Region:Europe

Author(s):Shubham

Product Code:KRAB1245

Pages:95

Published On:October 2025

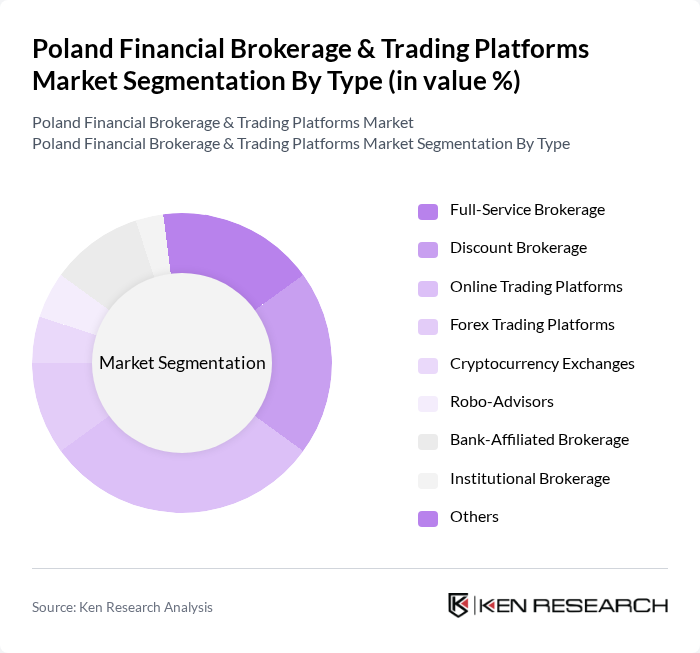

By Type:The market is segmented into Full-Service Brokerage, Discount Brokerage, Online Trading Platforms, Forex Trading Platforms, Cryptocurrency Exchanges, Robo-Advisors, Bank-Affiliated Brokerage, Institutional Brokerage, and Others. Each of these segments addresses distinct investor needs and preferences. Online trading platforms are experiencing the most significant traction due to their intuitive interfaces, lower transaction fees, and the growing demand for self-directed investment tools. The rise of digital assets and algorithmic trading is also contributing to the expansion of cryptocurrency exchanges and robo-advisory services .

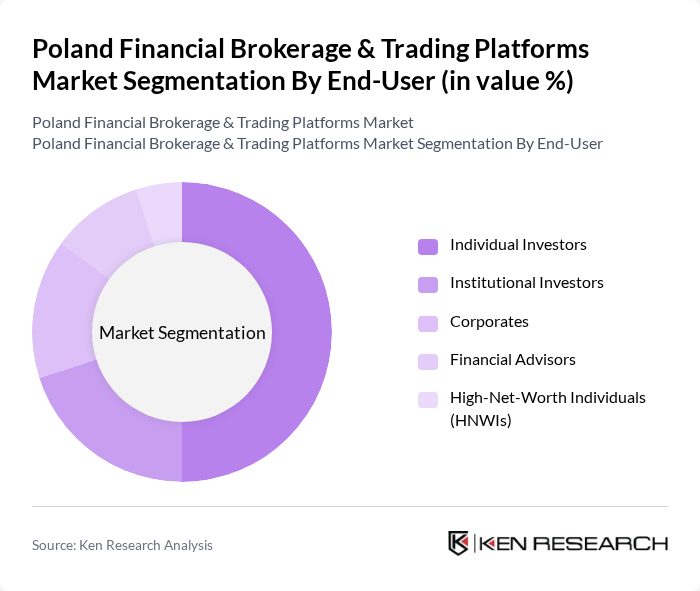

By End-User:The end-user segmentation includes Individual Investors, Institutional Investors, Corporates, Financial Advisors, and High-Net-Worth Individuals (HNWIs). Individual investors continue to dominate the market, driven by the increasing popularity of retail trading and the accessibility of online platforms, which offer low-cost trading options and a broad range of investment products. Institutional investors, corporates, and financial advisors also represent important segments, leveraging advanced trading tools and tailored brokerage services .

The Poland Financial Brokerage & Trading Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as XTB S.A., mBank S.A., Dom Maklerski BO? S.A., Noble Securities S.A., Santander Biuro Maklerskie, ING Bank ?l?ski S.A. (ING Securities), TMS Brokers S.A. (OANDA TMS Brokers S.A.), eToro (Europe) Ltd., Plus500 Ltd., Interactive Brokers LLC, Saxo Bank A/S, CMC Markets Plc, TradeStation Group, Inc., OANDA Corporation, IG Group Holdings Plc contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Poland financial brokerage and trading platforms market appears promising, driven by technological advancements and evolving investor preferences. As mobile trading solutions gain traction, firms are likely to enhance their platforms to cater to a tech-savvy clientele. Additionally, the growing interest in sustainable investing and cryptocurrency trading will shape product offerings, encouraging innovation. With regulatory support and a focus on user experience, the market is set to evolve, attracting more participants and fostering a dynamic trading environment in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Full-Service Brokerage Discount Brokerage Online Trading Platforms Forex Trading Platforms Cryptocurrency Exchanges Robo-Advisors Bank-Affiliated Brokerage Institutional Brokerage Others |

| By End-User | Individual Investors Institutional Investors Corporates Financial Advisors High-Net-Worth Individuals (HNWIs) |

| By Investment Type | Equities Bonds Derivatives Commodities ETFs Mutual Funds Structured Products Others |

| By Trading Method | Day Trading Swing Trading Position Trading Algorithmic Trading Social Trading |

| By Geographic Focus | Domestic Investments International Investments |

| By Account Type | Margin Accounts Cash Accounts Retirement Accounts Custodial Accounts |

| By Service Offering | Research and Analysis Portfolio Management Trading Tools and Resources Customer Support Services Educational Services API/Integration Services |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Brokerage Users | 100 | Individual Investors, Retail Traders |

| Institutional Brokerage Clients | 60 | Portfolio Managers, Institutional Investors |

| Fintech Platform Users | 50 | Tech-Savvy Investors, Young Professionals |

| Regulatory Stakeholders | 40 | Financial Regulators, Compliance Officers |

| Market Analysts and Experts | 30 | Financial Analysts, Economic Researchers |

The Poland Financial Brokerage & Trading Platforms Market is valued at approximately USD 1.5 billion, driven by the increasing adoption of digital trading solutions and a surge in retail investor participation, among other factors.