Region:Asia

Author(s):Rebecca

Product Code:KRAB1020

Pages:89

Published On:December 2025

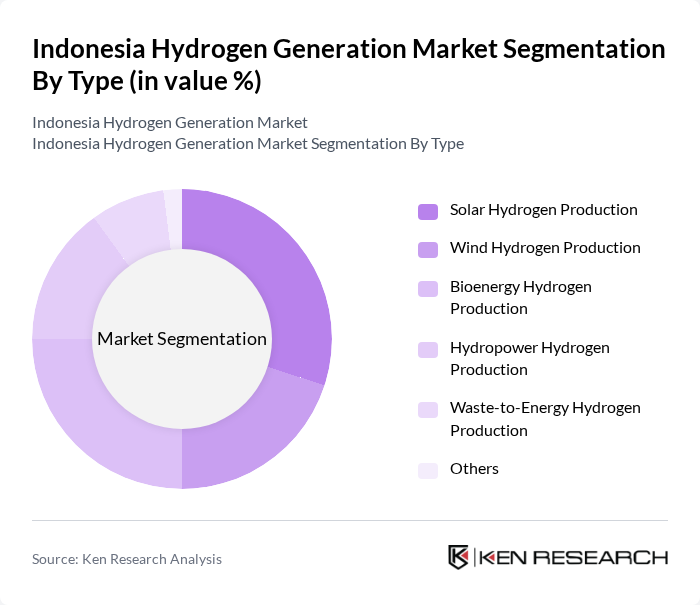

By Type:The hydrogen generation market in Indonesia is segmented by type, which includes various methods of hydrogen production. Among these, solar hydrogen production is gaining traction due to the country's abundant sunlight, making it a viable option for sustainable energy generation. Wind hydrogen production is also emerging, particularly in regions with favorable wind conditions. Bioenergy hydrogen production is significant as it utilizes organic waste, aligning with Indonesia's waste management strategies. Hydropower and waste-to-energy methods are also being explored, contributing to the diversification of hydrogen sources.

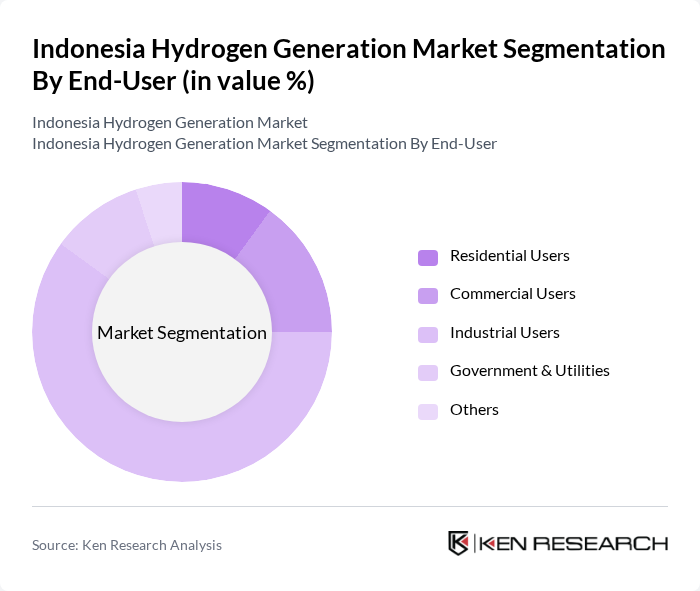

By End-User:The end-user segmentation of the hydrogen generation market in Indonesia includes residential, commercial, industrial, and government & utilities sectors. The industrial sector is the largest consumer of hydrogen, utilizing it for various applications such as refining and chemical production. The commercial sector is also growing, driven by the increasing adoption of hydrogen fuel cells in transportation and logistics. Government initiatives to promote clean energy are further enhancing the demand from utilities, while residential users are gradually adopting hydrogen solutions for energy needs.

The Indonesia Hydrogen Generation Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT Pertamina (Persero), Air Products and Chemicals, Inc., PT Pupuk Indonesia (Persero), PT PLN (Persero), Linde plc, Shell Indonesia, TotalEnergies, Mitsubishi Corporation, Hyundai Motor Company, Siemens AG, ENGIE, BP p.l.c., Toshiba Energy Systems & Solutions Corporation, JGC Corporation, PT Wijaya Karya (Persero) Tbk contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesia hydrogen generation market appears promising, driven by the potential for significant production surpluses and the establishment of large-scale hydrogen projects. With a projected capacity to produce **17.5 million tonnes per year** by future, Indonesia is well-positioned to meet both domestic and international hydrogen demands. Additionally, the integration of renewable energy sources is expected to lower production costs, enhancing the competitiveness of green hydrogen in the global market. The development of a robust hydrogen ecosystem will further support this growth trajectory.

| Segment | Sub-Segments |

|---|---|

| By Type (e.g., Solar, Wind, Bioenergy, Hydropower, Waste-to-Energy) | Solar Hydrogen Production Wind Hydrogen Production Bioenergy Hydrogen Production Hydropower Hydrogen Production Waste-to-Energy Hydrogen Production Others |

| By End-User (Residential, Commercial, Industrial, Government & Utilities) | Residential Users Commercial Users Industrial Users Government & Utilities Others |

| By Region (Java, Sumatra, Kalimantan, Sulawesi, Bali, Nusa Tenggara) | Java Sumatra Kalimantan Sulawesi Bali Nusa Tenggara |

| By Technology (Electrolysis, Steam Methane Reforming, Biomass Gasification) | Electrolysis Steam Methane Reforming Biomass Gasification Others |

| By Application (Fuel Cells, Industrial Processes, Transportation) | Fuel Cells Industrial Processes Transportation Others |

| By Investment Source (Domestic, FDI, PPP, Government Schemes) | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes Others |

| By Policy Support (Subsidies, Tax Exemptions, RECs) | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hydrogen Production Companies | 100 | CEOs, Operations Managers, R&D Directors |

| Government Energy Policy Makers | 50 | Policy Analysts, Energy Regulators, Environmental Officers |

| Renewable Energy Firms | 80 | Business Development Managers, Project Engineers |

| Academic Researchers in Hydrogen Technology | 40 | Professors, Research Scientists, Graduate Students |

| Industry Associations and NGOs | 30 | Executive Directors, Policy Advocates, Research Analysts |

The Indonesia Hydrogen Generation Market is valued at approximately USD 2,145 million, driven by industrial decarbonization efforts and the growing demand for hydrogen as a clean energy alternative in heavy industries across Southeast Asia.