Region:Asia

Author(s):Dev

Product Code:KRAE0106

Pages:93

Published On:December 2025

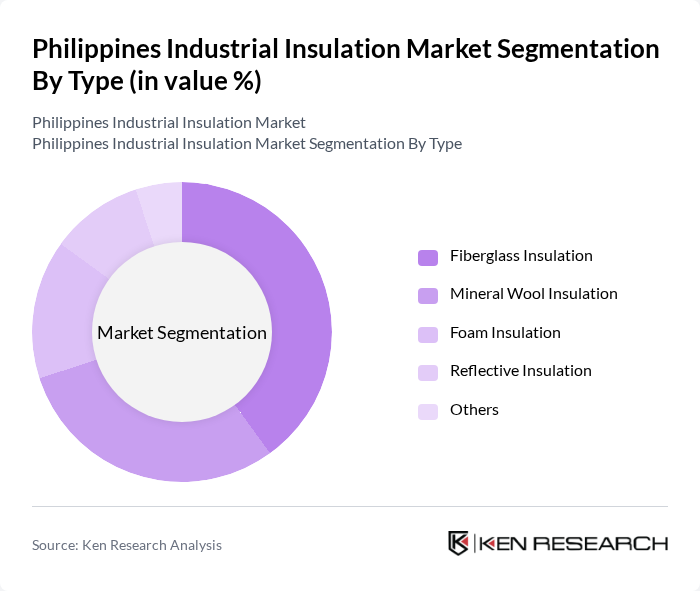

By Type:The market is segmented into various types of insulation materials, including fiberglass insulation, mineral wool insulation, foam insulation, reflective insulation, and others. Fiberglass insulation is currently the dominant type due to its cost-effectiveness and excellent thermal performance, making it a preferred choice in various industrial applications. Mineral wool insulation follows closely, favored for its fire-resistant properties, particularly in sectors like oil and gas and power generation.

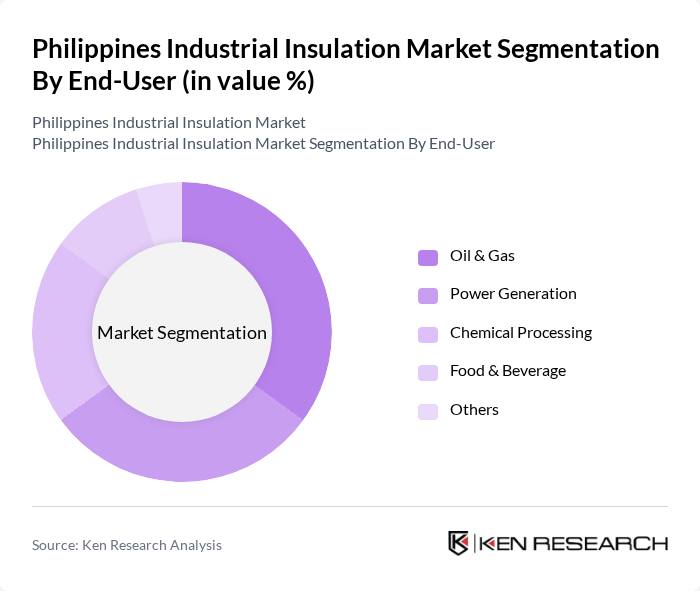

By End-User:The industrial insulation market is primarily driven by key end-user sectors such as oil & gas, power generation, chemical processing, food & beverage, and others. The oil & gas sector is the largest consumer of industrial insulation due to the need for thermal management and safety in high-temperature environments. The power generation sector also significantly contributes to the market, driven by the demand for energy-efficient solutions in power plants.

The Philippines Industrial Insulation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Rockwool International A/S, Owens Corning, Saint-Gobain, Kingspan Group, BASF SE, Johns Manville, Armacell International, Knauf Insulation, Thermafiber, Insulation Corporation of the Philippines, K-Flex, 3M Company, U.S. G. Corporation, Aeroflex, Fibertex Nonwovens contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines industrial insulation market is poised for significant growth, driven by increasing energy efficiency mandates and a surge in industrial activities. As the government continues to invest in infrastructure, the demand for advanced insulation solutions will rise. Additionally, the shift towards eco-friendly materials and smart technologies will shape the market landscape, encouraging manufacturers to innovate. Collaboration between industry stakeholders will be crucial in overcoming challenges and capitalizing on emerging opportunities in the insulation sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Fiberglass Insulation Mineral Wool Insulation Foam Insulation Reflective Insulation Others |

| By End-User | Oil & Gas Power Generation Chemical Processing Food & Beverage Others |

| By Application | Thermal Insulation Acoustic Insulation Fire Protection Others |

| By Material | Organic Insulation Materials Inorganic Insulation Materials Composite Insulation Materials Others |

| By Installation Type | New Construction Retrofitting Others |

| By Region | Luzon Visayas Mindanao |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector Insulation Usage | 100 | Production Managers, Facility Engineers |

| Construction Industry Insulation Demand | 80 | Project Managers, Architects |

| Energy Sector Insulation Applications | 70 | Energy Auditors, Operations Managers |

| HVAC Insulation Practices | 60 | HVAC Technicians, Building Managers |

| Insulation Material Suppliers | 90 | Sales Managers, Product Development Heads |

The Philippines Industrial Insulation Market is valued at approximately USD 10 billion. This valuation reflects the growing demand for energy efficiency in various sectors, including construction, HVAC systems, and industrial operations, driven by urbanization and sustainability initiatives.