Region:Middle East

Author(s):Dev

Product Code:KRAB7430

Pages:90

Published On:October 2025

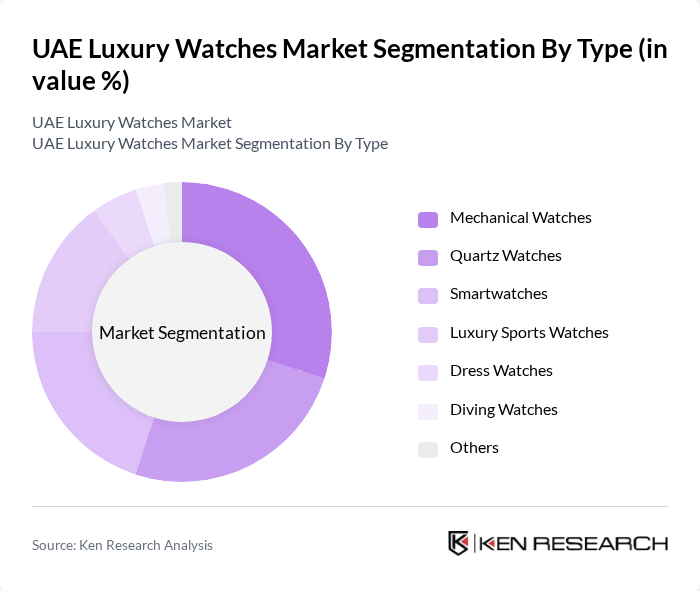

By Type:The luxury watches market can be segmented into various types, including Mechanical Watches, Quartz Watches, Smartwatches, Luxury Sports Watches, Dress Watches, Diving Watches, and Others. Among these, Mechanical Watches and Quartz Watches are the most popular due to their craftsmanship and reliability. Mechanical watches are often favored for their intricate designs and traditional appeal, while quartz watches are appreciated for their accuracy and affordability. The growing trend of smartwatches is also notable, as they combine luxury with technology, appealing to a younger demographic.

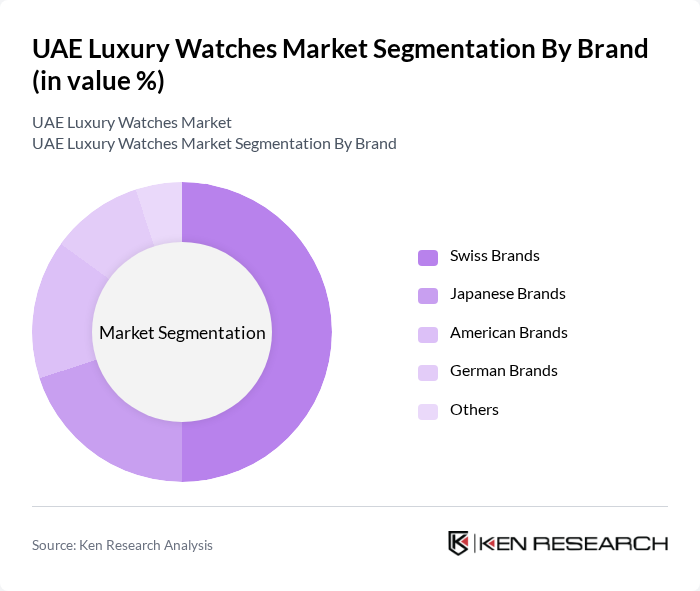

By Brand:The luxury watches market is characterized by a diverse range of brands, including Swiss Brands, Japanese Brands, American Brands, German Brands, and Others. Swiss brands dominate the market due to their long-standing reputation for quality and precision. Brands like Rolex and Patek Philippe are particularly sought after for their heritage and craftsmanship. Japanese brands, while known for their innovation and technology, cater to a different segment of consumers who value reliability and affordability.

The UAE Luxury Watches Market is characterized by a dynamic mix of regional and international players. Leading participants such as Rolex SA, Patek Philippe SA, Audemars Piguet, Omega SA, TAG Heuer, Hublot, Cartier, IWC Schaffhausen, Jaeger-LeCoultre, Panerai, Breitling, Chopard, Breguet, Longines, Seiko Holdings Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The UAE luxury watches market is poised for dynamic growth, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, brands that adopt eco-friendly practices are likely to attract environmentally conscious consumers. Additionally, the integration of smart technology into luxury watches is expected to enhance product appeal, catering to tech-savvy buyers. The market will also benefit from increased digital marketing efforts, allowing brands to engage with a broader audience and adapt to changing consumer behaviors effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Mechanical Watches Quartz Watches Smartwatches Luxury Sports Watches Dress Watches Diving Watches Others |

| By Brand | Swiss Brands Japanese Brands American Brands German Brands Others |

| By Price Range | Below AED 5,000 AED 5,000 - AED 15,000 AED 15,000 - AED 30,000 Above AED 30,000 |

| By Distribution Channel | Online Retail Luxury Boutiques Department Stores Authorized Dealers Others |

| By End-User | Individual Consumers Corporate Clients Gift Purchases Collectors |

| By Occasion | Weddings Anniversaries Corporate Events Personal Milestones |

| By Material | Stainless Steel Gold Platinum Ceramic Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Watch Retailers | 100 | Store Managers, Sales Executives |

| Affluent Consumers | 150 | High Net-Worth Individuals, Luxury Shoppers |

| Watch Collectors and Enthusiasts | 80 | Collectors, Hobbyists |

| Luxury Watch Brand Executives | 50 | Brand Managers, Marketing Directors |

| Industry Experts and Analysts | 30 | Market Analysts, Consultants |

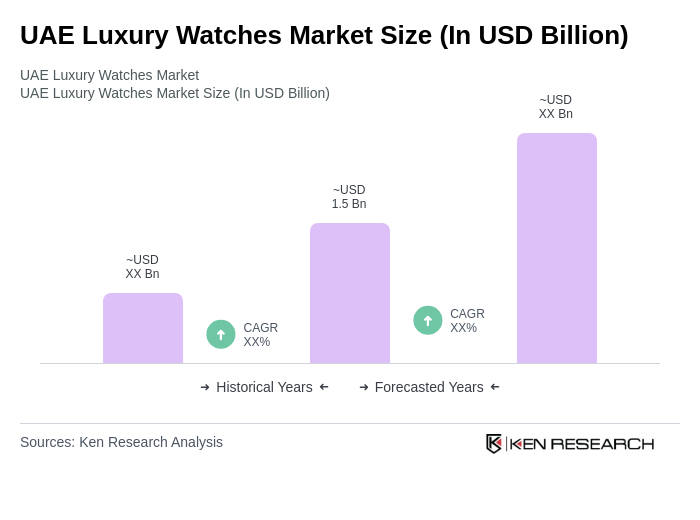

The UAE Luxury Watches Market is valued at approximately USD 1.5 billion, driven by increasing disposable income, a preference for luxury goods, and the UAE's reputation as a global shopping destination.