Region:Asia

Author(s):Geetanshi

Product Code:KRAA6620

Pages:80

Published On:September 2025

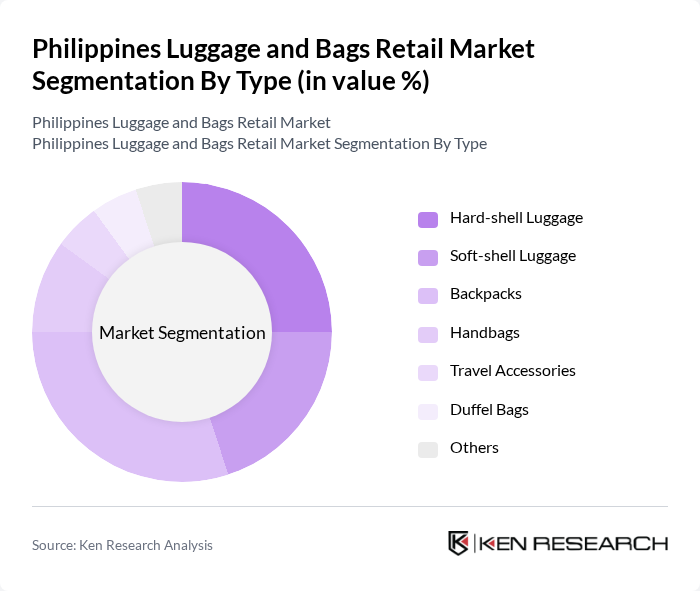

By Type:The luggage and bags retail market can be segmented into various types, including Hard-shell Luggage, Soft-shell Luggage, Backpacks, Handbags, Travel Accessories, Duffel Bags, and Others. Among these, Hard-shell Luggage is gaining popularity due to its durability and security features, while Backpacks are favored for their versatility and convenience. The increasing trend of travel, both for leisure and business, has led to a surge in demand across these segments.

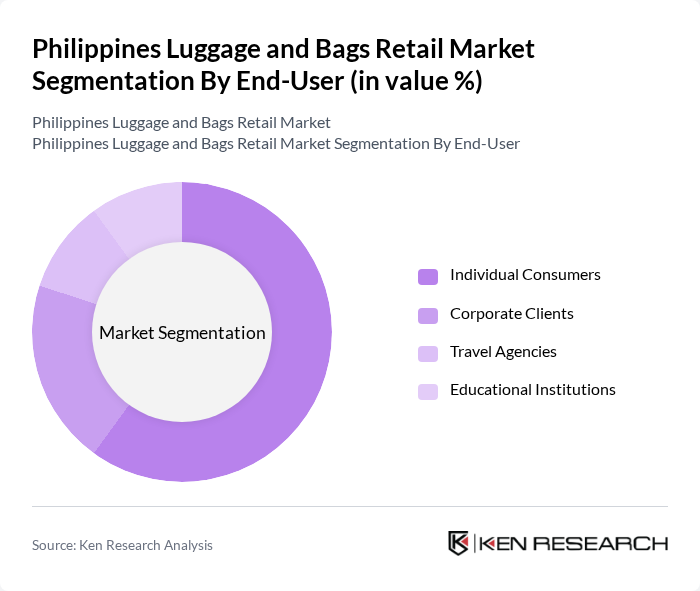

By End-User:The market can be segmented based on end-users, including Individual Consumers, Corporate Clients, Travel Agencies, and Educational Institutions. Individual Consumers dominate the market due to the increasing trend of personal travel and leisure activities. Corporate Clients also contribute significantly, as businesses often require luggage for employee travel. The rise in educational trips and travel agency packages further supports the growth of this segment.

The Philippines Luggage and Bags Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsonite Philippines, American Tourister, Roxy, Adidas Philippines, The North Face, Herschel Supply Co., Travelite, Toby's Sports, Luggage Factory, Osprey, Kipling, Targus, Eastpak, Delsey, Under Armour contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines luggage and bags retail market is poised for continued growth, driven by evolving consumer preferences and technological advancements. The increasing integration of smart technology in luggage, such as GPS tracking and built-in charging ports, is expected to attract tech-savvy consumers. Additionally, the rise of eco-consciousness among shoppers will likely push brands to innovate sustainable products, aligning with global trends and enhancing market competitiveness in the near future.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard-shell Luggage Soft-shell Luggage Backpacks Handbags Travel Accessories Duffel Bags Others |

| By End-User | Individual Consumers Corporate Clients Travel Agencies Educational Institutions |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Department Stores Specialty Stores |

| By Price Range | Budget Mid-range Premium |

| By Brand Type | Local Brands International Brands |

| By Material | Polyester Nylon Leather Canvas |

| By Usage Occasion | Business Travel Leisure Travel Daily Commute Special Events |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Luggage Sales | 150 | Store Managers, Retail Buyers |

| Consumer Preferences in Bags | 200 | Frequent Travelers, College Students |

| E-commerce Luggage Purchases | 120 | Online Shoppers, Digital Marketing Managers |

| Brand Loyalty Insights | 100 | Brand Managers, Marketing Executives |

| Market Trends and Innovations | 80 | Product Designers, Trend Analysts |

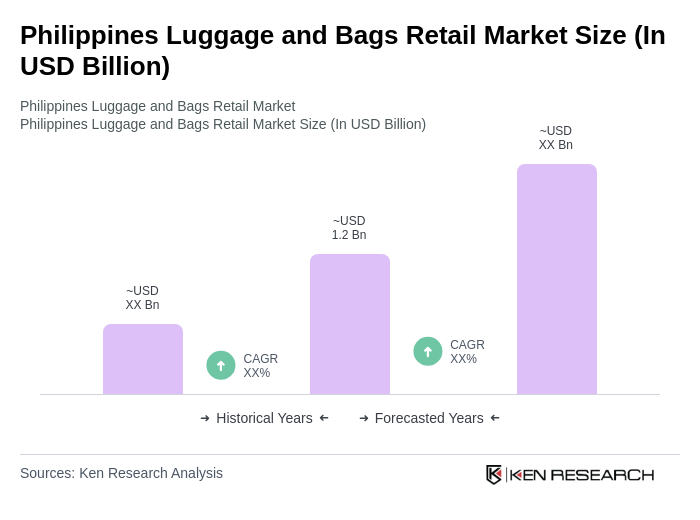

The Philippines Luggage and Bags Retail Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by increasing travel, rising disposable incomes, and the trend towards online shopping.