Region:Asia

Author(s):Shubham

Product Code:KRAD6749

Pages:99

Published On:December 2025

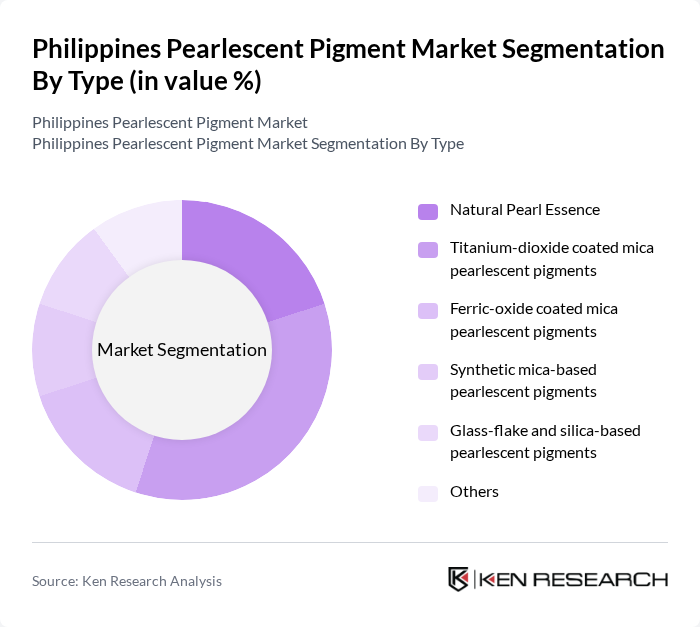

By Type:The pearlescent pigment market can be segmented into various types, including Natural Pearl Essence, Titanium-dioxide coated mica pearlescent pigments, Ferric-oxide coated mica pearlescent pigments, Synthetic mica-based pearlescent pigments, Glass-flake and silica-based pearlescent pigments, and Others. This typology is consistent with global industry classification, where titanium dioxide mica and iron/ferric oxide mica are among the most widely used pearlescent pigment categories in coatings, plastics, and cosmetics.

The Titanium-dioxide coated mica pearlescent pigments segment dominates the market due to their superior light-scattering properties, high hiding power, and versatility in applications such as automotive topcoats, industrial coatings, and color cosmetics, which is aligned with global product leadership of titanium dioxide mica in the pearlescent pigment market. This type of pigment is favored for its ability to provide vibrant colors, pearly luster, and a high-quality finish, matching consumer trends towards premium and visually differentiated products in both automotive finishes and beauty products. Additionally, the growing automotive and transportation coatings demand in the Philippines, supported by increasing vehicle sales and assembly activities, has contributed to higher consumption of special-effect and pearlescent coatings, thereby sustaining demand for titanium-dioxide coated mica pigments.

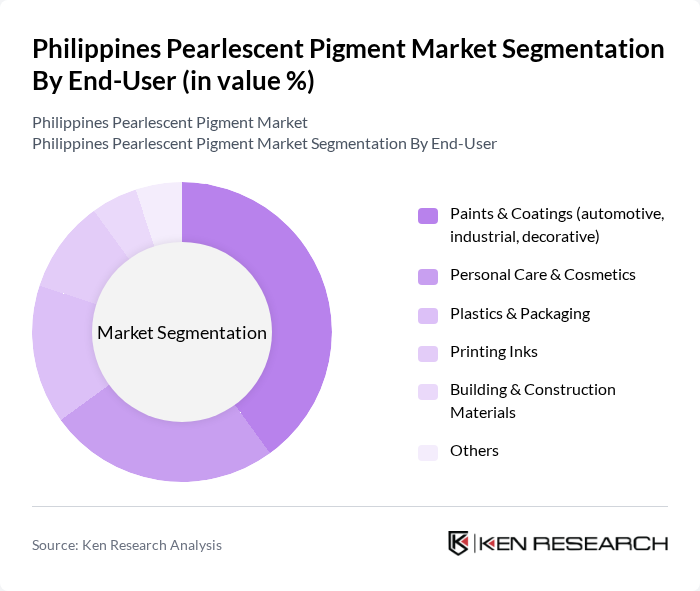

By End-User:The pearlescent pigment market is segmented by end-user industries, including Paints & Coatings (automotive, industrial, decorative), Personal Care & Cosmetics, Plastics & Packaging, Printing Inks, Building & Construction Materials, and Others. This segmentation reflects the core global application areas of pearlescent pigments, where paints and coatings, plastics, and cosmetics are consistently the largest demand centers.

The Paints & Coatings segment is the leading end-user in the market, consistent with global patterns where coatings represent the largest application share for pearlescent pigments, particularly in automotive OEM and refinish, industrial, and decorative coatings. In the Philippines, growth in construction activity and infrastructure investment, together with rising demand for automotive and industrial coatings, supports higher consumption of effect pigments in paints and protective finishes. Additionally, the decorative coatings market is expanding as consumers increasingly favor paints and finishes that offer unique visual effects and enhanced durability, while the personal care and cosmetics segment benefits from strong social media and retail trends towards luminous and shimmering formulations that often rely on pearlescent pigments.

The Philippines Pearlescent Pigment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Merck KGaA (EMD Performance Materials / Effect Pigments), BASF SE, DIC Corporation, ECKART GmbH (ALTANA Group), Sudarshan Chemical Industries Ltd., Kuncai Pigment Co., Ltd., Clariant AG, The Shepherd Color Company, KOBO Products, Inc., Nabaltec AG, CQV Co., Ltd., Nippon Sheet Glass Co., Ltd. (glass-flake effect pigments), Venator Materials PLC, Guangzhou Yortay Fine Chemicals Co., Ltd., TKB Trading, LLC contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines pearlescent pigment market is poised for significant growth, driven by increasing demand across various sectors, particularly automotive and cosmetics. As consumer preferences shift towards sustainable and innovative products, manufacturers are likely to invest in research and development to create eco-friendly pigments. Additionally, the rise of e-commerce platforms will facilitate broader market access, enabling companies to reach a wider audience and enhance their distribution channels, ultimately contributing to market expansion.

| Segment | Sub-Segments |

|---|---|

| By Type | Natural Pearl Essence Titanium-dioxide coated mica pearlescent pigments Ferric-oxide coated mica pearlescent pigments Synthetic mica-based pearlescent pigments Glass-flake and silica-based pearlescent pigments Others |

| By End-User | Paints & Coatings (automotive, industrial, decorative) Personal Care & Cosmetics Plastics & Packaging Printing Inks Building & Construction Materials Others |

| By Application | Automotive OEM and refinish coatings Architectural and decorative coatings Industrial coatings and powder coatings Cosmetics (color cosmetics, skin care, personal wash) Plastics masterbatches and compounding Printing inks and packaging Others |

| By Distribution Channel | Direct sales to key accounts (OEMs and large converters) Local distributors and chemical traders Regional importers and agents Online and e-commerce channels Others |

| By Region | Luzon Visayas Mindanao |

| By Product Form | Powder Liquid dispersions Paste and slurry Granules Others |

| By Customer Type | B2B – coatings, plastics, and ink manufacturers B2B – cosmetics and personal care manufacturers B2C – DIY and small-scale users Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Coatings | 120 | Product Managers, Quality Control Engineers |

| Cosmetic Applications | 90 | Brand Managers, R&D Specialists |

| Plastics and Polymers | 80 | Procurement Managers, Production Supervisors |

| Construction Materials | 70 | Architects, Material Engineers |

| Specialty Coatings | 100 | Sales Directors, Technical Support Staff |

The Philippines Pearlescent Pigment Market is valued at approximately USD 12 million, reflecting a five-year historical analysis. This growth is driven by increasing demand across various sectors, including automotive coatings, cosmetics, and packaging.