Region:Asia

Author(s):Geetanshi

Product Code:KRAB5229

Pages:80

Published On:October 2025

By Type:The online advertising market in the Philippines is segmented into various types, including Display Advertising, Search Engine Marketing, Social Media Advertising, Video Advertising, Mobile Advertising, Affiliate Marketing, Native Advertising, Programmatic Advertising, Influencer Marketing, and Others. Among these, Social Media Advertising has emerged as the leading sub-segment due to the widespread use of platforms like Facebook, Instagram, and TikTok, which allow brands to engage directly with consumers. The increasing time spent on social media by Filipinos has made it a crucial channel for advertisers.

By End-User:The end-user segmentation of the online advertising market includes Retail & E-commerce, Travel and Tourism, Education, Healthcare, Entertainment & Media, Financial Services (BFSI), Automotive, Real Estate, Telecommunications, and Others. The Retail & E-commerce sector is the dominant end-user, driven by the rapid growth of online shopping platforms and the increasing number of consumers opting for digital purchases. This trend has led to a significant increase in advertising budgets allocated to online channels by retailers.

The Philippines Online Advertising and Retail Media Market is characterized by a dynamic mix of regional and international players. Leading participants such as Google Philippines, Meta Platforms, Inc. (Facebook Philippines), AdSpark, Inc., Inquirer.net (Philippine Daily Inquirer Digital), GMA Network Inc., ABS-CBN Corporation, Globe Telecom, Inc., Smart Communications, Inc., Lazada Philippines, Shopee Philippines, Zalora Philippines, Viber Media S.à r.l., TikTok Philippines (ByteDance Ltd.), X Corp. (formerly Twitter Philippines), LinkedIn Singapore Pte. Ltd. (Philippines operations) contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines online advertising and retail media market is poised for significant evolution, driven by technological advancements and changing consumer behaviors. The integration of artificial intelligence in advertising strategies is expected to enhance targeting and personalization, improving campaign effectiveness. Additionally, the growing emphasis on sustainability in advertising practices will likely shape brand strategies, as consumers increasingly favor eco-friendly initiatives. These trends indicate a dynamic market landscape that will require adaptability and innovation from advertisers to thrive in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Display Advertising Search Engine Marketing Social Media Advertising Video Advertising Mobile Advertising Affiliate Marketing Native Advertising Programmatic Advertising Influencer Marketing Others |

| By End-User | Retail & E-commerce Travel and Tourism Education Healthcare Entertainment & Media Financial Services (BFSI) Automotive Real Estate Telecommunications Others |

| By Sales Channel | Direct Sales Online Marketplaces Affiliate Networks Agency/Media Buying Platforms Others |

| By Audience Targeting | Demographic Targeting Behavioral Targeting Contextual Targeting Retargeting Geo-targeting Others |

| By Content Format | Text Ads Image Ads Video Ads Interactive Ads Others |

| By Device Type | Mobile Devices Desktop Computers Tablets Smart TVs Others |

| By Pricing Model | Cost Per Click (CPC) Cost Per Impression (CPM) Cost Per Acquisition (CPA) Flat Rate Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Retail Advertising Strategies | 100 | Marketing Managers, Digital Strategists |

| Consumer Engagement in Digital Campaigns | 80 | Brand Managers, Social Media Coordinators |

| Effectiveness of Influencer Marketing | 60 | Influencer Marketing Specialists, PR Managers |

| Trends in Mobile Advertising | 50 | Mobile Marketing Experts, App Marketing Specialists |

| Performance Metrics in Retail Media | 60 | Data Analysts, E-commerce Managers |

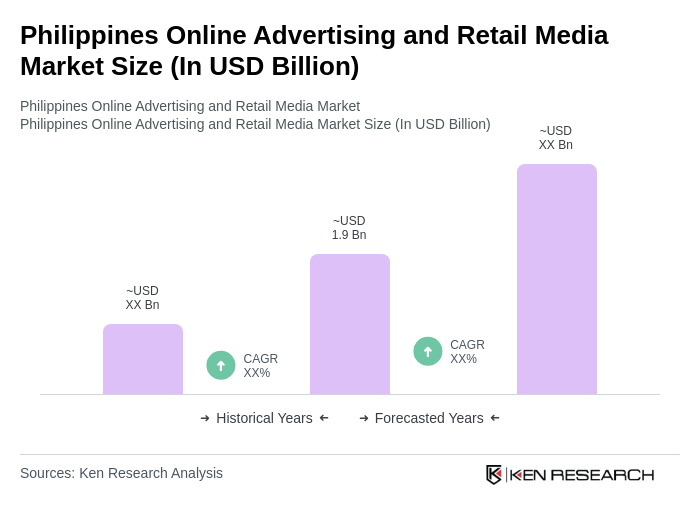

The Philippines Online Advertising and Retail Media Market is valued at approximately USD 1.9 billion, reflecting significant growth driven by increased internet penetration, mobile device usage, and a shift towards online shopping and digital content consumption.