Nigeria Luggage and Bags Retail Market Overview

- The Nigeria Luggage and Bags Retail Market is valued at USD 1.2 billion, based on a five-year historical analysis. This growth is primarily driven by urbanization, rising disposable incomes, and an increasing travel culture among Nigerians. This expansion is supported by a surge in both business and leisure travel, as well as greater consumer spending on functional and stylish luggage and bags.

- Lagos, Abuja, and Port Harcourt remain the dominant cities in the Nigerian luggage and bags retail market. Lagos, as the commercial hub, hosts a high concentration of retail outlets and consumers with disposable income. Abuja attracts government and corporate clients, while Port Harcourt’s oil and gas sector drives demand for quality luggage among professionals.

- In 2023, the Nigerian government introduced theRevised Excise Duty Rates (Goods Manufactured in Nigeria) Order, 2023, issued by the Federal Ministry of Finance, which includes tax incentives for local manufacturers of luggage and bags. The order also imposes higher import tariffs on foreign-made luggage and bags, aiming to encourage domestic production, reduce import dependency, and stimulate job creation within the sector. Compliance requires manufacturers to meet specified local content thresholds and obtain relevant certifications from the Standards Organization of Nigeria (SON).

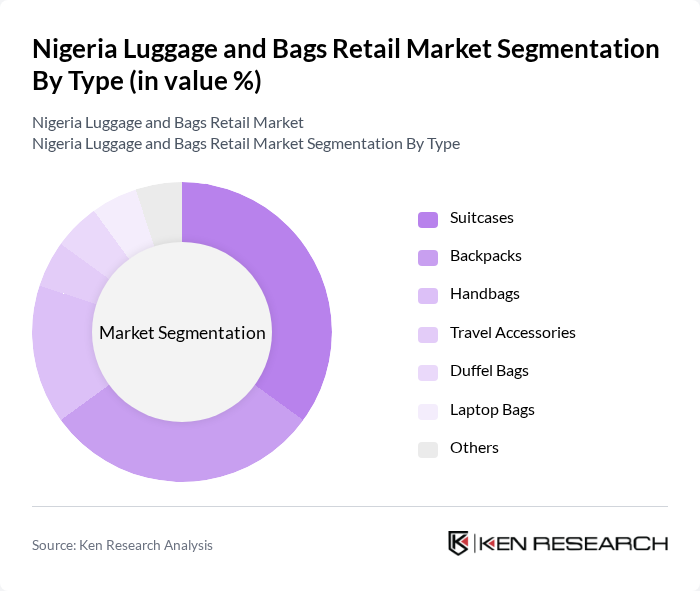

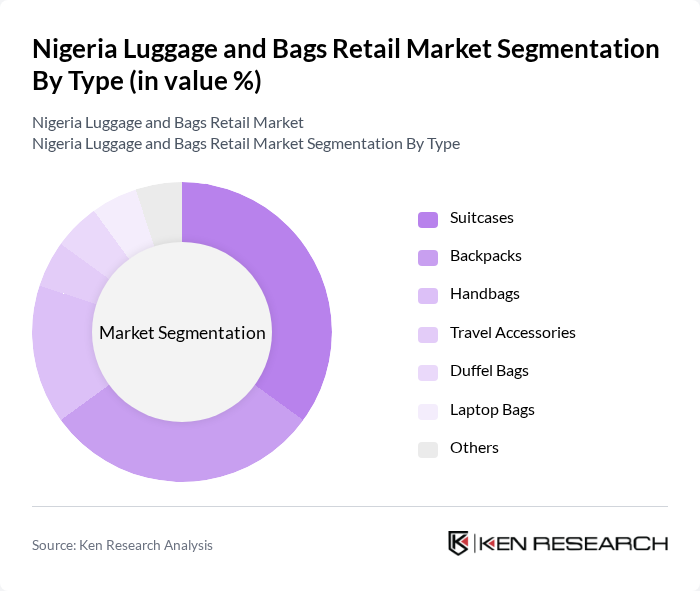

Nigeria Luggage and Bags Retail Market Segmentation

By Type:The luggage and bags retail market is segmented into various types, including suitcases, backpacks, handbags, travel accessories, duffel bags, laptop bags, and others. Among these, suitcases and backpacks dominate the market due to their practicality and versatility. Suitcases are preferred for travel, while backpacks cater to both students and professionals, reflecting a growing trend towards casual and functional designs. The increasing trend of travel and outdoor activities has further propelled the demand for these segments.

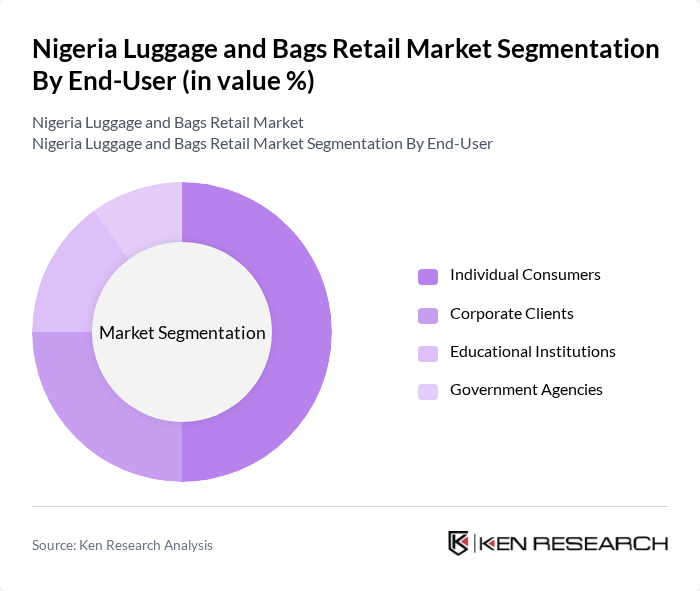

By End-User:The end-user segmentation includes individual consumers, corporate clients, educational institutions, and government agencies. Individual consumers represent the largest segment, driven by the increasing trend of personal travel and the need for stylish and functional bags. Corporate clients also contribute significantly, as businesses require quality luggage for employee travel. Educational institutions and government agencies are growing segments, reflecting the need for backpacks and travel accessories among students and officials.

Nigeria Luggage and Bags Retail Market Competitive Landscape

The Nigeria Luggage and Bags Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsonite International S.A., Tumi Holdings, Inc., American Tourister, Delsey S.A., VIP Industries Ltd., Antler Ltd., Wenger S.A., Herschel Supply Co., Osprey Packs, Inc., The North Face, Inc., Kipling, RIMOWA, Piquadro S.p.A., Polo Avenue (Nigeria), Ruff 'n' Tumble (Nigeria), Leatherworld Nigeria Ltd., Oba Couture (Nigeria), FemiHandbags (Nigeria), Zashadu (Nigeria), Morin O. (Nigeria) contribute to innovation, geographic expansion, and service delivery in this space.

Nigeria Luggage and Bags Retail Market Industry Analysis

Growth Drivers

- Increasing Urbanization:Nigeria's urban population is projected to reach 250 million in future, up from 200 million in 2021, according to the World Bank. This rapid urbanization drives demand for luggage and bags as more individuals engage in travel for work and leisure. Urban centers like Lagos and Abuja are seeing a surge in retail outlets, catering to the growing middle class, which is increasingly seeking quality travel products. This trend is expected to significantly boost sales in the luggage sector.

- Rising Disposable Income:The average disposable income in Nigeria is expected to rise to approximately $4,000 per capita in future, up from $2,500 in 2021, as reported by the IMF. This increase in disposable income allows consumers to spend more on non-essential items, including luggage and bags. As more Nigerians travel for business and leisure, the demand for high-quality, stylish luggage is anticipated to grow, further stimulating market expansion.

- Growth in Travel and Tourism:The Nigerian tourism sector is projected to contribute $10 billion to the GDP in future, up from $7.2 billion in 2021, according to the World Travel & Tourism Council. This growth is driven by increased domestic and international travel, leading to higher demand for luggage and bags. As travel becomes more accessible, consumers are likely to invest in durable and fashionable travel gear, enhancing market prospects for retailers in this segment.

Market Challenges

- Economic Instability:Nigeria's economy faces significant challenges, with inflation rates projected to reach 20% in future, up from 15% in 2021, according to the Central Bank of Nigeria. This economic instability affects consumer purchasing power, leading to reduced spending on non-essential items like luggage. Retailers may struggle to maintain sales volumes as consumers prioritize essential goods over luxury items, impacting overall market growth.

- High Import Tariffs:Import tariffs on luggage and bags in Nigeria can reach as high as 25%, according to the Nigerian Customs Service. These tariffs increase the cost of imported goods, making them less competitive against locally produced alternatives. As a result, retailers may face challenges in pricing their products competitively, which could hinder market growth and limit consumer access to a variety of quality luggage options.

Nigeria Luggage and Bags Retail Market Future Outlook

The future of the Nigeria luggage and bags retail market appears promising, driven by increasing urbanization and rising disposable incomes. As the travel and tourism sector continues to expand, consumer preferences are shifting towards high-quality, stylish products. Retailers are likely to adapt by enhancing their online presence and diversifying product offerings. Additionally, the growing trend of eco-friendly products will encourage brands to innovate, aligning with consumer values and sustainability goals, further shaping the market landscape.

Market Opportunities

- Growth of Local Manufacturing:With the Nigerian government promoting local manufacturing through initiatives and incentives, there is a significant opportunity for domestic brands to capture market share. By producing locally, companies can reduce costs associated with import tariffs and appeal to consumers seeking locally made products, potentially increasing brand loyalty and market penetration.

- Increasing Demand for Eco-friendly Products:As global awareness of environmental issues rises, Nigerian consumers are increasingly seeking eco-friendly luggage options. The market for sustainable products is expected to grow, with consumers willing to pay a premium for items made from recycled materials. This trend presents an opportunity for brands to innovate and differentiate themselves by offering environmentally responsible products that align with consumer values.