Philippines Furniture & Modular Living Market Overview

- The Philippines Furniture & Modular Living Market is valued at USD 4 billion, based on a five-year historical analysis. This growth is primarily driven by increasing urbanization, rising disposable incomes, a growing middle class, and a heightened preference for modern and modular living solutions among consumers. The market has seen a surge in demand for both residential and commercial furniture, reflecting changing lifestyles, the need for functional living spaces, and the expansion of online furniture sales, which offer convenience and broader product access. Additionally, trends such as minimalist design, tech-integrated furniture, and sustainability are shaping consumer preferences.

- Metro Manila, Cebu, and Davao are the dominant cities in the Philippines Furniture & Modular Living Market. Metro Manila, as the capital region, serves as the economic and cultural hub, attracting significant investments and housing developments. Cebu is renowned for its craftsmanship and export-oriented furniture industry, while Davao benefits from its growing population and increasing demand for home furnishings. These cities lead in both production and consumption, supported by robust infrastructure, skilled labor, and active participation in global trade fairs.

- The "Furniture Industry Development Act of 2023," issued by the Department of Trade and Industry (DTI), mandates the promotion of local furniture manufacturing and enhances sector competitiveness. This regulation encourages the use of sustainable materials, sets standards for eco-friendly production, and provides fiscal incentives for manufacturers adopting green practices. It covers compliance requirements for material sourcing, product labeling, and certification, supporting the growth and global competitiveness of the local furniture industry.

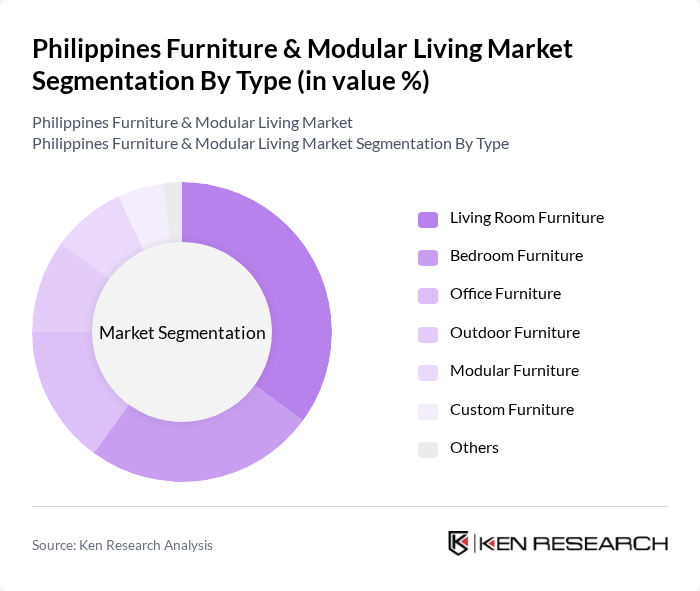

Philippines Furniture & Modular Living Market Segmentation

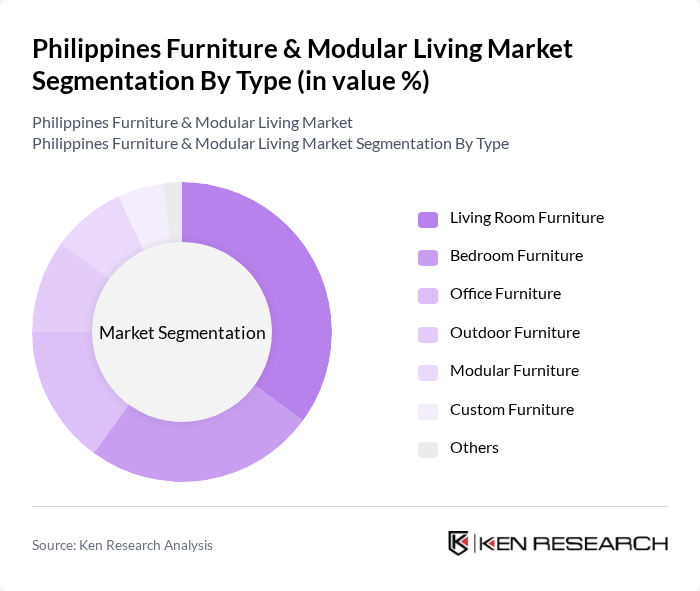

By Type:The market is segmented into Living Room Furniture, Bedroom Furniture, Office Furniture, Outdoor Furniture, Modular Furniture, Custom Furniture, and Others. Among these,Living Room Furnitureis the most dominant segment, driven by the increasing trend of home entertainment, social gatherings, and the desire for stylish, multi-functional pieces that enhance home aesthetics and comfort. The popularity of compact, tech-enabled, and sustainable living room solutions is rising, reflecting urban living patterns and evolving consumer expectations.

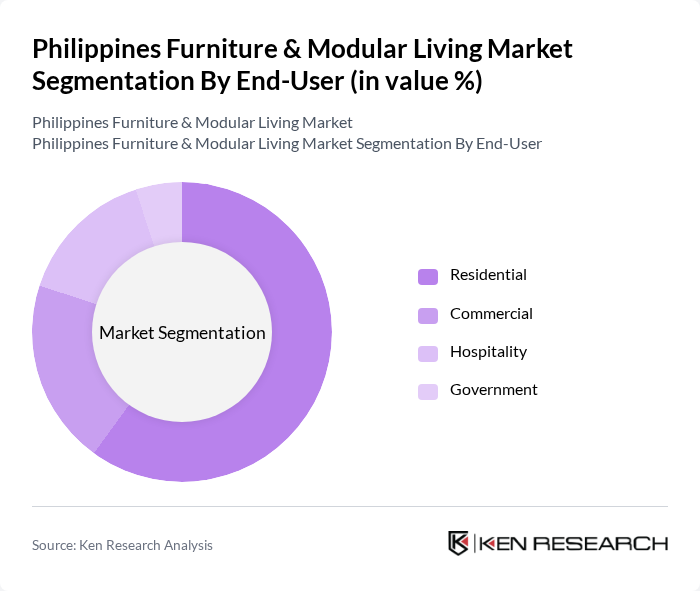

By End-User:The market is segmented by end-user into Residential, Commercial, Hospitality, and Government. TheResidentialsegment holds the largest share, driven by the increasing number of housing projects, the rise of home improvement trends, and the demand for furniture that combines style, comfort, and functionality. The segment is further supported by the growth of e-commerce, which enables consumers to access a wider range of products and customization options.

Philippines Furniture & Modular Living Market Competitive Landscape

The Philippines Furniture & Modular Living Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA Philippines, Mandaue Foam Industries Inc., Blims Fine Furniture, Our Home, Furniture Republic, Homeworks, AllHome Corp., SM Home, Wilcon Depot Inc., Furniture City, Citi Furniture, Philux Inc., Prizmic & Brill, Genteel Home, and Designs Ligna contribute to innovation, geographic expansion, and service delivery in this space.

Philippines Furniture & Modular Living Market Industry Analysis

Growth Drivers

- Increasing Urbanization:The Philippines is experiencing rapid urbanization, with urban population growth projected to reach 48% by future, according to the World Bank. This shift is driving demand for furniture and modular living solutions that cater to smaller living spaces. Urban areas are seeing a surge in residential construction, with over 1.2 million housing units expected to be built in future, further fueling the need for innovative furniture designs that maximize space efficiency.

- Rising Disposable Incomes:The average disposable income in the Philippines is projected to increase to approximately PHP 264,000 per capita in future, as reported by the Philippine Statistics Authority. This rise in income levels is enabling consumers to invest in higher-quality furniture and modular living solutions. As more households move into the middle-income bracket, the demand for stylish, durable, and functional furniture is expected to grow significantly, enhancing market opportunities for manufacturers.

- Expansion of E-commerce Platforms:E-commerce sales in the Philippines are anticipated to reach PHP 229 billion in future, according to Statista. The growth of online retailing is transforming how consumers purchase furniture, making it more accessible. With increased internet penetration, estimated at 73% in future, consumers are increasingly turning to online platforms for convenience and variety, driving demand for modular living solutions that can be easily showcased and sold online.

Market Challenges

- Supply Chain Disruptions:The Philippines' furniture industry faces significant supply chain challenges, exacerbated by global disruptions. In future, shipping costs are expected to remain high, with average freight rates projected at USD 3,000 per container. These disruptions can lead to delays in production and delivery, impacting the ability of manufacturers to meet consumer demand and maintain competitive pricing in the market.

- Fluctuating Raw Material Prices:The volatility of raw material prices poses a significant challenge for the furniture industry. In future, the price of wood and other essential materials is expected to fluctuate by up to 15% due to global supply constraints and increased demand. This unpredictability can affect profit margins and pricing strategies, making it difficult for manufacturers to maintain consistent product offerings and manage costs effectively.

Philippines Furniture & Modular Living Market Future Outlook

The Philippines furniture and modular living market is poised for significant growth, driven by urbanization and rising disposable incomes. As consumers increasingly seek sustainable and multifunctional furniture solutions, manufacturers are likely to innovate and adapt to these trends. The expansion of e-commerce will further enhance market accessibility, allowing businesses to reach a broader audience. However, challenges such as supply chain disruptions and fluctuating raw material prices will require strategic management to ensure sustained growth and competitiveness in the evolving landscape.

Market Opportunities

- Sustainable Furniture Trends:With a growing awareness of environmental issues, the demand for sustainable furniture is on the rise. In future, the market for eco-friendly furniture is expected to grow by 20%, driven by consumer preferences for responsibly sourced materials and sustainable production practices. This trend presents a significant opportunity for manufacturers to differentiate their offerings and attract environmentally conscious consumers.

- Customization and Personalization:The trend towards customization in furniture design is gaining traction, with 60% of consumers expressing interest in personalized products. This shift offers manufacturers the chance to cater to individual preferences, enhancing customer satisfaction and loyalty. By leveraging technology, companies can provide tailored solutions that meet specific consumer needs, thereby capturing a larger market share in the competitive landscape.