Region:Asia

Author(s):Rebecca

Product Code:KRAB1819

Pages:89

Published On:October 2025

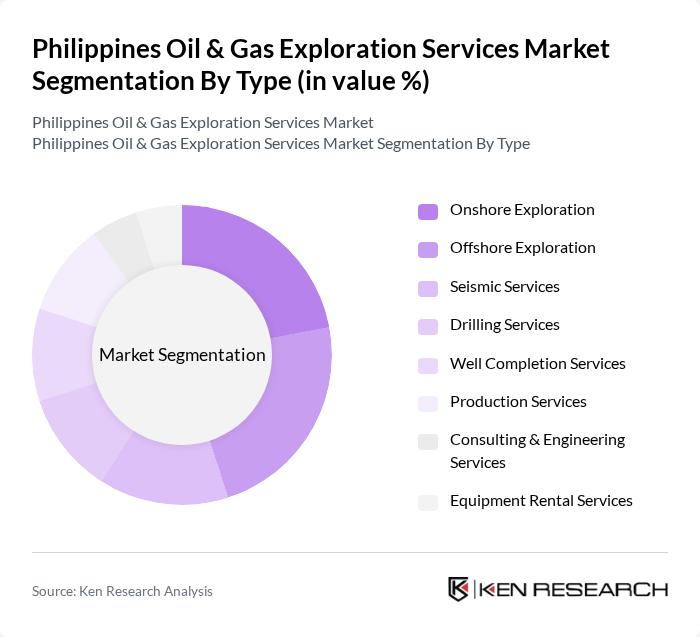

By Type:The segmentation by type includes various services essential for oil and gas exploration. The subsegments are Onshore Exploration, Offshore Exploration, Seismic Services, Drilling Services, Well Completion Services, Production Services, Consulting & Engineering Services, and Equipment Rental Services. Each of these services plays a crucial role in the exploration and production phases of oil and gas projects.

The Onshore Exploration segment is currently leading the market, reflecting the government's drive for energy independence and the relative ease of mobilizing resources for onshore projects. Lower operational costs, faster project timelines, and recent technological advancements in drilling and seismic imaging have made onshore exploration increasingly attractive to both domestic and foreign investors. Sustainability considerations, including reduced environmental impact and improved resource management, are further shaping the segment's growth.

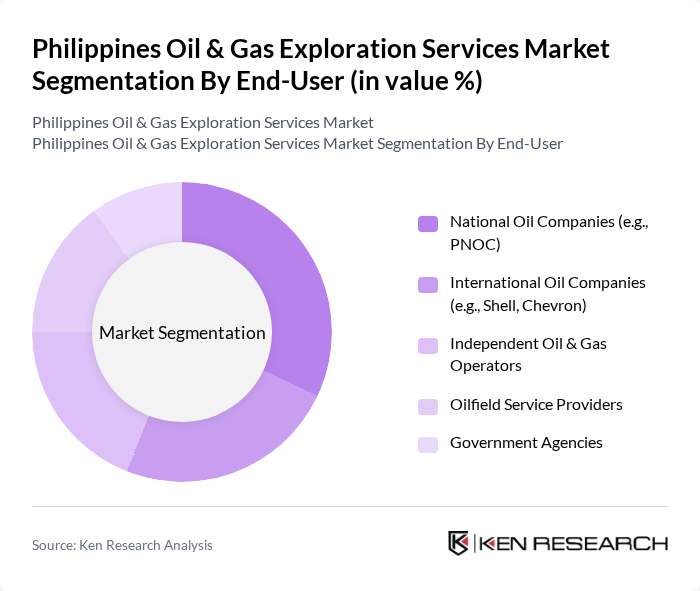

By End-User:The segmentation by end-user includes National Oil Companies (e.g., PNOC), International Oil Companies (e.g., Shell, Chevron), Independent Oil & Gas Operators, Oilfield Service Providers, and Government Agencies. Each end-user category has distinct needs and influences the demand for exploration services.

National Oil Companies (NOCs) are the dominant end-users in the market, leveraging government support to undertake large-scale exploration and production projects. NOCs such as PNOC benefit from preferential access to funding and regulatory facilitation, and often form strategic alliances with international oil companies to enhance technical and operational capabilities. The ongoing emphasis on energy security and maximizing domestic resource utilization continues to strengthen the position of NOCs in the exploration services sector.

The Philippines Oil & Gas Exploration Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philippine National Oil Company (PNOC), Chevron Philippines Inc., Shell Philippines Exploration B.V., TotalEnergies Philippines Corporation, Petron Corporation, CNOOC Gas and Power Group Co., Ltd., Halliburton Energy Services, Inc., SLB (Schlumberger Limited), Baker Hughes Company, Weatherford International plc, TechnipFMC plc, McDermott International, Ltd., John Wood Group plc, Ensign Energy Services Inc., Nabors Industries Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Philippines oil and gas exploration services market appears promising, driven by increasing energy demands and government support for local production. As the country seeks to enhance energy security, investments in technology and sustainable practices are likely to grow. Additionally, the integration of renewable energy sources into the exploration framework will create a more resilient energy landscape. Strategic partnerships between local and foreign firms will further bolster exploration efforts, ensuring a balanced approach to energy development in the Philippines.

| Segment | Sub-Segments |

|---|---|

| By Type | Onshore Exploration Offshore Exploration Seismic Services Drilling Services Well Completion Services Production Services Consulting & Engineering Services Equipment Rental Services |

| By End-User | National Oil Companies (e.g., PNOC) International Oil Companies (e.g., Shell, Chevron) Independent Oil & Gas Operators Oilfield Service Providers Government Agencies |

| By Application | Exploration Appraisal Development Production Decommissioning |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Funding |

| By Regulatory Compliance Level | Fully Compliant Partially Compliant Non-Compliant |

| By Technology Used | Conventional Technology Advanced Technology (e.g., Digital Oilfield, Enhanced Recovery) Hybrid Technology |

| By Project Size | Small Scale Projects Medium Scale Projects Large Scale Projects |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Offshore Exploration Projects | 60 | Project Managers, Exploration Geologists |

| Onshore Drilling Operations | 50 | Operations Supervisors, Drilling Engineers |

| Regulatory Compliance and Policy | 40 | Regulatory Affairs Managers, Legal Advisors |

| Environmental Impact Assessments | 45 | Environmental Scientists, Sustainability Officers |

| Local Community Engagement | 45 | Community Relations Managers, Local Government Officials |

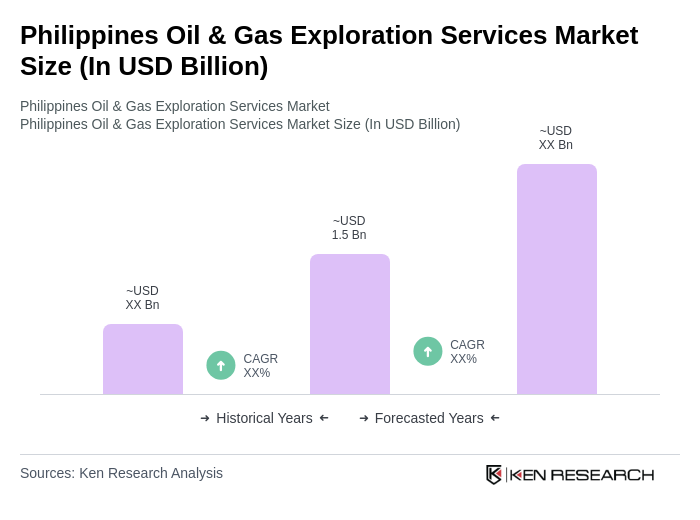

The Philippines Oil & Gas Exploration Services Market is valued at approximately USD 1.5 billion, driven by increasing domestic energy demand, government initiatives to boost local production, and foreign investments in exploration activities.