Region:Asia

Author(s):Geetanshi

Product Code:KRAD1249

Pages:84

Published On:November 2025

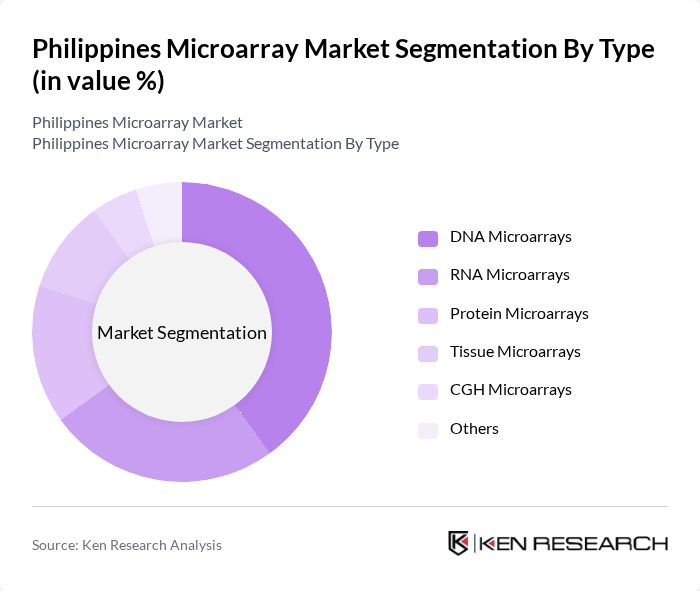

By Type:The microarray market can be segmented into various types, including DNA Microarrays, RNA Microarrays, Protein Microarrays, Tissue Microarrays, CGH Microarrays, and Others. Among these, DNA Microarrays are the most widely used due to their applications in genomics and personalized medicine, driving significant demand. RNA Microarrays also hold a substantial share, particularly in gene expression analysis. Protein Microarrays have emerged as the largest segment within multiplex assay technologies, reflecting their critical role in biomarker discovery and validation.

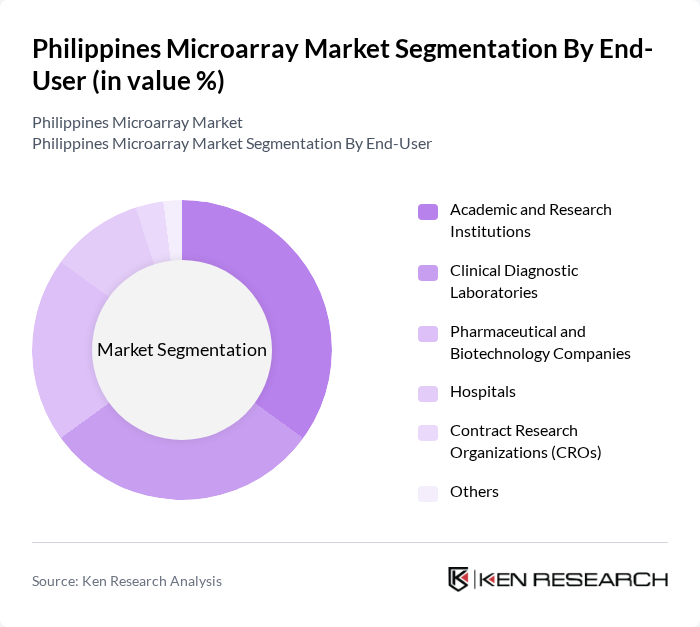

By End-User:The end-user segmentation includes Academic and Research Institutions, Clinical Diagnostic Laboratories, Pharmaceutical and Biotechnology Companies, Hospitals, Contract Research Organizations (CROs), and Others. Academic and Research Institutions dominate this segment due to their extensive research activities and funding for genomic studies, followed by Clinical Diagnostic Laboratories that utilize microarrays for various diagnostic applications. The growing adoption of tissue microarray platforms in oncology research and precision medicine applications is driving increased demand across hospitals and specialized diagnostic centers.

The Philippines Microarray Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philippine Genome Center, Bioinformatics Philippines, Genomics Institute of Asia, Inc., Merck KGaA, Illumina, Inc., Thermo Fisher Scientific Inc., Agilent Technologies, Inc., Roche Diagnostics (F. Hoffmann-La Roche Ltd.), QIAGEN N.V., BGI Group, PerkinElmer, Inc. (now Revvity, Inc.), Arrayit Corporation, Affymetrix, Inc. (now part of Thermo Fisher Scientific), Genomatix Software GmbH (now part of Intrexon Corporation), Eurofins Scientific SE contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines microarray market is poised for significant growth, driven by advancements in genomic research and increasing healthcare investments. As the government continues to support biotechnology initiatives, the integration of microarrays with next-generation sequencing technologies is expected to enhance diagnostic capabilities. Furthermore, the rising focus on personalized medicine will likely lead to increased collaborations between local research institutions and international biotech firms, fostering innovation and expanding market reach in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | DNA Microarrays RNA Microarrays Protein Microarrays Tissue Microarrays CGH Microarrays Others |

| By End-User | Academic and Research Institutions Clinical Diagnostic Laboratories Pharmaceutical and Biotechnology Companies Hospitals Contract Research Organizations (CROs) Others |

| By Application | Cancer Diagnostics & Research Genetic Disease Research Drug Discovery & Development Infectious Disease Diagnostics Agricultural Biotechnology Others |

| By Technology | Array-based Technologies Bead-based Microarrays Label-free Technologies Hybridization-based Technologies Others |

| By Region | Luzon Visayas Mindanao |

| By Investment Source | Government Funding Private Investments International Grants Others |

| By Policy Support | Research Grants Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Clinical Diagnostics Laboratories | 45 | Laboratory Managers, Clinical Pathologists |

| Research Institutions | 38 | Research Scientists, Lab Technicians |

| Biotechnology Firms | 32 | Product Development Managers, R&D Directors |

| Healthcare Providers | 28 | Healthcare Administrators, Medical Directors |

| Regulatory Bodies | 17 | Policy Makers, Regulatory Affairs Specialists |

The Philippines Microarray Market is valued at approximately USD 11.57 billion, driven by advancements in genomics, personalized medicine, and increased investments in research and development from both public and private sectors.