Region:Africa

Author(s):Geetanshi

Product Code:KRAA3319

Pages:92

Published On:September 2025

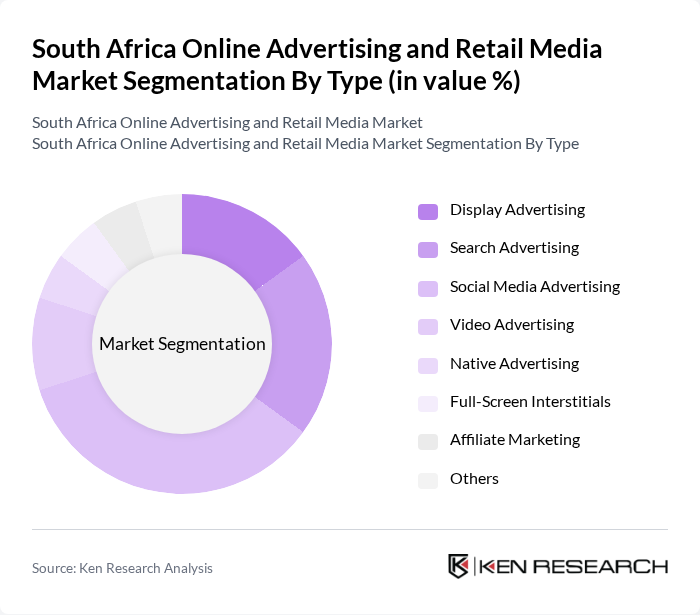

By Type:The market is segmented into various types of online advertising, including Display Advertising, Search Advertising, Social Media Advertising, Video Advertising, Native Advertising, Full-Screen Interstitials, Affiliate Marketing, and Others. Among these, Video Advertising was the largest revenue-generating type in 2024. Social media platforms continue to play a significant role due to their interactive nature, allowing for targeted campaigns that resonate with specific demographics.

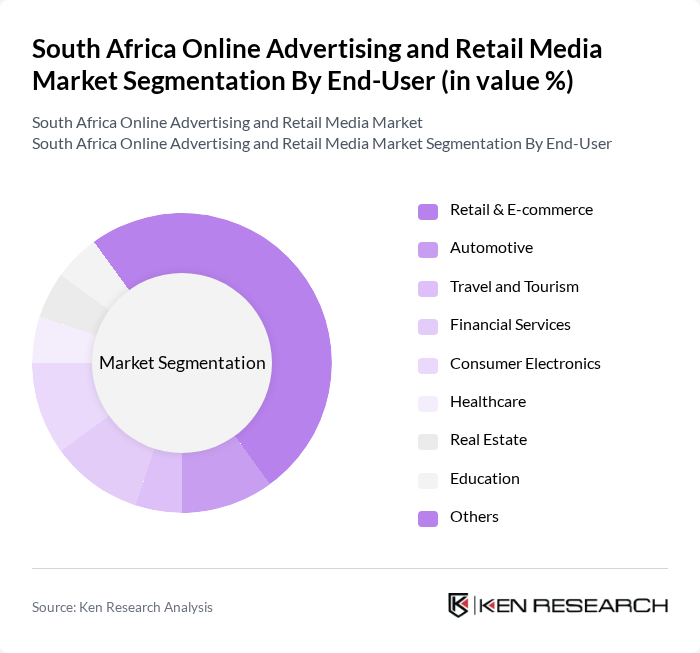

By End-User:The end-user segmentation includes Retail & E-commerce, Automotive, Travel and Tourism, Financial Services, Consumer Electronics, Healthcare, Real Estate, Education, and Others. The Retail & E-commerce sector is the leading segment, driven by the rapid growth of online shopping in South Africa. As consumers increasingly prefer the convenience of online shopping, retailers are allocating more budget towards digital advertising to capture this growing market, enhancing their visibility and sales through targeted campaigns.

The South Africa Online Advertising and Retail Media Market is characterized by a dynamic mix of regional and international players. Leading participants such as Naspers Limited, Media24, Google South Africa, Meta Platforms South Africa (Facebook & Instagram), Amazon Advertising South Africa, AdColony South Africa, Clicks Group, The Digital Media Collective, iProspect South Africa, Ogilvy South Africa, WPP South Africa, Dentsu South Africa, Publicis Groupe Africa, TBWA\South Africa, Havas South Africa, Primedia Group, Takealot.com, Superbalist, Makro South Africa, X (formerly Twitter) South Africa contribute to innovation, geographic expansion, and service delivery in this space.

The South African online advertising and retail media market is poised for significant evolution, driven by technological advancements and changing consumer preferences. As businesses increasingly adopt programmatic advertising, the efficiency of ad placements will improve, leading to better ROI. Additionally, the integration of artificial intelligence in marketing strategies will enhance personalization, allowing brands to connect more effectively with their target audiences. Sustainability will also play a crucial role, as consumers demand more responsible advertising practices, shaping future campaigns.

| Segment | Sub-Segments |

|---|---|

| By Type | Display Advertising Search Advertising Social Media Advertising Video Advertising Native Advertising Full-Screen Interstitials Affiliate Marketing Others |

| By End-User | Retail & E-commerce Automotive Travel and Tourism Financial Services Consumer Electronics Healthcare Real Estate Education Others |

| By Sales Channel | Direct Sales Online Marketplaces (e.g., Takealot, Makro, Superbalist) Social Media Platforms (e.g., Facebook, Instagram, X) Affiliate Networks Programmatic Platforms Others |

| By Audience Targeting | Demographic Targeting Behavioral Targeting Contextual Targeting Retargeting Geo-targeting Others |

| By Format | Text Ads Image Ads Video Ads Interactive Ads (including AR/VR) Shoppable Content Others |

| By Device | Mobile Devices (Smartphones) Desktop Computers Tablets Smart TVs Others |

| By Industry Vertical | E-commerce Healthcare Education Real Estate FMCG Entertainment & Media Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Retail Advertising Strategies | 120 | Marketing Directors, Digital Strategists |

| Consumer Engagement in E-commerce | 100 | Online Shoppers, User Experience Designers |

| Performance Metrics for Digital Campaigns | 80 | Data Analysts, Campaign Managers |

| Trends in Retail Media Networks | 70 | Media Buyers, Brand Managers |

| Impact of Social Media Advertising | 90 | Social Media Managers, Content Creators |

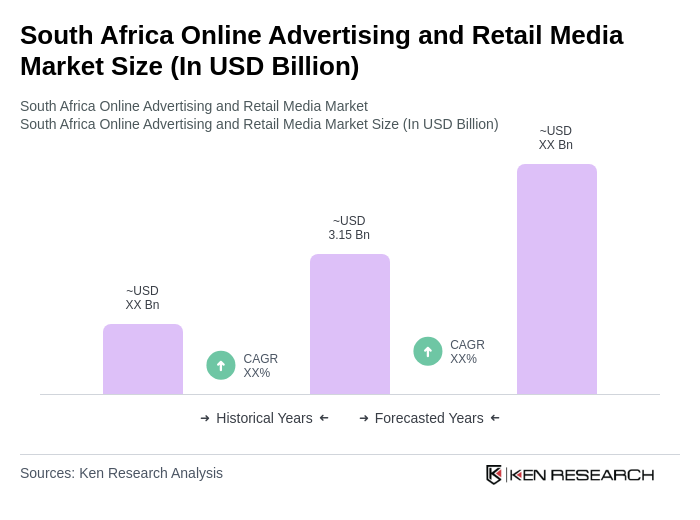

The South Africa Online Advertising and Retail Media Market is valued at approximately USD 3.15 billion, reflecting significant growth driven by increased internet penetration, mobile device usage, and the rise of e-commerce.