Region:Middle East

Author(s):Dev

Product Code:KRAD1637

Pages:99

Published On:November 2025

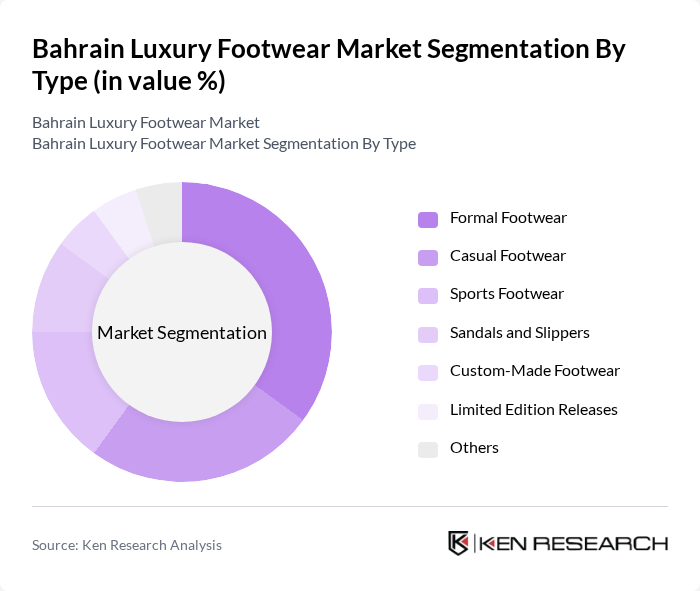

By Type:The luxury footwear market can be segmented into various types, including formal footwear, casual footwear, sports footwear, sandals and slippers, custom-made footwear, limited edition releases, and others. Among these,formal footwearremains the dominant segment, driven by increasing demand for high-quality dress shoes for business and formal occasions. Consumers are increasingly willing to invest in premium formal shoes that offer both comfort and elegance, reflecting a growing trend towards luxury in professional attire.

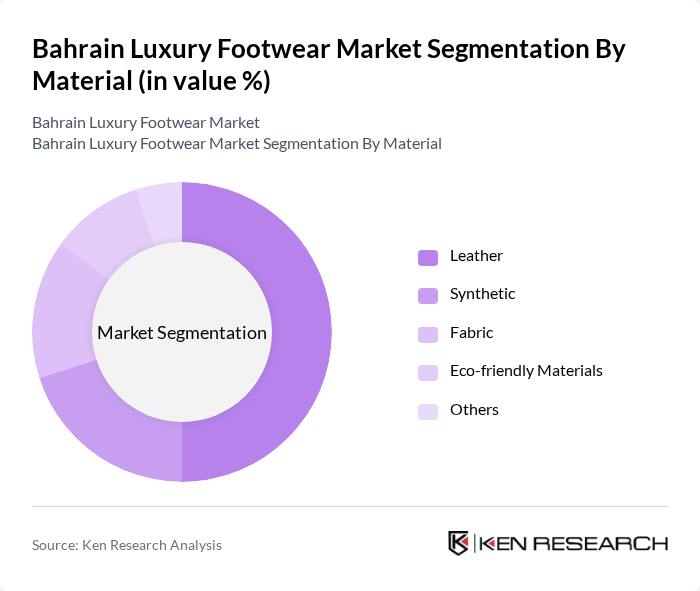

By Material:The market can also be segmented based on the materials used, including leather, synthetic, fabric, eco-friendly materials, and others.Leather footwearremains the most popular choice among consumers due to its durability, comfort, and luxurious appeal. The trend towards sustainability has also led to a growing interest in eco-friendly materials, as consumers become more conscious of their environmental impact and seek out brands that align with their values. Sustainable footwear options are increasingly promoted by luxury brands in Bahrain, responding to both regulatory requirements and consumer preferences.

The Bahrain Luxury Footwear Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al-Haddad Group, Al-Futtaim Group, Al-Mohannad Group, Al-Zayani Investments, Al-Sayed Group, Al-Mansoori Group, Al-Bahar Group, Al-Muhaidib Group, Al-Mahroos Group, Al-Muhtadi Group, Al-Mahmood Group, Chalhoub Group, Richemont Group, LVMH Moët Hennessy Louis Vuitton, Kering Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain luxury footwear market appears promising, driven by increasing disposable incomes and a growing appetite for premium products. As e-commerce continues to expand, brands that effectively leverage online platforms will likely capture a larger share of the market. Additionally, the trend towards sustainability and ethical sourcing is expected to shape consumer preferences, prompting brands to innovate and adapt. Overall, the market is poised for growth, with opportunities for both established and emerging players to thrive in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Formal Footwear Casual Footwear Sports Footwear Sandals and Slippers Custom-Made Footwear Limited Edition Releases Others |

| By Material | Leather Synthetic Fabric Eco-friendly Materials Others |

| By Gender | Men's Footwear Women's Footwear Children's Footwear Unisex Footwear Others |

| By Price Range | Premium Super Premium Ultra Luxury Others |

| By Distribution Channel | Online Retail Brick-and-Mortar Stores Luxury Department Stores Exclusive Boutiques Others |

| By Occasion | Formal Events Casual Outings Sports Activities Seasonal Events Others |

| By Brand Origin | Local Brands International Brands Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Footwear Retailers | 50 | Store Managers, Brand Representatives |

| Consumer Insights on Luxury Footwear | 150 | Affluent Consumers, Fashion Enthusiasts |

| Market Trends and Preferences | 40 | Fashion Influencers, Trend Analysts |

| Distribution Channel Effectiveness | 40 | Retail Executives, Supply Chain Managers |

| Brand Loyalty and Consumer Behavior | 60 | Luxury Footwear Buyers, Market Researchers |

The Bahrain Luxury Footwear Market is valued at approximately USD 250 million, reflecting a significant growth trend driven by increasing disposable incomes, a preference for luxury brands, and a rise in tourism, enhancing foot traffic in luxury retail areas.