Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4180

Pages:84

Published On:December 2025

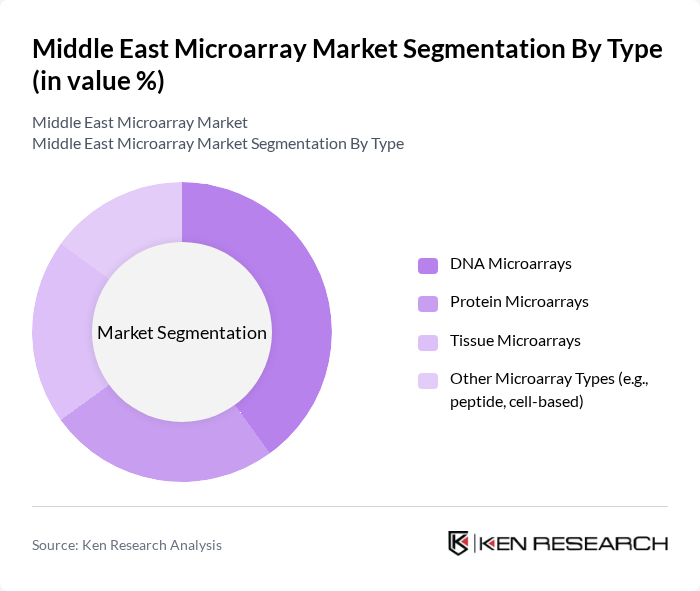

By Type:The market can be segmented into various types of microarrays, including DNA microarrays, protein microarrays, tissue microarrays, and other microarray types such as peptide and cell-based microarrays. Each type serves distinct applications in research and diagnostics, catering to the diverse needs of end-users, with DNA microarrays widely used for gene expression and genotyping, protein microarrays for biomarker discovery and proteomic profiling, and tissue microarrays for high-throughput pathology and oncology research.

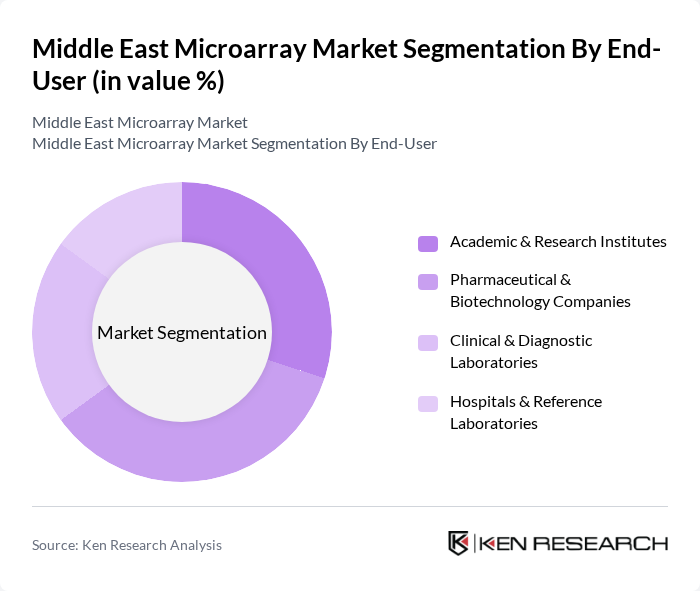

By End-User:The end-user segmentation includes academic and research institutes, pharmaceutical and biotechnology companies, clinical and diagnostic laboratories, and hospitals and reference laboratories. Each of these segments plays a crucial role in the adoption and utilization of microarray technologies for various applications, with research and academic institutes typically leading in platform adoption for genomics and proteomics studies, and pharmaceutical and biotechnology companies increasingly using microarrays in drug discovery, target validation, and biomarker research.

The Middle East Microarray Market is characterized by a dynamic mix of regional and international players. Leading participants such as Illumina, Inc., Thermo Fisher Scientific Inc., Agilent Technologies, Inc., F. Hoffmann-La Roche Ltd (Roche Diagnostics), Bio-Rad Laboratories, Inc., PerkinElmer, Inc. (Revvity, Inc.), Merck KGaA (MilliporeSigma), QIAGEN N.V., Arrayit Corporation, Microarrays Inc., Molecular Devices, LLC, LGC Limited, Zymo Research Corp., Tecan Group Ltd., Macrogen Inc. contribute to innovation, geographic expansion, and service delivery in this space by offering microarray instruments, consumables, and associated software platforms that support applications in gene expression, genotyping, copy number variation, and proteomics.

The future of the Middle East microarray market appears promising, driven by ongoing advancements in technology and increasing investments in healthcare infrastructure. As governments prioritize biotechnology and personalized medicine, the market is expected to expand significantly. Additionally, the integration of artificial intelligence in data analysis will enhance the efficiency of microarray applications, making them more accessible and user-friendly for healthcare providers across the region.

| Segment | Sub-Segments |

|---|---|

| By Type | DNA Microarrays Protein Microarrays Tissue Microarrays Other Microarray Types (e.g., peptide, cell-based) |

| By End-User | Academic & Research Institutes Pharmaceutical & Biotechnology Companies Clinical & Diagnostic Laboratories Hospitals & Reference Laboratories |

| By Application | Disease Diagnostics & Clinical Testing Drug Discovery & Development Gene Expression & Genomic Profiling Research Companion Diagnostics & Precision Medicine |

| By Technology / Platform | Oligonucleotide Microarrays cDNA Microarrays SNP & CGH Microarrays Other Emerging Microarray Platforms |

| By Region | Saudi Arabia United Arab Emirates Qatar, Kuwait, Oman & Bahrain (Rest of GCC) Turkey, Israel & Rest of Middle East |

| By Research Type | Basic Research Translational & Applied Research Clinical Research & Trials Biomarker Discovery & Validation |

| By Funding Source | Government & Public Sector Grants Private Investments & Venture Capital Academic & Institutional Funding Industry-Sponsored Research & PPPs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Clinical Diagnostics Laboratories | 120 | Laboratory Directors, Clinical Pathologists |

| Research Institutions | 90 | Research Scientists, Principal Investigators |

| Biotechnology Firms | 80 | Product Managers, R&D Heads |

| Healthcare Providers | 70 | Chief Medical Officers, Procurement Managers |

| Regulatory Bodies | 60 | Policy Makers, Regulatory Affairs Specialists |

The Middle East Microarray Market is valued at approximately USD 180 million, driven by advancements in genomic research, increasing chronic disease prevalence, and rising investments in biotechnology and personalized medicine across the region.