Region:Europe

Author(s):Shubham

Product Code:KRAB1163

Pages:81

Published On:October 2025

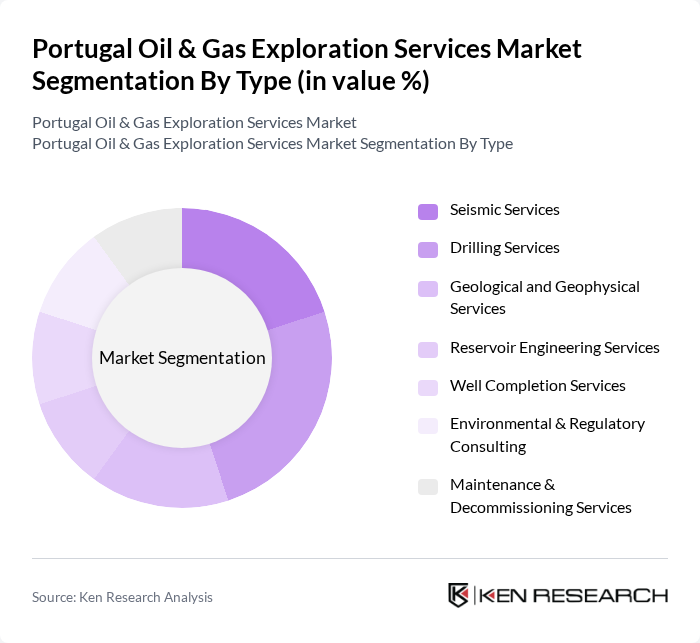

By Type:The market is segmented into various types of services that cater to the needs of oil and gas exploration. These include seismic services, drilling services, geological and geophysical services, reservoir engineering services, well completion services, environmental & regulatory consulting, and maintenance & decommissioning services. Each of these segments plays a crucial role in the overall exploration process, contributing to the efficiency and effectiveness of operations with enhanced focus on digital technologies and automated drilling systems.

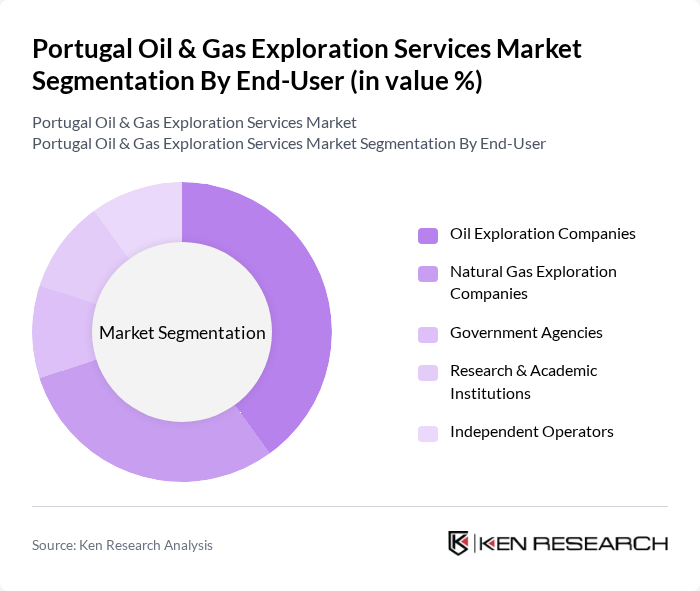

By End-User:The end-user segmentation includes oil exploration companies, natural gas exploration companies, government agencies, research & academic institutions, and independent operators. Each of these end-users has distinct requirements and contributes differently to the market dynamics, influencing the demand for various exploration services with increasing emphasis on sustainable exploration practices and digital transformation initiatives.

The Portugal Oil & Gas Exploration Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Galp Energia, S.G.P.S., S.A., Petrogal, S.A., Repsol, S.A., Partex Oil and Gas (Portugal) Corporation, Schlumberger Limited, Halliburton Company, TechnipFMC plc, Wood Group PLC, Baker Hughes Company, Saipem S.p.A., Aker Solutions ASA, Subsea 7 S.A., KBR, Inc., Worley Limited, DNV AS contribute to innovation, geographic expansion, and service delivery in this space.

The future of the oil and gas exploration services market in Portugal appears promising, driven by technological advancements and government initiatives aimed at enhancing energy security. As the country seeks to balance its energy mix, the integration of renewable energy sources alongside traditional oil and gas exploration will become increasingly important. Furthermore, the focus on sustainable practices and compliance with environmental regulations will shape the industry's evolution, fostering innovation and attracting investment in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Seismic Services Drilling Services Geological and Geophysical Services Reservoir Engineering Services Well Completion Services Environmental & Regulatory Consulting Maintenance & Decommissioning Services |

| By End-User | Oil Exploration Companies Natural Gas Exploration Companies Government Agencies Research & Academic Institutions Independent Operators |

| By Application | Offshore Exploration Onshore Exploration Appraisal Drilling Development Drilling Production Optimization Decommissioning |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) EU Funding & Grants Others |

| By Regulatory Compliance | Environmental Compliance Safety Standards Compliance Licensing Compliance Reporting Compliance Others |

| By Market Maturity | Emerging Market Growth Market Mature Market Declining Market Others |

| By Service Model | Contractual Services Project-Based Services Retainer Services Integrated Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Offshore Exploration Projects | 100 | Project Managers, Exploration Directors |

| Onshore Drilling Operations | 80 | Field Engineers, Operations Supervisors |

| Environmental Impact Assessments | 60 | Environmental Consultants, Compliance Officers |

| Regulatory Framework Analysis | 40 | Policy Makers, Legal Advisors |

| Technological Innovations in Exploration | 50 | R&D Managers, Technology Officers |

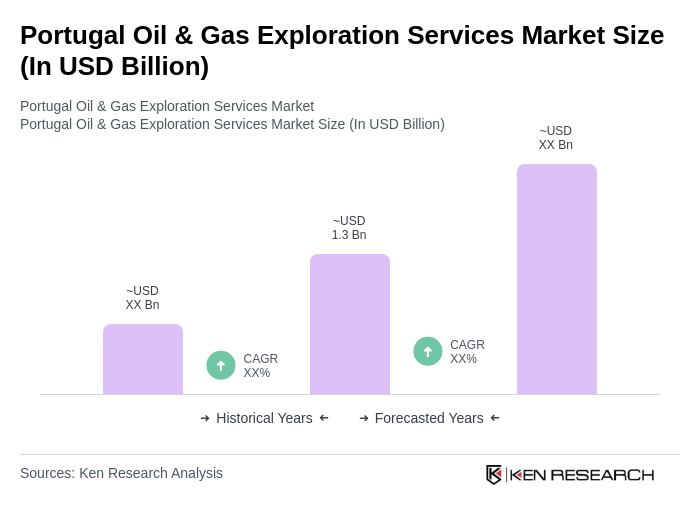

The Portugal Oil & Gas Exploration Services Market is valued at approximately USD 1.3 billion, reflecting a steady growth driven by increasing energy demand, technological advancements, and investments in offshore exploration activities.