Region:Africa

Author(s):Geetanshi

Product Code:KRAB3924

Pages:93

Published On:October 2025

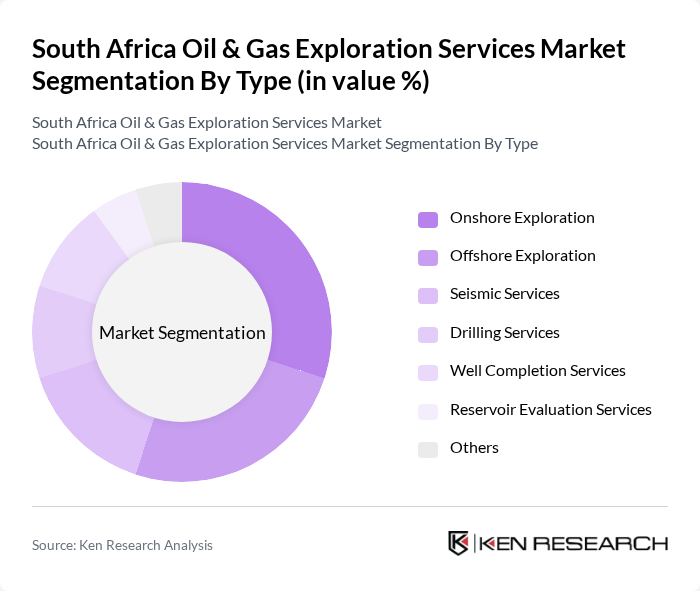

By Type:The market is segmented into Onshore Exploration, Offshore Exploration, Seismic Services, Drilling Services, Well Completion Services, Reservoir Evaluation Services, and Others. Onshore and offshore exploration remain the largest segments, driven by ongoing development in the Orange Basin and other prospective regions. Seismic services and reservoir evaluation are increasingly adopting advanced digital technologies to improve accuracy and reduce exploration risk. Drilling and well completion services are benefiting from new automation and remote monitoring solutions, which enhance operational efficiency and safety .

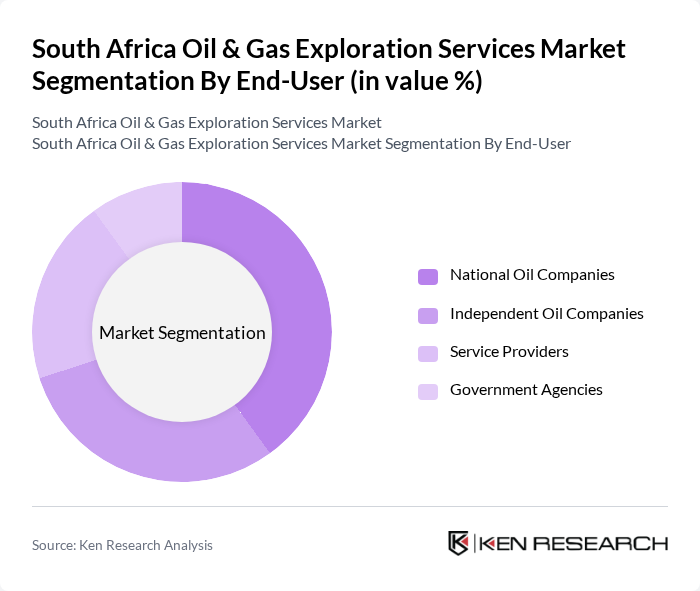

By End-User:The end-user segmentation includes National Oil Companies, Independent Oil Companies, Service Providers, and Government Agencies. National Oil Companies and Independent Oil Companies are the primary drivers of exploration activity, leveraging partnerships with service providers for advanced technical solutions. Government agencies play a critical role in regulatory oversight and strategic resource management, while service providers are increasingly focused on digital transformation and operational efficiency .

The South Africa Oil & Gas Exploration Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sasol Limited, TotalEnergies SE, ExxonMobil Corporation, Shell South Africa, PetroSA, African Exploration Mining and Finance Corporation, AECI Limited, Halliburton Company, Schlumberger Limited, Baker Hughes Company, Weatherford International, EnQuest PLC, Tullow Oil plc, CNOOC Limited, Petrofac Limited contribute to innovation, geographic expansion, and service delivery in this space .

The South African oil and gas exploration market is poised for transformation, driven by technological advancements and a shift towards sustainable practices. As the government enhances its support for the sector, investments in research and development are expected to rise, fostering innovation. Additionally, the exploration of new reserves will be critical in meeting the growing energy demand. Strategic partnerships between local and international firms will likely emerge, facilitating knowledge transfer and resource sharing, ultimately strengthening the market's resilience.

| Segment | Sub-Segments |

|---|---|

| By Type | Onshore Exploration Offshore Exploration Seismic Services Drilling Services Well Completion Services Reservoir Evaluation Services Others |

| By End-User | National Oil Companies Independent Oil Companies Service Providers Government Agencies |

| By Application | Exploration Production Development Decommissioning |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Grants |

| By Regulatory Framework | Licensing Regulations Environmental Regulations Safety Regulations Local Content Regulations |

| By Market Maturity | Emerging Markets Established Markets Declining Markets |

| By Technology Adoption | Conventional Technologies Advanced Technologies Digital Technologies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Onshore Oil Exploration | 100 | Exploration Managers, Geologists |

| Offshore Gas Exploration | 80 | Project Engineers, Environmental Consultants |

| Regulatory Compliance in Exploration | 60 | Compliance Officers, Legal Advisors |

| Technological Innovations in Exploration | 90 | R&D Managers, Technology Officers |

| Market Trends and Investment Opportunities | 75 | Investment Analysts, Market Researchers |

The South Africa Oil & Gas Exploration Services Market is valued at approximately USD 5 billion, reflecting significant growth driven by rising energy demand, government initiatives for energy security, and advancements in exploration technologies.