Region:Europe

Author(s):Rebecca

Product Code:KRAB5313

Pages:94

Published On:October 2025

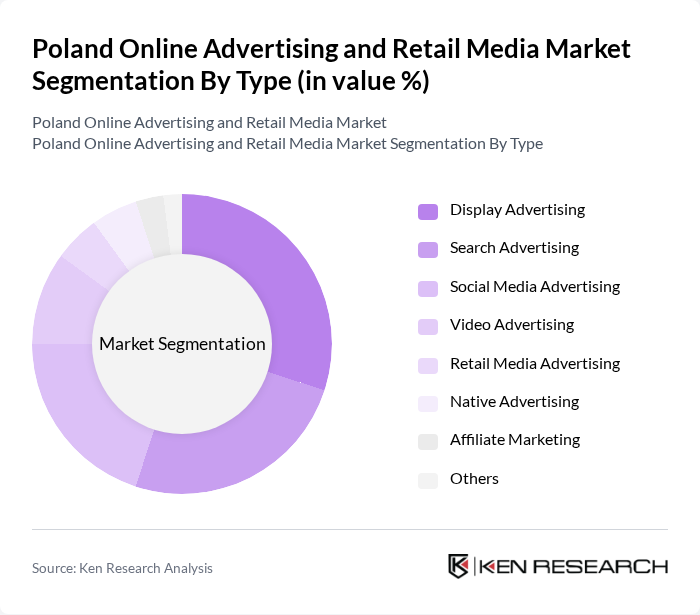

By Type:The online advertising market in Poland is segmented into various types, including Display Advertising, Search Advertising, Social Media Advertising, Video Advertising, Retail Media Advertising, Native Advertising, Affiliate Marketing, and Others. Among these, Search Engine Advertising and Social Media Advertising are particularly prominent due to their effectiveness in reaching a broad audience and engaging consumers through AI-driven targeting capabilities. The increasing adoption of programmatic advertising and mobile-first strategies has contributed to the growth of these segments, with advertisers leveraging artificial intelligence and machine learning to enhance targeting accuracy and optimize campaigns for mobile platforms.

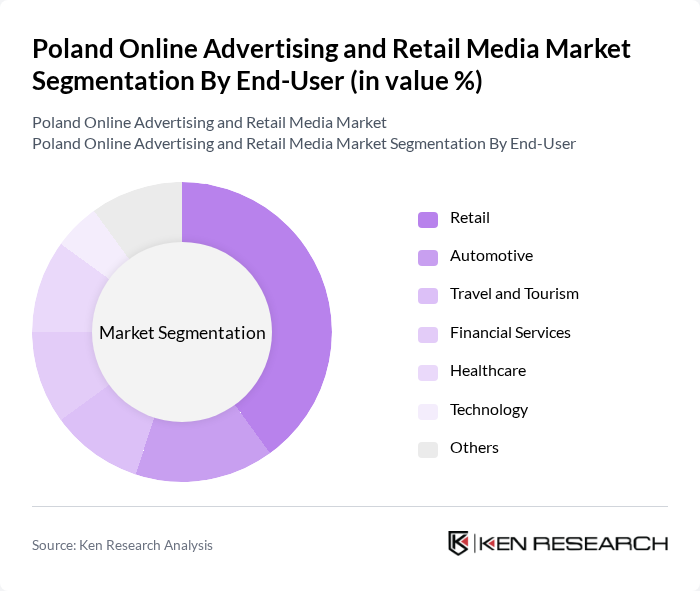

By End-User:The end-user segmentation of the online advertising market includes Retail, Automotive, Travel and Tourism, Financial Services, Healthcare, Technology, and Others. The Retail sector is the leading end-user, driven by the rapid growth of e-commerce and the need for retailers to engage consumers through targeted advertising. The retail sector generated the largest volume growth in advertising investments, with a 15.3% year-over-year increase, while the telecommunications sector experienced the largest decline with a 30.0% decrease in investment volume. The increasing competition in the retail space has prompted businesses to invest heavily in online advertising to enhance their visibility and attract customers.

The Poland Online Advertising and Retail Media Market is characterized by a dynamic mix of regional and international players. Leading participants such as Google Poland (Alphabet Inc.), Meta Platforms (Facebook Poland), Allegro.pl, Criteo, Adform, GroupM Poland, Publicis Groupe Poland, Havas Media Poland, Zenith Media Poland, K2 Precise, Onet.pl (Ringier Axel Springer Polska), Wirtualna Polska (WP.pl), Interia.pl (Grupa Polsat Plus), Amazon Ads Poland, Media Expert, Temu Poland, Dentsu Polska, Omnicom Media Group Poland, IPG Mediabrands Poland, Taboola Poland, Outbrain Poland, LinkedIn Poland, Lidl Polska, Jeronimo Martins Polska (Biedronka), Cyfrowy Polsat, Orange Polska, P4 (Play), Polkomtel (Plus), TVN24.pl contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Poland online advertising and retail media market appears promising, driven by technological advancements and evolving consumer preferences. As businesses increasingly adopt omnichannel strategies, integrating online and offline experiences, the demand for personalized advertising will continue to rise. Additionally, the growth of programmatic advertising and video content will likely reshape the advertising landscape, enabling brands to engage consumers more effectively and efficiently in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Display Advertising Search Advertising Social Media Advertising Video Advertising Retail Media Advertising Native Advertising Affiliate Marketing Others |

| By End-User | Retail Automotive Travel and Tourism Financial Services Healthcare Technology Others |

| By Sales Channel | Direct Sales Programmatic Sales Agency Sales Reseller Sales Others |

| By Audience Targeting | Demographic Targeting Behavioral Targeting Contextual Targeting Retargeting Others |

| By Format | Banner Ads Video Ads Sponsored Content Email Marketing Mobile Ads Others |

| By Device | Mobile Devices Desktop Computers Tablets Others |

| By Industry Vertical | E-commerce Entertainment Education Real Estate Telecommunications Others |

| By Budget Size | Small Budget Medium Budget Large Budget Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Media Advertising Strategies | 120 | Marketing Directors, Brand Managers |

| Consumer Engagement in Online Advertising | 100 | Digital Marketing Specialists, Social Media Managers |

| Performance Metrics in Digital Campaigns | 90 | Data Analysts, Campaign Managers |

| Trends in E-commerce Advertising | 110 | E-commerce Managers, Product Marketing Leads |

| Impact of Regulatory Changes on Advertising | 80 | Compliance Officers, Legal Advisors |

The Poland Online Advertising and Retail Media Market is valued at approximately USD 1.8 billion, reflecting significant growth driven by increased internet penetration, the rise of e-commerce, and the adoption of digital marketing strategies among businesses.