Region:Europe

Author(s):Rebecca

Product Code:KRAB1713

Pages:80

Published On:October 2025

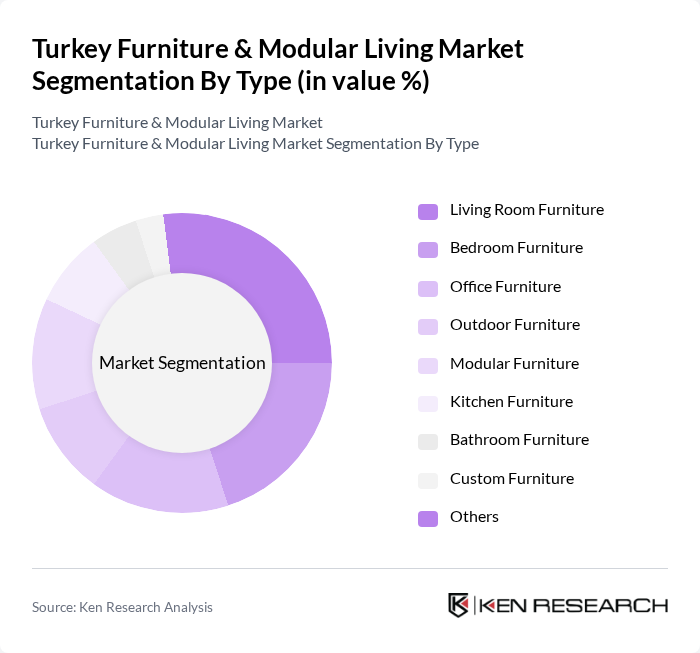

By Type:The market is segmented into various types of furniture, including living room furniture, bedroom furniture, office furniture, outdoor furniture, modular furniture, kitchen furniture, bathroom furniture, custom furniture, and others. Each sub-segment addresses specific consumer needs and preferences, reflecting evolving trends in home design, space optimization, and multi-functionality. Modular and customizable furniture continues to gain traction, particularly among urban consumers seeking flexibility and efficient use of space .

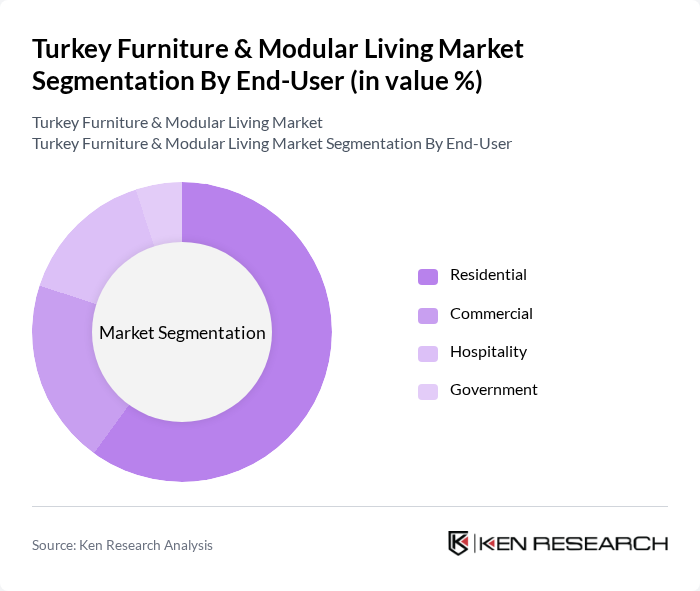

By End-User:The market is segmented based on end-users, including residential, commercial, hospitality, and government sectors. Each segment has distinct requirements and preferences, influencing the types of furniture purchased and overall market dynamics. The residential segment is the largest, driven by ongoing housing development and urbanization, while commercial and hospitality segments are expanding due to growth in office spaces and tourism infrastructure .

The Turkey Furniture & Modular Living Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA Turkey, Do?ta? Kelebek Mobilya San. ve Tic. A.?., Bellona Mobilya Sanayi ve Ticaret A.?., Yata? Grup (Yata? Bedding, Enza Home), Çilek Mobilya Sanayi ve Pazarlama A.?., Kelebek Mobilya, Mudo Concept, Tekzen Ticaret ve Yat?r?m A.?., Lazzoni Mobilya, Enza Home, Vivense, Koçta? Yap? Marketleri A.?., Modoko (Istanbul Furniture Center), Ayd?nlar Mobilya, Teleset Mobilya contribute to innovation, geographic expansion, and service delivery in this space.

The Turkey furniture and modular living market is poised for significant transformation as consumer preferences evolve towards multifunctional and sustainable solutions. With urbanization driving demand for space-efficient designs, manufacturers are likely to innovate in modular furniture offerings. Additionally, the integration of technology in furniture, such as smart features, will cater to tech-savvy consumers. As the market adapts to these trends, opportunities for growth in customization and eco-friendly products will emerge, positioning Turkey as a competitive player in the regional furniture landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Living Room Furniture Bedroom Furniture Office Furniture Outdoor Furniture Modular Furniture Kitchen Furniture Bathroom Furniture Custom Furniture Others |

| By End-User | Residential Commercial Hospitality Government |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Wholesale Specialty Stores DIY Stores |

| By Material | Wood Metal Plastic Fabric Glass |

| By Price Range | Budget Mid-range Premium |

| By Design Style | Modern Traditional Contemporary Rustic Minimalist |

| By Functionality | Multi-functional Space-saving Ergonomic Smart Furniture Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Furniture Purchases | 120 | Homeowners, Interior Designers |

| Modular Office Solutions | 90 | Office Managers, Facility Coordinators |

| Retail Furniture Trends | 60 | Retail Store Managers, Merchandisers |

| Consumer Preferences in Modular Living | 100 | Young Professionals, Urban Dwellers |

| Sustainability in Furniture Design | 50 | Product Designers, Sustainability Consultants |

The Turkey Furniture & Modular Living Market is valued at approximately USD 12 billion, driven by factors such as urbanization, rising disposable incomes, and a growing demand for modular and customizable furniture solutions.