Region:Asia

Author(s):Rebecca

Product Code:KRAD7524

Pages:90

Published On:December 2025

By Type of Polymer Membrane:

The market for polymer membranes is predominantly led by Proton Exchange Membranes (PEM), which are widely used in fuel cells because of their high ionic conductivity, compactness, and efficiency in converting chemical to electrical energy for stationary and distributed power applications. Growing interest in hydrogen and fuel cell projects across transport and backup power segments reinforces PEM usage as a key membrane technology in the country. Anion Exchange Membranes (AEM) are also gaining traction globally due to their potential for lower system costs, use of non-precious metal catalysts, and improving performance in emerging alkaline fuel cell and electrolysis applications, which supports their rising share in advanced energy storage and power-to-X systems.

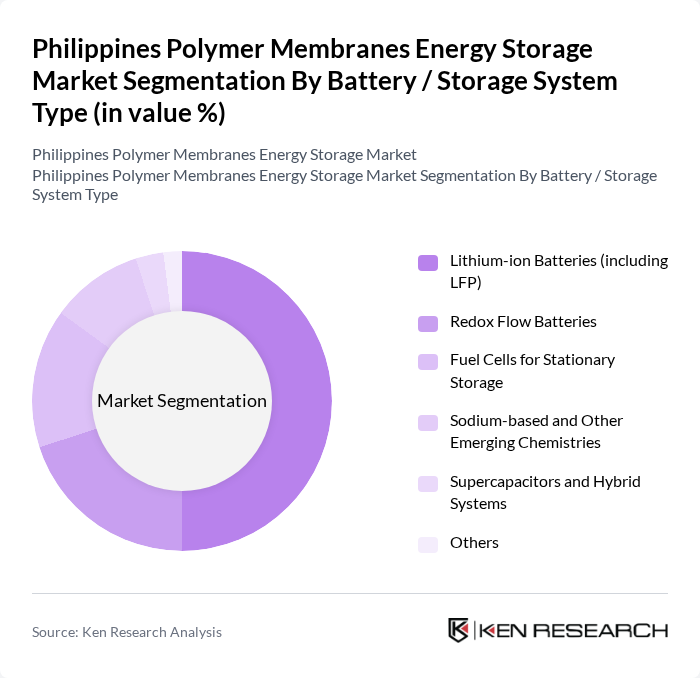

By Battery / Storage System Type:

Lithium-ion batteries dominate the energy storage market due to their high energy density, improving cycle life, fast response, and rapidly decreasing costs supported by global manufacturing scale, and they are the core technology in the Philippines for residential, commercial and industrial, and utility-scale battery energy storage systems. The widespread adoption of solar PV plus storage in households and businesses, along with grid-connected BESS for ancillary services and peak shaving, has further fueled demand for lithium iron phosphate and other lithium-ion chemistries. Redox flow batteries are emerging as a competitive alternative for large-scale and long-duration energy storage because of their independent scaling of power and energy, long cycle life, and safety advantages, making them attractive for renewable integration and microgrid applications. The growing interest in sustainable and resource-diverse energy solutions is also driving innovation in sodium-based batteries and other emerging chemistries, which aim to reduce dependence on critical minerals while supporting grid-scale and distributed storage use cases.

The Philippines Polymer Membranes Energy Storage Market is characterized by a dynamic mix of regional and international players. Leading participants such as ACEN Corporation (AC Energy), Aboitiz Power Corporation, SMC Global Power Holdings Corp., Manila Electric Company (Meralco) / Meralco PowerGen Corp., Energy Development Corporation (EDC), First Gen Corporation, Solar Philippines Power Project Holdings, Inc., Philippine National Oil Company – Renewables Corporation (PNOC RC), AES Corporation (Philippines Operations), Fluence Energy, Inc., Tesla, Inc. (Energy Storage Solutions), LG Energy Solution, Ltd., Samsung SDI Co., Ltd., Sumitomo Electric Industries, Ltd., Nippon Chemical Industrial Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines' polymer membranes energy storage market is poised for significant growth, driven by increasing investments in renewable energy and technological advancements. As the government continues to implement supportive policies and incentives, the market is expected to attract more players and innovations. Additionally, the rising focus on energy efficiency and sustainability will further propel the adoption of polymer membranes, making them integral to the country's energy landscape in the future.

| Segment | Sub-Segments |

|---|---|

| By Type of Polymer Membrane | Proton Exchange Membranes (PEM) Anion Exchange Membranes (AEM) Cation Exchange Membranes Porous Polymeric Separator Membranes Solid Polymer Electrolyte (SPE) Membranes Others (Composite/Hybrid Polymer Membranes) |

| By Battery / Storage System Type | Lithium-ion Batteries (including LFP) Redox Flow Batteries Fuel Cells for Stationary Storage Sodium-based and Other Emerging Chemistries Supercapacitors and Hybrid Systems Others |

| By Application | Front-of-the-Meter Grid-Scale Storage Behind-the-Meter Commercial & Industrial (C&I) Residential Energy Storage Systems Renewable Integration (Solar + Storage, Wind + Storage) Microgrids & Remote / Islanded Systems Electric Mobility Charging Infrastructure & EV Fleets Others |

| By End-User | Utilities & Power Generators Commercial & Industrial Facilities Residential Prosumer Segment Government, Public Sector & Critical Infrastructure Transportation & Logistics Operators Others |

| By Installation Type | New-Build Storage Projects Retrofit & Hybridization of Existing Power Plants Distributed Rooftop and Building-Integrated Systems Containerized / Modular Storage Systems Others |

| By Procurement Model | CAPEX Purchase (Owner-Operated) Energy Storage-as-a-Service (ESaaS) Power Purchase Agreements (PPAs) & Tolling Public–Private Partnership (PPP) Projects Donor / Climate Finance & Multilateral Funding Others |

| By Region | Luzon Visayas Mindanao |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Polymer Membrane Manufacturers | 100 | Production Managers, R&D Directors |

| Energy Storage Solution Providers | 80 | Sales Managers, Technical Consultants |

| Government Regulatory Bodies | 40 | Policy Makers, Energy Analysts |

| Academic Institutions and Research Organizations | 60 | Researchers, Professors in Energy Studies |

| End-users in Renewable Energy Sector | 70 | Project Managers, Sustainability Officers |

The Philippines Polymer Membranes Energy Storage Market is valued at approximately USD 1.3 billion, reflecting significant growth driven by the increasing deployment of battery energy storage systems and the rising demand for renewable energy solutions.