Philippines LED Lighting for Smart Homes Market Overview

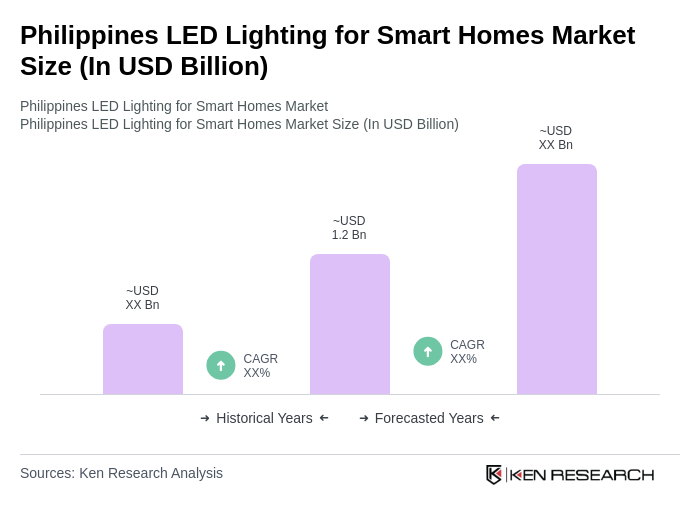

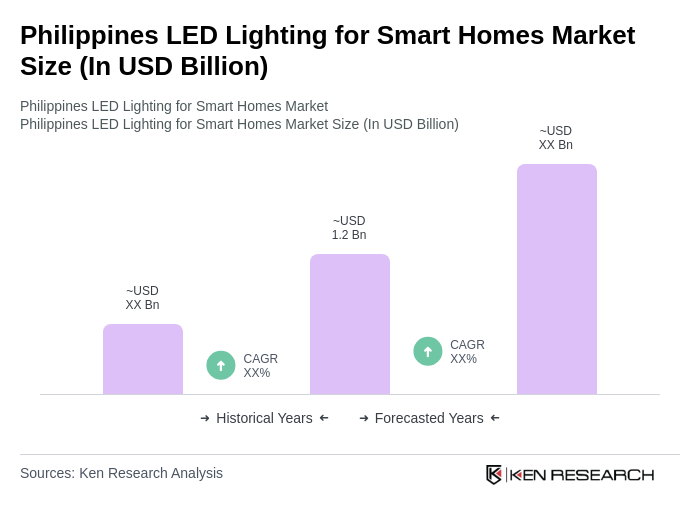

- The Philippines LED Lighting for Smart Homes Market is valued at USD 1.2 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of energy-efficient lighting solutions, rising consumer awareness regarding sustainability, and the integration of smart technologies in residential spaces. The shift towards smart homes has significantly influenced the demand for LED lighting, as consumers seek to enhance energy efficiency and convenience.

- Metro Manila, Cebu, and Davao are the dominant cities in the Philippines LED Lighting for Smart Homes Market. Metro Manila, being the capital region, has a high concentration of urban development and technological advancements, making it a hub for smart home innovations. Cebu and Davao are also experiencing rapid urbanization and infrastructure development, contributing to the growing demand for LED lighting solutions in residential and commercial sectors.

- The Philippine government has implemented the Energy Efficiency and Conservation Act, which mandates the promotion of energy-efficient technologies, including LED lighting. This regulation aims to reduce energy consumption and greenhouse gas emissions, encouraging both consumers and businesses to adopt energy-efficient lighting solutions as part of their sustainability initiatives.

Philippines LED Lighting for Smart Homes Market Segmentation

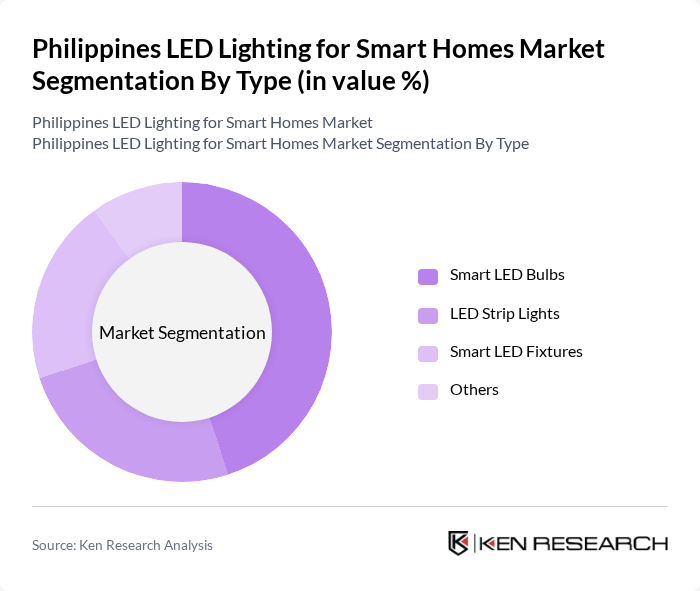

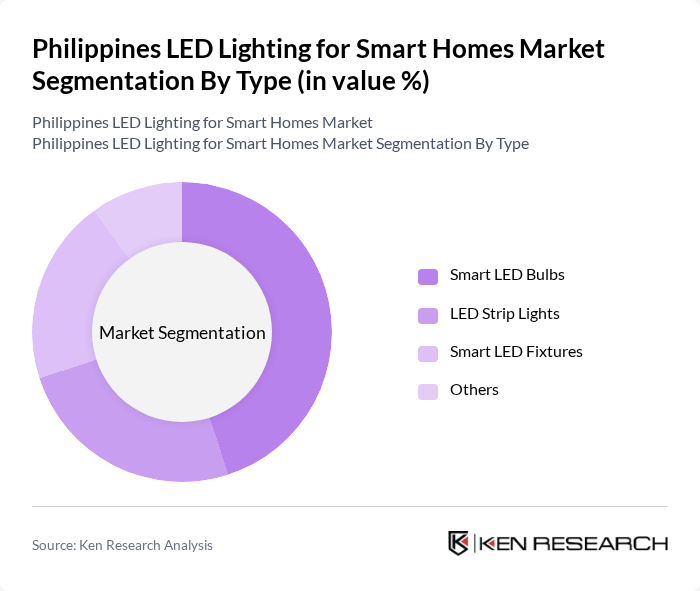

By Type:The market is segmented into Smart LED Bulbs, LED Strip Lights, Smart LED Fixtures, and Others. Among these, Smart LED Bulbs are leading the market due to their versatility, ease of installation, and compatibility with smart home systems. Consumers are increasingly opting for smart bulbs that can be controlled via mobile apps or voice commands, enhancing convenience and energy management. LED Strip Lights are also gaining popularity for decorative purposes, especially in residential settings.

By End-User:The market is categorized into Residential, Commercial, Industrial, and Government & Utilities. The Residential segment dominates the market, driven by the increasing trend of smart home adoption and consumer preference for energy-efficient lighting solutions. Homeowners are investing in smart LED lighting to enhance their living spaces, improve energy efficiency, and reduce electricity costs. The Commercial segment is also significant, as businesses seek to upgrade their lighting systems to comply with energy regulations and improve operational efficiency.

Philippines LED Lighting for Smart Homes Market Competitive Landscape

The Philippines LED Lighting for Smart Homes Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips Lighting, Osram Licht AG, Cree, Inc., General Electric Company, Signify N.V., Acuity Brands, Inc., Eaton Corporation, Panasonic Corporation, Toshiba Corporation, Samsung Electronics Co., Ltd., LG Electronics Inc., Hubbell Incorporated, Legrand S.A., Zumtobel Group AG, FSL Electronics Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

Philippines LED Lighting for Smart Homes Market Industry Analysis

Growth Drivers

- Increasing Demand for Energy-Efficient Solutions:The Philippines is experiencing a significant shift towards energy-efficient solutions, with the Department of Energy reporting a 20% increase in energy-efficient lighting adoption from 2022 to 2023. This trend is driven by rising electricity costs, which averaged PHP 11.00 per kWh in the future, prompting consumers to seek cost-effective alternatives. The government's commitment to reducing energy consumption by 30% by 2030 further fuels this demand, making LED lighting a preferred choice for smart homes.

- Government Initiatives Promoting Smart Home Technologies:The Philippine government has launched several initiatives to promote smart home technologies, including the Smart Cities Program, which allocated PHP 1.8 billion in the future for infrastructure development. This program aims to enhance urban living through technology integration, including smart lighting solutions. Additionally, the government is providing tax incentives for companies investing in smart home technologies, which is expected to boost the adoption of LED lighting systems in residential areas.

- Rising Consumer Awareness About Sustainability:Consumer awareness regarding sustainability is on the rise, with a future survey indicating that 70% of Filipinos prioritize eco-friendly products. This shift is reflected in the growing preference for LED lighting, which consumes up to 75% less energy than traditional bulbs. The increasing availability of information on the environmental impact of lighting choices is driving consumers towards sustainable options, further propelling the LED lighting market in smart homes across the Philippines.

Market Challenges

- High Initial Investment Costs:One of the primary challenges facing the LED lighting market in the Philippines is the high initial investment costs associated with smart home technologies. The average cost of installing a smart LED lighting system can reach PHP 32,000, which is a significant barrier for many consumers. Despite long-term savings on energy bills, the upfront costs deter potential buyers, limiting market growth and adoption rates in the residential sector.

- Limited Consumer Knowledge About Smart Home Integration:Limited consumer knowledge regarding smart home integration poses a significant challenge to the LED lighting market. A future study revealed that only 40% of Filipino homeowners are familiar with smart home technologies, including LED lighting systems. This lack of understanding hampers adoption rates, as consumers are hesitant to invest in technologies they do not fully comprehend, thereby slowing market penetration and growth.

Philippines LED Lighting for Smart Homes Market Future Outlook

The future of the LED lighting market for smart homes in the Philippines appears promising, driven by technological advancements and increasing consumer demand for energy-efficient solutions. As the government continues to support smart home initiatives, the integration of IoT-enabled lighting systems is expected to rise. Additionally, the growing trend of home automation will likely lead to more innovative lighting solutions, enhancing user experience and energy savings, thus fostering a more sustainable living environment.

Market Opportunities

- Expansion of Smart Home Infrastructure:The ongoing expansion of smart home infrastructure presents a significant opportunity for LED lighting manufacturers. With urbanization rates projected to reach 65% in the future, there is a growing demand for integrated smart home solutions, including energy-efficient lighting systems. This trend is expected to drive investments in LED technology, creating a favorable market environment for innovative products.

- Partnerships with Technology Providers:Collaborating with technology providers can enhance the development of advanced LED lighting solutions. Strategic partnerships can facilitate the integration of smart lighting with other home automation systems, improving functionality and user experience. This collaboration is crucial as the market shifts towards more interconnected and user-friendly smart home technologies, providing a competitive edge for companies involved.