Region:Asia

Author(s):Shubham

Product Code:KRAA8784

Pages:85

Published On:November 2025

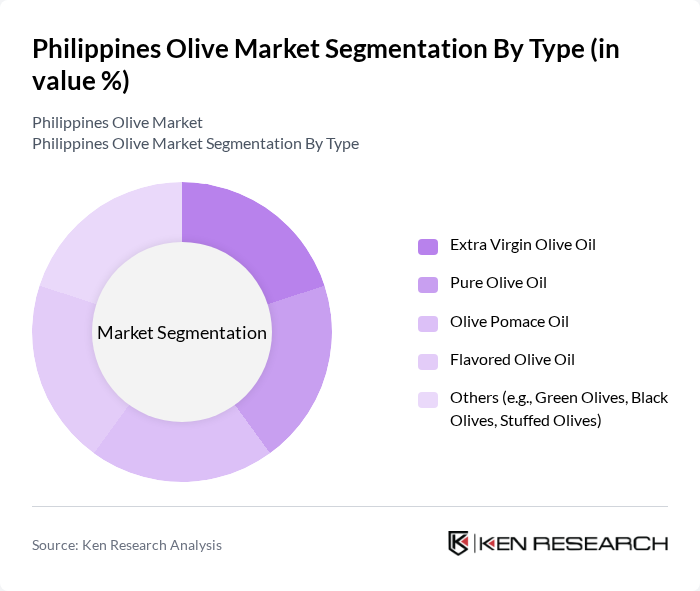

By Type:The market is segmented into various types of olive oil products, including Extra Virgin Olive Oil, Pure Olive Oil, Olive Pomace Oil, Flavored Olive Oil, and Others (e.g., Green Olives, Black Olives, Stuffed Olives). Each type caters to different consumer preferences and culinary uses, with Extra Virgin Olive Oil being the most sought after for its quality and health benefits.

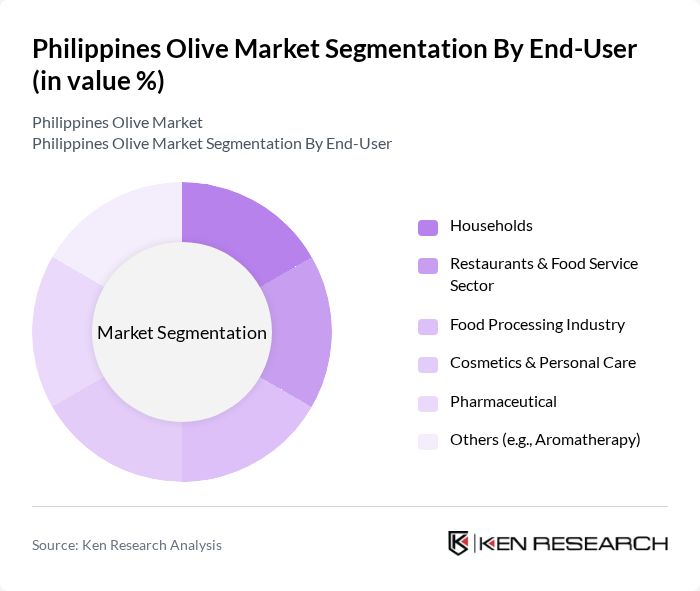

By End-User:The olive market is segmented by end-users, including Households, Restaurants & Food Service Sector, Food Processing Industry, Cosmetics & Personal Care, Pharmaceutical, and Others (e.g., Aromatherapy). Households represent a significant portion of the market, driven by the increasing trend of healthy cooking and the use of olive oil in everyday meals.

The Philippines Olive Market is characterized by a dynamic mix of regional and international players. Leading participants such as Doña Elena Olive Oil (Fly Ace Corporation), Borges Philippines (Borges International Group), Figaro Olive Oil (Figaro Coffee Group), Minola Olive Oil (Minola Food Corporation), Goya Olive Oil (Goya Foods, Inc.), San Remo Philippines (San Remo Macaroni Company Pty Ltd), Filippo Berio Philippines (Salov S.p.A.), Colavita Philippines (Colavita S.p.A.), Pietro Coricelli Philippines (Pietro Coricelli S.p.A.), Monini Philippines (Monini S.p.A.), Capilano Olive Oil (Capilano Honey Limited), Olive Tree Trading Inc., Olive Oil Depot Philippines, La Española Olive Oil (Acesur Group), Ybarra Philippines (Ybarra Alimentación S.A.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the olive market in the Philippines appears promising, driven by increasing health awareness and a growing appetite for gourmet products. As local production initiatives gain momentum, the market is expected to see a gradual shift towards domestic sourcing. Additionally, the rise of e-commerce will likely enhance distribution channels, making olive oil more accessible to consumers. With government support for agricultural innovation, the market is poised for sustainable growth, fostering a more robust local industry in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Extra Virgin Olive Oil Pure Olive Oil Olive Pomace Oil Flavored Olive Oil Others (e.g., Green Olives, Black Olives, Stuffed Olives) |

| By End-User | Households Restaurants & Food Service Sector Food Processing Industry Cosmetics & Personal Care Pharmaceutical Others (e.g., Aromatherapy) |

| By Packaging Type | Glass Bottles Plastic Bottles Tetra Packs Cans Sachets Others |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Specialty Stores Convenience Stores Food Service Distributors Others |

| By Region | Luzon Visayas Mindanao |

| By Price Range | Premium Mid-Range Economy |

| By Consumer Demographics | Age Group Income Level Lifestyle Preferences Others |

| By Extraction Method | First-Press Cold-Pressed Cold-Extracted |

| By Flavour | Full-Bodied & Earthy Mild & Buttery Fruity & Peppery Fruity & Herby |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Olive Oil | 120 | Health-conscious Consumers, Home Chefs |

| Retail Market Insights | 90 | Store Managers, Grocery Buyers |

| Production Insights from Olive Farmers | 50 | Olive Farmers, Agricultural Consultants |

| Distribution Channel Analysis | 60 | Logistics Managers, Import/Export Agents |

| Culinary Usage and Trends | 40 | Culinary Experts, Nutritionists |

The Philippines Olive Market is valued at approximately USD 50 million, reflecting a growing trend driven by health consciousness, demand for premium cooking oils, and the popularity of Mediterranean diets among consumers.