Region:Asia

Author(s):Rebecca

Product Code:KRAA5063

Pages:96

Published On:September 2025

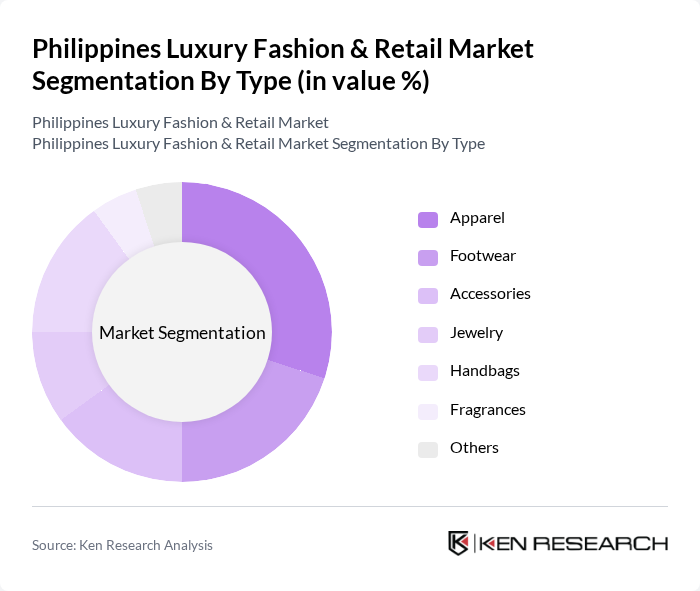

By Type:The luxury fashion market can be segmented into various types, including apparel, footwear, accessories, jewelry, handbags, fragrances, and others. Each of these segments caters to different consumer preferences and trends, with specific brands leading in each category.

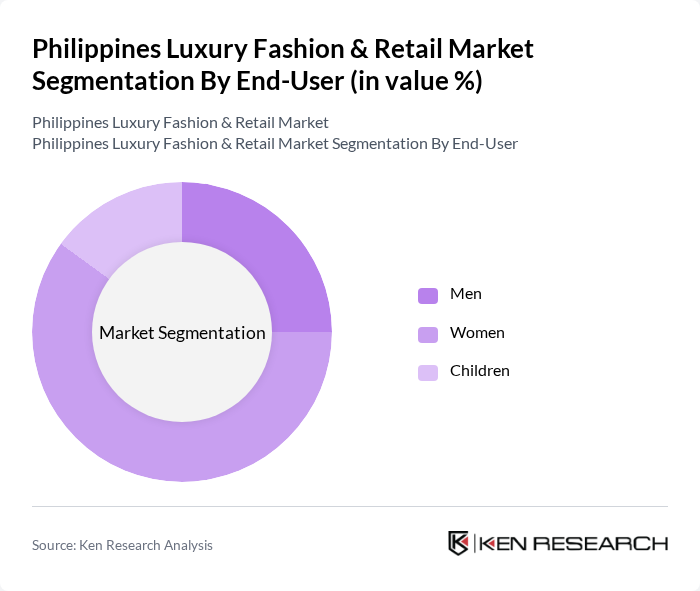

By End-User:The market is segmented by end-user demographics, including men, women, and children. Each demographic has distinct preferences and purchasing behaviors, influencing the types of luxury products that are in demand.

The Philippines Luxury Fashion & Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Louis Vuitton Malletier, Gucci, Chanel, Prada, Hermès, Burberry, Versace, Salvatore Ferragamo, Michael Kors, Bvlgari, Fendi, Valentino, Dolce & Gabbana, Balenciaga, Tory Burch contribute to innovation, geographic expansion, and service delivery in this space.

The future of the luxury fashion market in the Philippines appears promising, driven by increasing consumer sophistication and a growing appetite for premium products. As digital transformation continues, brands are expected to enhance their online presence, catering to the evolving preferences of tech-savvy consumers. Additionally, the rise of sustainable fashion will likely influence purchasing decisions, as consumers become more environmentally conscious, seeking brands that align with their values and lifestyle choices.

| Segment | Sub-Segments |

|---|---|

| By Type | Apparel Footwear Accessories Jewelry Handbags Fragrances Others |

| By End-User | Men Women Children |

| By Sales Channel | Online Retail Department Stores Specialty Stores Luxury Boutiques |

| By Price Range | Premium High-End Ultra-Luxury |

| By Consumer Demographics | Age Group Income Level Lifestyle Preferences |

| By Brand Origin | Local Brands International Brands |

| By Distribution Mode | Direct Sales Indirect Sales Franchise |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Apparel Purchasers | 150 | Affluent Consumers, Fashion Enthusiasts |

| High-End Accessory Buyers | 100 | Luxury Brand Loyalists, Trendsetters |

| Footwear Segment Consumers | 80 | Fashion Retail Managers, High-Income Shoppers |

| Luxury E-commerce Shoppers | 120 | Online Shoppers, Digital Influencers |

| Fashion Industry Experts | 60 | Designers, Retail Analysts, Brand Strategists |

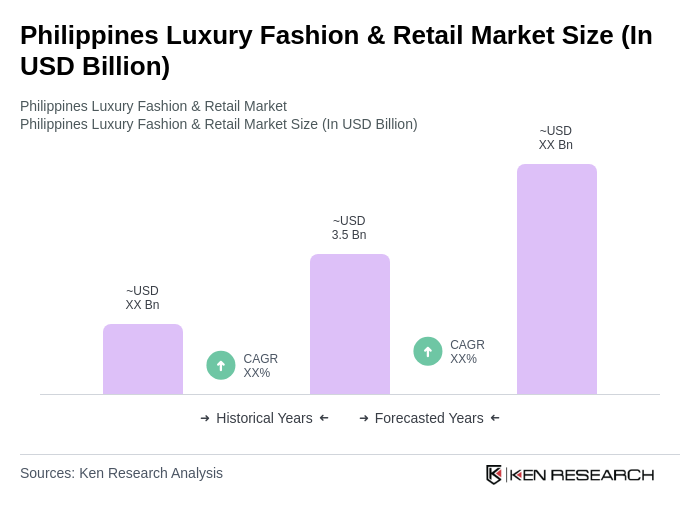

The Philippines Luxury Fashion & Retail Market is valued at approximately USD 3.5 billion, reflecting significant growth driven by rising disposable incomes and an increasing demand for luxury goods among Filipino consumers.