Region:Europe

Author(s):Geetanshi

Product Code:KRAA3267

Pages:91

Published On:September 2025

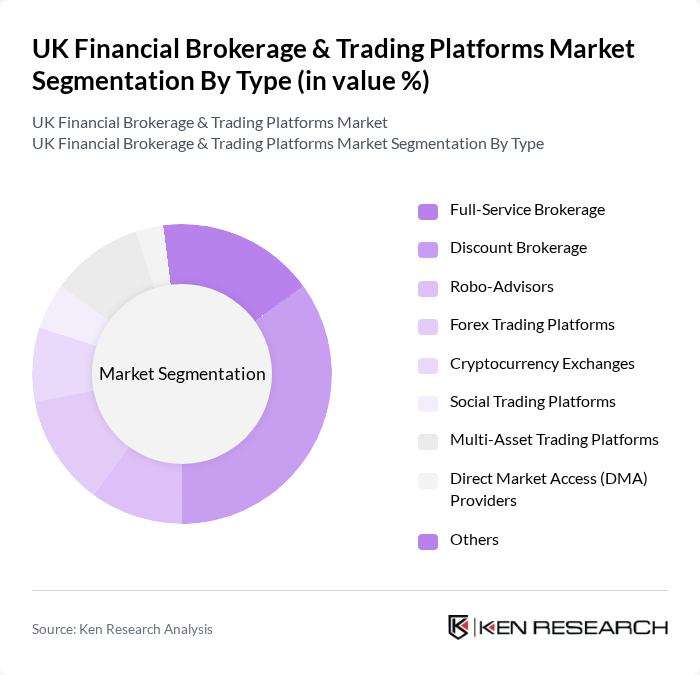

By Type:The market is segmented into various types of brokerage services, each catering to different investor needs and preferences. The subsegments include Full-Service Brokerage, Discount Brokerage, Robo-Advisors, Forex Trading Platforms, Cryptocurrency Exchanges, Social Trading Platforms, Multi-Asset Trading Platforms, Direct Market Access (DMA) Providers, and Others. Among these, Discount Brokerage has gained significant traction due to its cost-effectiveness and accessibility for retail investors .

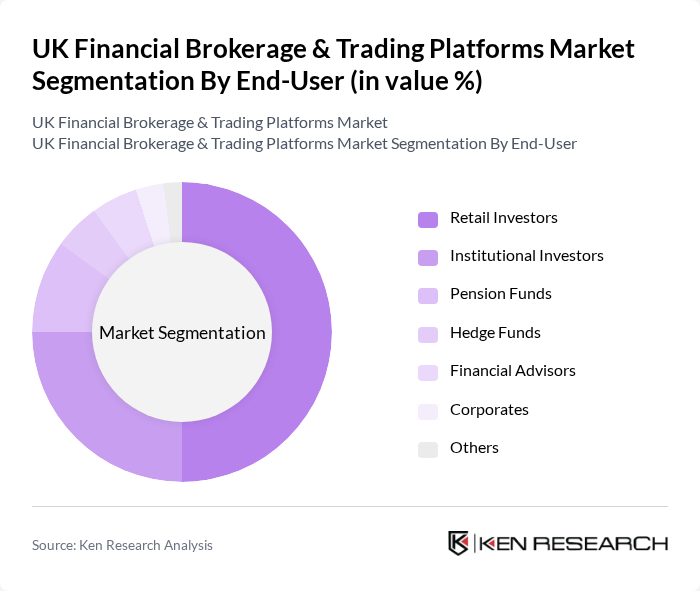

By End-User:The market is also segmented by end-users, which include Retail Investors, Institutional Investors, Pension Funds, Hedge Funds, Financial Advisors, Corporates, and Others. Retail Investors represent the largest segment, driven by the increasing number of individuals engaging in self-directed trading and investment activities, particularly through mobile and online platforms .

The UK Financial Brokerage & Trading Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as IG Group Holdings plc, CMC Markets plc, Interactive Investor Limited, Hargreaves Lansdown plc, eToro (UK) Ltd., Plus500 Ltd., Saxo Capital Markets UK Ltd., DEGIRO B.V., Trading 212 Ltd., Revolut Ltd., Freetrade Ltd., XTB Limited, OANDA Europe Limited, AJ Bell plc, Charles Schwab UK contribute to innovation, geographic expansion, and service delivery in this space.

The UK financial brokerage and trading platforms market is poised for continued evolution, driven by technological advancements and changing investor preferences. The integration of artificial intelligence and machine learning is expected to enhance trading strategies and risk management. Additionally, the growing emphasis on sustainable investing will likely shape product offerings, as investors increasingly seek ethical investment options. As regulatory frameworks adapt to new technologies, the market will witness further innovation, creating a dynamic environment for both established and emerging players.

| Segment | Sub-Segments |

|---|---|

| By Type | Full-Service Brokerage Discount Brokerage Robo-Advisors Forex Trading Platforms Cryptocurrency Exchanges Social Trading Platforms Multi-Asset Trading Platforms Direct Market Access (DMA) Providers Others |

| By End-User | Retail Investors Institutional Investors Pension Funds Hedge Funds Financial Advisors Corporates Others |

| By Trading Instrument | Stocks Bonds Options Futures ETFs CFDs (Contracts for Difference) Cryptocurrencies Commodities Others |

| By Distribution Channel | Desktop Platforms Web-Based Platforms Mobile Applications Direct Sales Partnerships with Financial Institutions Others |

| By Customer Segment | High Net-Worth Individuals Mass Affluent Millennials Gen Z Retirees Others |

| By Service Type | Advisory Services Execution Services Research Services Portfolio Management Custody Services Others |

| By Pricing Model | Commission-Based Subscription-Based Freemium Model Performance-Based Fees Flat-Fee Model Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Brokerage Users | 100 | Individual Investors, Retail Traders |

| Institutional Trading Platforms | 60 | Institutional Investors, Fund Managers |

| Financial Advisors and Brokers | 50 | Financial Advisors, Wealth Managers |

| Regulatory Compliance Experts | 40 | Compliance Officers, Legal Advisors |

| Technology Providers for Trading Platforms | 40 | IT Managers, Software Developers |

The UK Financial Brokerage & Trading Platforms Market is valued at approximately USD 825 million, driven by the increasing adoption of digital trading platforms and advancements in technology, particularly in the wake of the COVID-19 pandemic.