Region:Asia

Author(s):Rebecca

Product Code:KRAC9631

Pages:83

Published On:November 2025

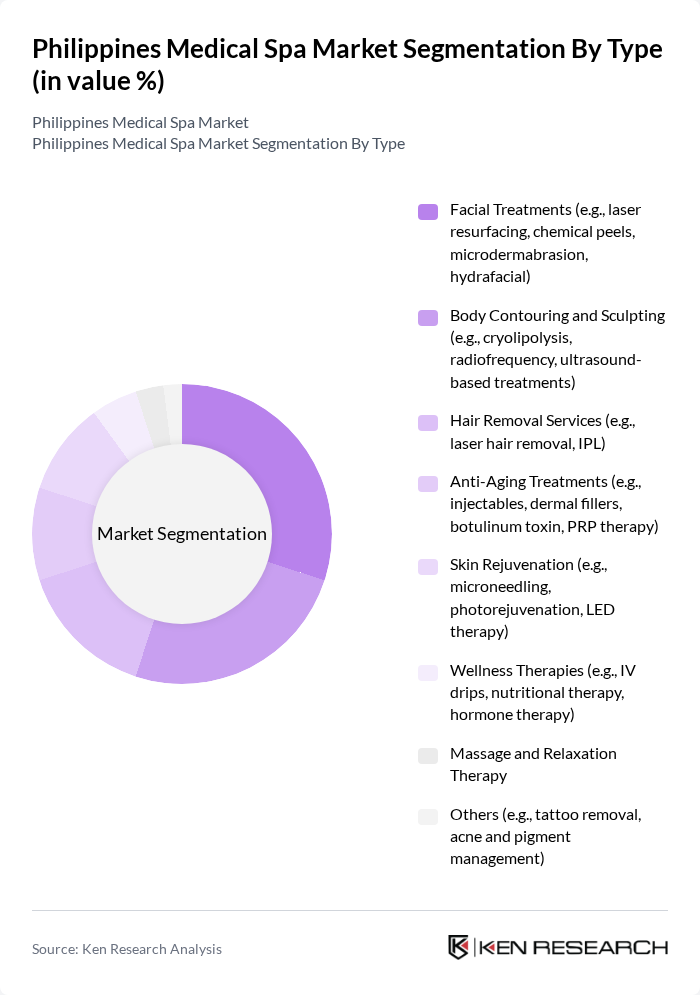

By Type:The market is segmented into various types of services offered by medical spas. The primary subsegments include Facial Treatments, Body Contouring and Sculpting, Hair Removal Services, Anti-Aging Treatments, Skin Rejuvenation, Wellness Therapies, Massage and Relaxation Therapy, and Others. Each subsegment addresses specific consumer needs, with facial treatments and body contouring remaining the most popular due to high demand for visible aesthetic results and minimally invasive procedures. Wellness therapies and integrative treatments are gaining traction as consumers seek holistic health benefits.

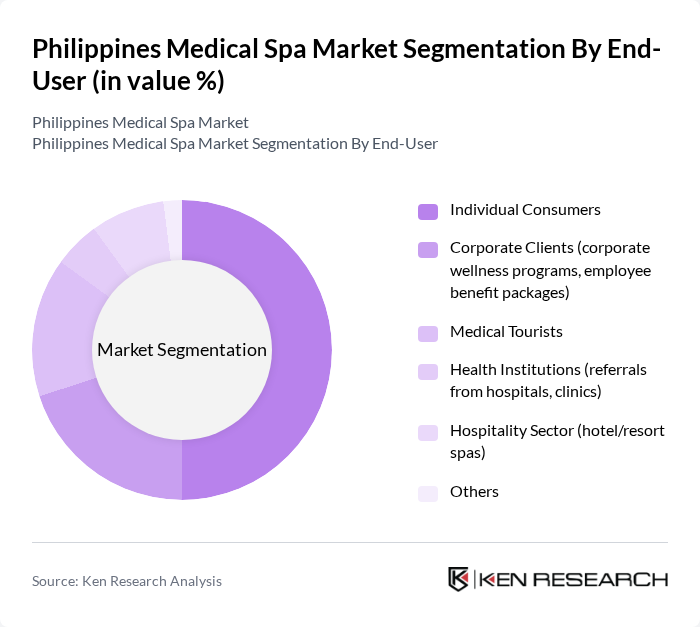

By End-User:The end-user segmentation includes Individual Consumers, Corporate Clients, Medical Tourists, Health Institutions, the Hospitality Sector, and Others. Individual consumers represent the largest segment, driven by rising interest in personal wellness and aesthetic enhancement. Corporate clients increasingly utilize medical spa services for employee wellness programs, while medical tourists are attracted by the Philippines' reputation for high-quality, affordable treatments and integrative recovery experiences. The hospitality sector, including hotel and resort spas, continues to expand offerings to meet growing demand for wellness-focused travel.

The Philippines Medical Spa Market is characterized by a dynamic mix of regional and international players. Leading participants such as The Medical City Wellness and Aesthetics Institute, SkinStation, Belo Medical Group, Dermclinic, The Aivee Clinic, The Zen Institute, Flawless Face & Body Clinic, Luminisce Holistic Skin Innovations, Pristine Medical Aesthetics & Laser Clinic, The Spa Wellness at Shangri-La, Skin and Body Wellness Center, The Aesthetic Institute Manila, The Facial Care Centre, SvelT’i Health and Beauty Centre, The Skin Boutique contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Philippines medical spa market appears promising, driven by technological advancements and evolving consumer preferences. As the integration of AI and telehealth services becomes more prevalent, medical spas are likely to enhance their service offerings. Additionally, the increasing focus on personalized wellness experiences will encourage spas to tailor treatments to individual needs, fostering customer loyalty and satisfaction. This dynamic environment presents opportunities for growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Facial Treatments (e.g., laser resurfacing, chemical peels, microdermabrasion, hydrafacial) Body Contouring and Sculpting (e.g., cryolipolysis, radiofrequency, ultrasound-based treatments) Hair Removal Services (e.g., laser hair removal, IPL) Anti-Aging Treatments (e.g., injectables, dermal fillers, botulinum toxin, PRP therapy) Skin Rejuvenation (e.g., microneedling, photorejuvenation, LED therapy) Wellness Therapies (e.g., IV drips, nutritional therapy, hormone therapy) Massage and Relaxation Therapy Others (e.g., tattoo removal, acne and pigment management) |

| By End-User | Individual Consumers Corporate Clients (corporate wellness programs, employee benefit packages) Medical Tourists Health Institutions (referrals from hospitals, clinics) Hospitality Sector (hotel/resort spas) Others |

| By Service Duration | Short Treatments (Under 1 hour) Medium Treatments (1-2 hours) Long Treatments (Over 2 hours) Others |

| By Customer Demographics | Age Groups (Adolescent, 18-25, 26-35, 36-50, 51+) Gender (Male, Female) Income Levels (Low, Middle, High) Others |

| By Geographic Distribution | Metro Manila Luzon (excluding Metro Manila) Visayas Mindanao Others |

| By Treatment Frequency | Regular Clients (monthly or more frequent visits) Occasional Clients (quarterly or less frequent visits) First-Time Clients Others |

| By Payment Method | Cash Payments Credit/Debit Cards Mobile Payments (e-wallets, QR payments) Insurance Coverage (where applicable) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Medical Spa Clientele | 120 | Regular Clients, First-time Visitors |

| Industry Professionals | 60 | Medical Spa Owners, Aesthetic Practitioners |

| Healthcare Providers | 40 | Dermatologists, Cosmetic Surgeons |

| Regulatory Bodies | 40 | Health Department Officials, Licensing Authorities |

| Wellness Industry Experts | 50 | Market Analysts, Health Consultants |

The Philippines Medical Spa Market is valued at approximately USD 25 billion, driven by increasing consumer demand for wellness and aesthetic treatments, rising disposable income, and heightened health and beauty consciousness among consumers.