Region:Asia

Author(s):Rebecca

Product Code:KRAC8526

Pages:84

Published On:November 2025

By Hydrogen Source:The hydrogen generation market in the Philippines can be segmented based on the source of hydrogen production. The primary sources include Gray Hydrogen, Blue Hydrogen, Green Hydrogen, Turquoise Hydrogen, Yellow Hydrogen, and Others. Each source has its unique production method and environmental impact, influencing its adoption across various sectors .

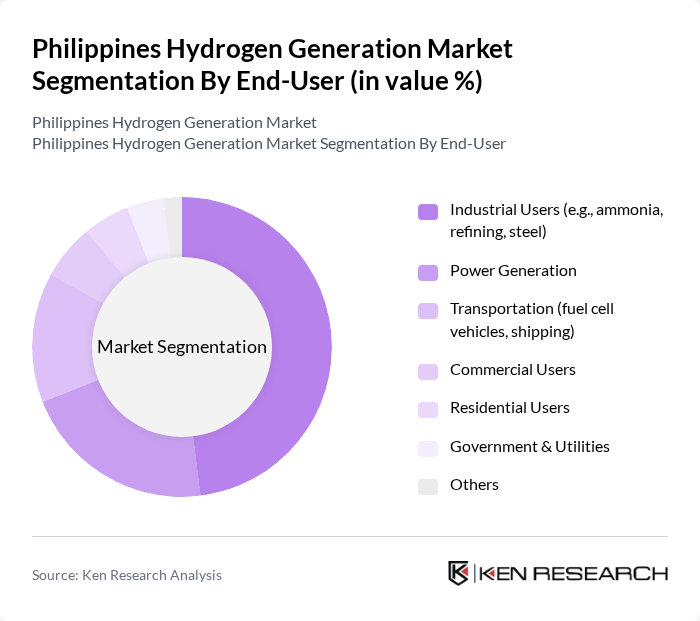

By End-User:The end-user segmentation of the hydrogen generation market includes various sectors such as Industrial Users, Power Generation, Transportation, Commercial Users, Residential Users, Government & Utilities, and Others. Each sector utilizes hydrogen differently, impacting the overall demand and growth of the market .

The Philippines Hydrogen Generation Market is characterized by a dynamic mix of regional and international players. Leading participants such as ACEN Corporation, First Gen Corporation, Energy Development Corporation, Manila Electric Company (Meralco), Philippine National Oil Company (PNOC), Aboitiz Power Corporation, SMC Global Power Holdings Corp., JG Summit Holdings, Inc., DMCI Holdings, Inc., Meralco PowerGen Corporation, Solar Philippines Power Project Holdings, Inc., PetroGreen Energy Corporation, Pilipinas Shell Petroleum Corporation, Shell Philippines Exploration B.V., TotalEnergies Philippines contribute to innovation, geographic expansion, and service delivery in this space.

The future of the hydrogen generation market in the Philippines appears promising, driven by increasing government support and a growing emphasis on sustainability. As the country continues to invest in renewable energy infrastructure, the integration of hydrogen into various sectors, particularly transportation, is expected to gain momentum. Additionally, advancements in technology and international collaborations will likely enhance production efficiency, making hydrogen a more viable energy source in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Hydrogen Source (Gray, Blue, Green, Turquoise, Yellow) | Gray Hydrogen (from natural gas/coal) Blue Hydrogen (with carbon capture) Green Hydrogen (from renewables via electrolysis) Turquoise Hydrogen (methane pyrolysis) Yellow Hydrogen (solar-powered electrolysis) Others |

| By End-User (Industrial, Power Generation, Transportation, Commercial, Residential, Government & Utilities) | Industrial Users (e.g., ammonia, refining, steel) Power Generation Transportation (fuel cell vehicles, shipping) Commercial Users Residential Users Government & Utilities Others |

| By Region (Luzon, Visayas, Mindanao) | Luzon Visayas Mindanao |

| By Technology (Electrolysis, Steam Methane Reforming, Biomass Gasification, Methane Pyrolysis) | Electrolysis (PEM, Alkaline, SOEC) Steam Methane Reforming (SMR) Biomass Gasification Methane Pyrolysis Others |

| By Application (Ammonia Production, Refining, Power Generation, Mobility, Industrial Processes, Fuel Cells) | Ammonia Production Petroleum Refining Power Generation Mobility (FCEVs, shipping, aviation) Industrial Processes Fuel Cells Others |

| By Investment Source (Domestic, FDI, PPP, Government Schemes) | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support (Subsidies, Tax Exemptions, Renewable Energy Certificates, Feed-in Tariffs) | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) Feed-in Tariffs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hydrogen Production Facilities | 60 | Plant Managers, Operations Directors |

| Energy Policy Makers | 40 | Government Officials, Regulatory Bodies |

| Technology Providers | 45 | R&D Managers, Product Development Leads |

| End-Users in Transportation Sector | 50 | Fleet Managers, Logistics Coordinators |

| Industrial Hydrogen Consumers | 55 | Procurement Managers, Operations Executives |

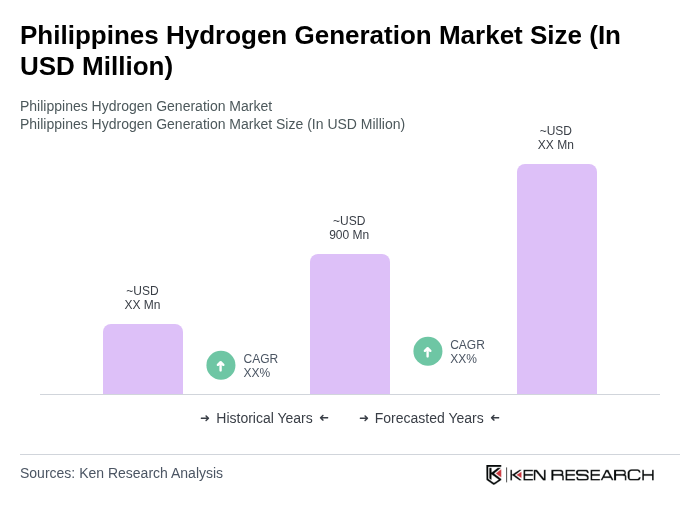

The Philippines Hydrogen Generation Market is valued at approximately USD 900 million, reflecting the country's share in the Southeast Asia hydrogen generation market and its growing renewable energy infrastructure.