Region:Asia

Author(s):Shubham

Product Code:KRAA8848

Pages:90

Published On:November 2025

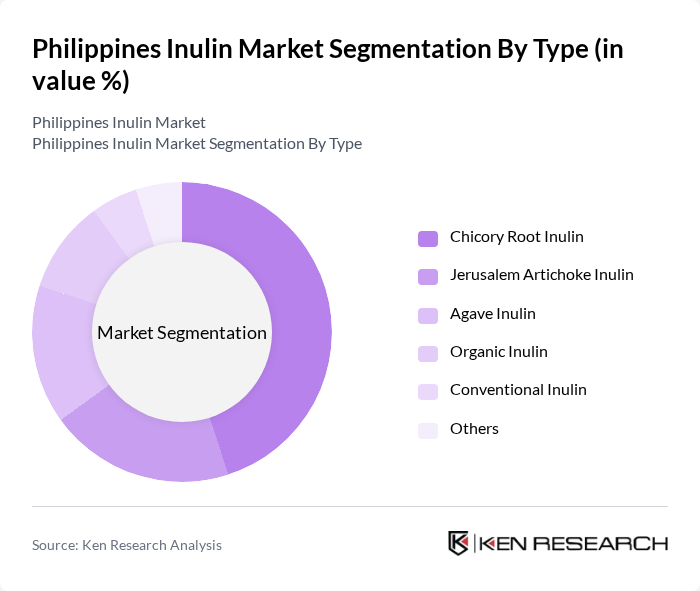

By Type:The market is segmented into various types of inulin, including Chicory Root Inulin, Jerusalem Artichoke Inulin, Agave Inulin, Organic Inulin, Conventional Inulin, and Others. Chicory Root Inulin is the most dominant, reflecting its established use in food and beverage applications due to its proven health benefits and functional versatility. The growing consumer preference for natural and organic products has also increased demand for Organic Inulin, making it a notable segment within the market.

By Form:The inulin market is categorized into Powder and Liquid forms. Powdered inulin is the most widely used, accounting for over two-thirds of the market, due to its ease of handling, storage, and integration into food processing systems. Liquid inulin, while less common, is gaining momentum in the beverage sector, where it is valued for its solubility and ability to enhance nutritional profiles without affecting taste or texture. The preference for powdered inulin is driven by its practicality in manufacturing and broad compatibility with various food applications.

The Philippines Inulin Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cosucra Groupe Warcoing, BENEO GmbH, Sensus B.V., Cargill, Incorporated, Ingredion Incorporated, Tate & Lyle PLC, Roquette Frères, Jarrow Formulas, Inc., The Green Labs LLC, Frutarom Industries Ltd., Archer Daniels Midland Company, DuPont Nutrition & Health, Fiberstar, Inc., KFSU Ltd., Now Foods contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines inulin market is poised for growth as health trends continue to shape consumer preferences. With increasing awareness of the benefits of dietary fibers, particularly inulin, the market is likely to see innovations in product formulations. Additionally, the rise of e-commerce platforms is expected to facilitate greater access to inulin-based products, enhancing distribution channels. As the government supports healthier food initiatives, the market is set to expand, driven by both local consumption and export opportunities.

| Segment | Sub-Segments |

|---|---|

| By Type | Chicory Root Inulin Jerusalem Artichoke Inulin Agave Inulin Organic Inulin Conventional Inulin Others |

| By Form | Powder Liquid |

| By Application | Food and Beverage Dietary Supplements Pharmaceuticals Animal Feed Others |

| By End-User | Commercial (Food Manufacturers, Pharma Companies) Household/Retail |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Health Food Stores Others |

| By Region | Luzon Visayas Mindanao |

| By Consumer Demographics | Age Group (Children, Adults, Seniors) Income Level (Low, Middle, High) |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Manufacturers | 100 | Product Development Managers, Quality Assurance Officers |

| Health and Wellness Retailers | 80 | Store Managers, Nutritionists |

| Dietary Supplement Producers | 70 | Research and Development Heads, Marketing Directors |

| Agricultural Suppliers of Inulin-Rich Crops | 60 | Farm Owners, Supply Chain Managers |

| Healthcare Professionals | 90 | Dietitians, General Practitioners |

The Philippines Inulin Market is valued at approximately USD 38 million, reflecting a growing demand for dietary fibers in food and beverage products, driven by health consciousness and the trend towards natural ingredients.