader audience.

- Growth of ESG Investment Trends:The growing interest in ESG investments offers brokerage firms a unique opportunity to diversify their product offerings. ESG funds in the Philippines saw inflows of approximately PHP 5 billion, reflecting a 30% increase from the previous year. By developing ESG-focused investment products, firms can cater to the rising demand for sustainable investment options, positioning themselves as leaders in this emerging market segment and attracting socially responsible investors.