Region:Asia

Author(s):Geetanshi

Product Code:KRAA9201

Pages:88

Published On:November 2025

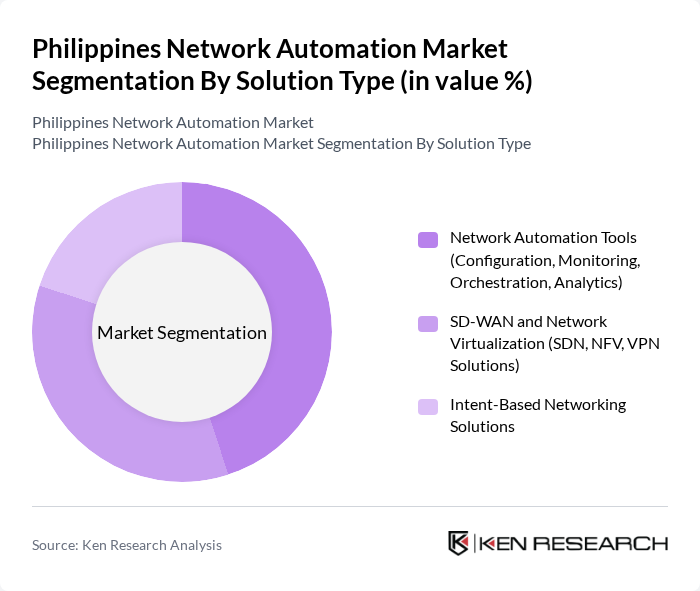

By Solution Type:The solution type segmentation includes Network Automation Tools, SD-WAN and Network Virtualization, and Intent-Based Networking Solutions. Network Automation Tools currently hold the largest market share due to their ability to streamline network operations, provide real-time monitoring, and enhance operational visibility. The increasing complexity of hybrid and multi-cloud environments, coupled with the need for automation in policy management and analytics, is driving the adoption of these tools across industries such as IT, telecommunications, and BFSI .

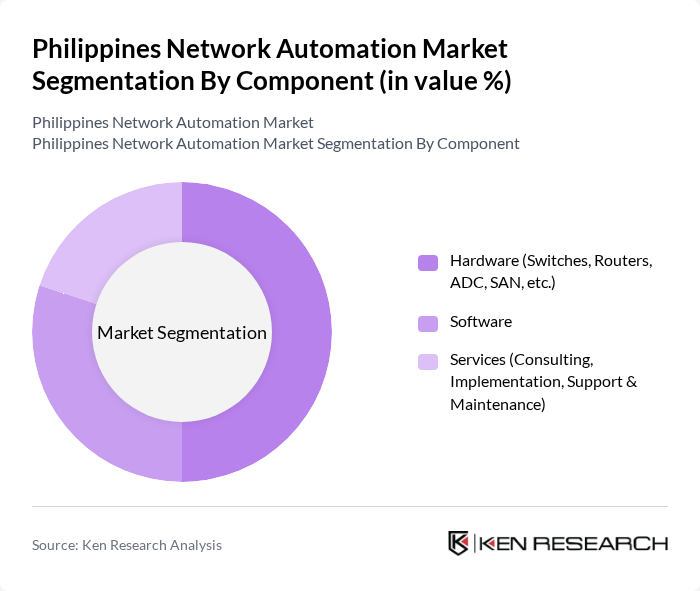

By Component:The component segmentation includes Hardware, Software, and Services. Hardware is currently the leading segment, supported by strong demand for advanced networking equipment such as switches, routers, application delivery controllers (ADC), and storage area networks (SAN). The need for high-speed connectivity, reliable infrastructure, and the modernization of data centers in sectors like telecommunications, finance, and healthcare is driving hardware adoption. Software and services segments are also expanding, propelled by the integration of AI, machine learning, and managed network services .

The Philippines Network Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cisco Systems, Inc., Juniper Networks, Inc., Arista Networks, Inc., Huawei Technologies Co., Ltd., Nokia Corporation, VMware, Inc., Extreme Networks, Inc., Fortinet, Inc., Palo Alto Networks, Inc., Check Point Software Technologies Ltd., F5, Inc., Riverbed Technology, Inc., SolarWinds Corporation, Zscaler, Inc., PLDT Inc., Globe Telecom, Inc., ePLDT, Inc., DITO Telecommunity Corporation, Aboitiz InfraCapital, Inc., Fujitsu Philippines, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines network automation market is poised for significant growth as businesses increasingly recognize the importance of digital transformation. With the expansion of 5G networks and the rise of IoT applications, companies are expected to invest heavily in automation technologies. Additionally, the emphasis on AI-driven solutions and managed services will shape the market landscape, enabling organizations to enhance operational efficiency and security. As these trends evolve, the demand for innovative automation tools will continue to rise, driving market expansion.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Network Automation Tools (Configuration, Monitoring, Orchestration, Analytics) SD-WAN and Network Virtualization (SDN, NFV, VPN Solutions) Intent-Based Networking Solutions |

| By Component | Hardware (Switches, Routers, ADC, SAN, etc.) Software Services (Consulting, Implementation, Support & Maintenance) |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By End-User Industry | Telecommunications BFSI (Banking, Financial Services & Insurance) Manufacturing Healthcare Government & Public Sector Retail Education Others |

| By Region | Luzon Visayas Mindanao |

| By Network Type | Local Area Network (LAN) Wide Area Network (WAN) Data Center Networks Software-Defined Networking (SDN) Others |

| By Service Type | Consulting Services Implementation & Integration Services Training & Support Services Managed Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecommunications Network Automation | 100 | Network Engineers, IT Directors |

| Financial Services Automation Solutions | 80 | IT Managers, Compliance Officers |

| Healthcare IT Network Management | 70 | Healthcare IT Administrators, CIOs |

| Manufacturing Automation Systems | 60 | Operations Managers, Systems Engineers |

| Retail Network Infrastructure | 90 | Supply Chain Managers, IT Support Staff |

The Philippines Network Automation Market is valued at approximately USD 260 million, driven by the increasing demand for efficient network management solutions, cloud computing adoption, and enhanced security measures to combat evolving cyber threats.