Region:Asia

Author(s):Rebecca

Product Code:KRAA4568

Pages:86

Published On:September 2025

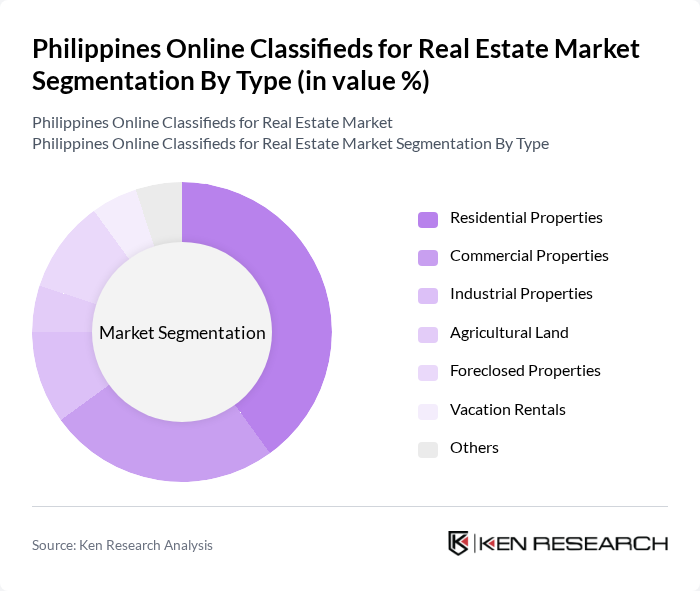

By Type:The market segmentation by type includes categories such asResidential Properties, Commercial Properties, Industrial Properties, Agricultural Land, Foreclosed Properties, Vacation Rentals, and Others. Each subsegment addresses distinct consumer needs—residential for homebuyers, commercial for businesses, industrial for logistics and manufacturing, agricultural for rural investments, foreclosed for value-seeking buyers, vacation rentals for short-term stays, and others for niche property types. This reflects the diverse nature of the Philippine real estate market.

TheResidential Propertiessubsegment dominates the market, driven by increasing demand for housing due to urban migration, population growth, and rising middle-class aspirations. First-time homebuyers and families seeking affordable options are significant contributors. The proliferation of online platforms enables buyers to access listings, compare prices, and make informed decisions, further boosting the residential property market.

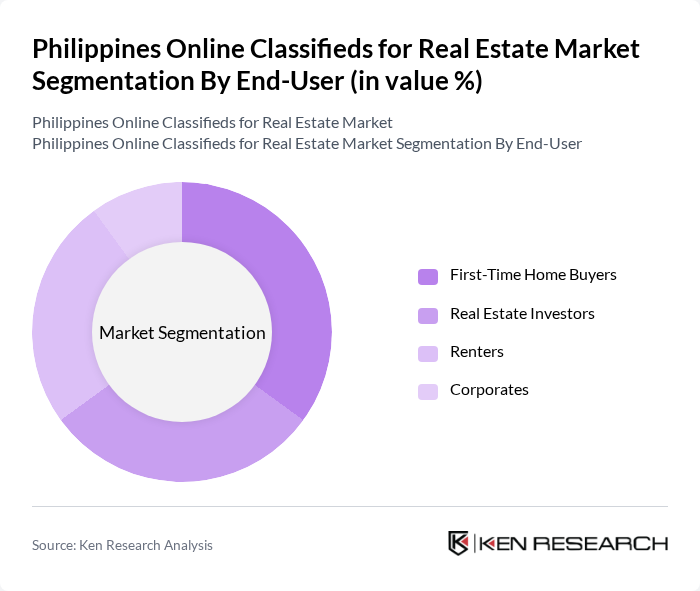

By End-User:The end-user segmentation includesFirst-Time Home Buyers, Real Estate Investors, Renters, and Corporates. First-time home buyers are motivated by favorable financing options and government incentives, while investors seek rental yields and capital appreciation. Renters look for flexible, affordable housing, and corporates require commercial and office spaces for expansion. These groups shape market dynamics and drive demand across property types.

First-Time Home Buyersrepresent the leading subsegment, driven by accessible mortgage products, government-backed housing programs, and the desire for personal space amid urbanization. This demographic increasingly relies on online platforms for property searches, simplifying navigation and decision-making. Urbanization and rising household incomes further fuel this segment's growth.

The Philippines Online Classifieds for Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lamudi Philippines, Property24 Philippines, OLX Philippines (now part of Carousell), ZipMatch, MyProperty.ph, Carousell Philippines, Dot Property Philippines, Hoppler, Pinnacle Real Estate Consulting Services, Point Blue, TheFlats, MyTown, Woke Coliving, The Communal, CoLiving Philippines contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Philippines online classifieds for real estate market appears promising, driven by technological advancements and changing consumer behaviors. As digital literacy improves, more users are expected to engage with online platforms. Additionally, the integration of innovative technologies such as virtual tours and augmented reality will enhance user experiences, making property viewing more accessible. The market is likely to see increased collaboration between online platforms and traditional real estate agents, creating a more comprehensive service offering for consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Properties Commercial Properties Industrial Properties Agricultural Land Foreclosed Properties Vacation Rentals Others |

| By End-User | First-Time Home Buyers Real Estate Investors Renters Corporates |

| By Sales Channel | Online Platforms Real Estate Agents Direct Sales Auctions |

| By Price Range | Below PHP 1 Million PHP 1 Million - PHP 5 Million PHP 5 Million - PHP 10 Million Above PHP 10 Million |

| By Location | Metro Manila Luzon Visayas Mindanao |

| By Property Condition | New Properties Pre-Owned Properties Renovated Properties |

| By Financing Options | Cash Purchases Bank Financing Pag-IBIG Financing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Real Estate Agents | 100 | Licensed Real Estate Brokers, Sales Agents |

| Property Developers | 80 | Project Managers, Marketing Directors |

| Homebuyers | 120 | First-time Buyers, Investors |

| Real Estate Analysts | 40 | Market Researchers, Economic Analysts |

| Online Classifieds Users | 90 | Active Users, Casual Browsers |

The Philippines Online Classifieds for Real Estate Market is valued at approximately USD 90 billion, driven by increasing internet penetration, mobile technology adoption, and the growth of PropTech solutions, enhancing accessibility and transparency in property listings.