Region:Asia

Author(s):Shubham

Product Code:KRAD6601

Pages:86

Published On:December 2025

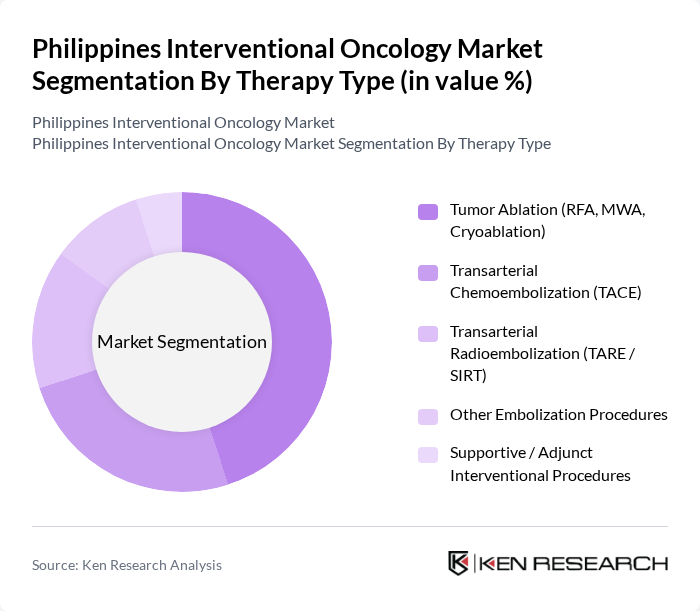

By Therapy Type:The therapy type segmentation includes various interventional oncology techniques that are crucial for treating different types of cancers. The subsegments are Tumor Ablation (RFA, MWA, Cryoablation), Transarterial Chemoembolization (TACE), Transarterial Radioembolization (TARE / SIRT), Other Embolization Procedures, and Supportive / Adjunct Interventional Procedures. Among these, Tumor Ablation techniques are leading the market due to their effectiveness in treating localized tumors with minimal invasiveness, which aligns with the growing preference for outpatient procedures and shorter recovery times.

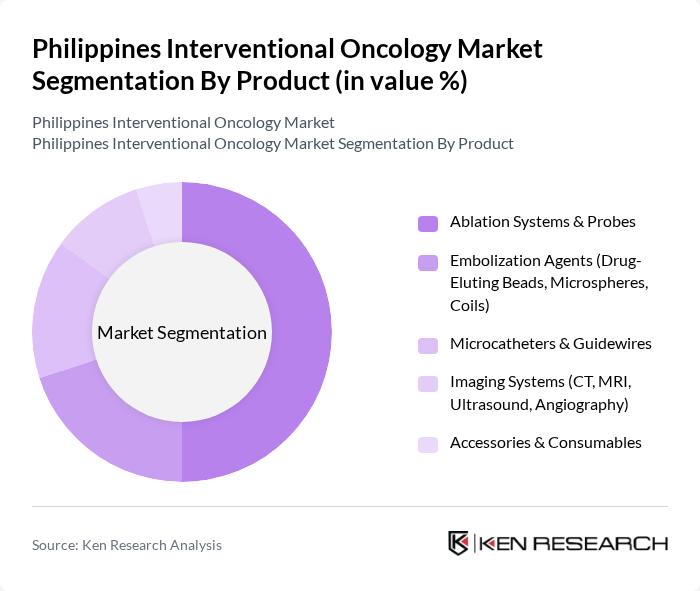

By Product:The product segmentation encompasses various devices and systems used in interventional oncology. This includes Ablation Systems & Probes, Embolization Agents (Drug-Eluting Beads, Microspheres, Coils), Microcatheters & Guidewires, Imaging Systems (CT, MRI, Ultrasound, Angiography), and Accessories & Consumables. The Ablation Systems & Probes segment is currently the market leader, driven by technological advancements and the increasing number of procedures performed, as healthcare providers seek to enhance treatment efficacy and patient outcomes.

The Philippines Interventional Oncology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philippine General Hospital (PGH), St. Luke's Medical Center (Quezon City & Global City), Makati Medical Center, The Medical City (Ortigas), Asian Hospital and Medical Center, Cardinal Santos Medical Center, National Kidney and Transplant Institute (NKTI), Jose R. Reyes Memorial Medical Center, Chong Hua Hospital Cancer Center (Cebu), Manila Doctors Hospital, University of Santo Tomas Hospital, Southern Philippines Medical Center (Davao City), Philippine Heart Center, Victor R. Potenciano Medical Center, Lung Center of the Philippines contribute to innovation, geographic expansion, and service delivery in this space.

The future of the interventional oncology market in the Philippines appears promising, driven by ongoing advancements in technology and increasing healthcare investments. As the government prioritizes cancer care, initiatives to enhance healthcare infrastructure and accessibility are expected to gain momentum. Furthermore, the integration of artificial intelligence in diagnostics and treatment planning will likely revolutionize patient care, leading to improved outcomes and greater efficiency in interventional oncology practices across the nation.

| Segment | Sub-Segments |

|---|---|

| By Therapy Type | Tumor Ablation (RFA, MWA, Cryoablation) Transarterial Chemoembolization (TACE) Transarterial Radioembolization (TARE / SIRT) Other Embolization Procedures Supportive / Adjunct Interventional Procedures |

| By Product | Ablation Systems & Probes Embolization Agents (Drug-Eluting Beads, Microspheres, Coils) Microcatheters & Guidewires Imaging Systems (CT, MRI, Ultrasound, Angiography) Accessories & Consumables |

| By Cancer Type | Hepatocellular Carcinoma (Primary Liver Cancer) Metastatic Liver Cancer Lung Cancer Renal Cell Carcinoma Bone & Spine Metastases Others |

| By Procedure Setting | Inpatient Interventional Oncology Procedures Day-care / Outpatient Interventional Oncology Procedures |

| By End-User | Tertiary Care Hospitals Specialized Cancer Centers Diagnostic & Interventional Imaging Centers Academic & Research Institutions Others |

| By Distribution Channel | Direct Sales to Hospitals & Cancer Centers Local Medical Device Distributors Tender-based Public Procurement Online & E-Procurement Platforms |

| By Region | Luzon (Metro Manila, North & South Luzon) Visayas Mindanao |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Interventional Radiology Practices | 100 | Interventional Radiologists, Oncology Specialists |

| Cancer Treatment Facilities | 80 | Healthcare Administrators, Medical Directors |

| Patient Experience in Interventional Oncology | 75 | Cancer Patients, Caregivers |

| Healthcare Policy Makers | 50 | Health Department Officials, Policy Analysts |

| Medical Equipment Suppliers | 60 | Sales Managers, Product Specialists |

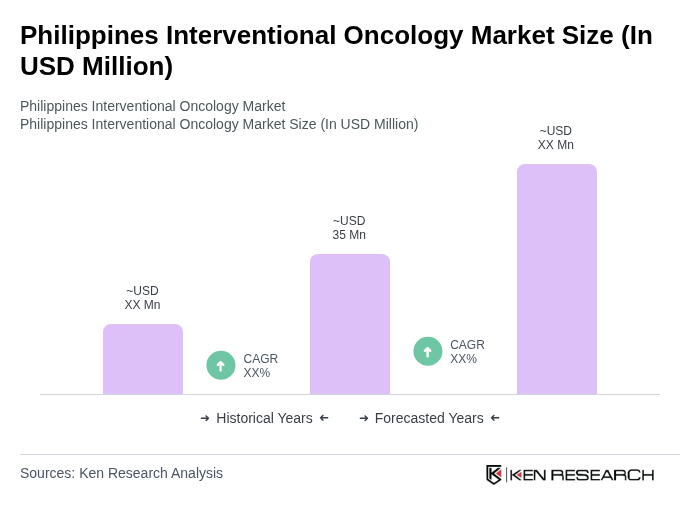

The Philippines Interventional Oncology Market is valued at approximately USD 35 million, reflecting a significant growth driven by the increasing prevalence of cancer and advancements in minimally invasive procedures.