Region:Asia

Author(s):Dev

Product Code:KRAC1934

Pages:90

Published On:October 2025

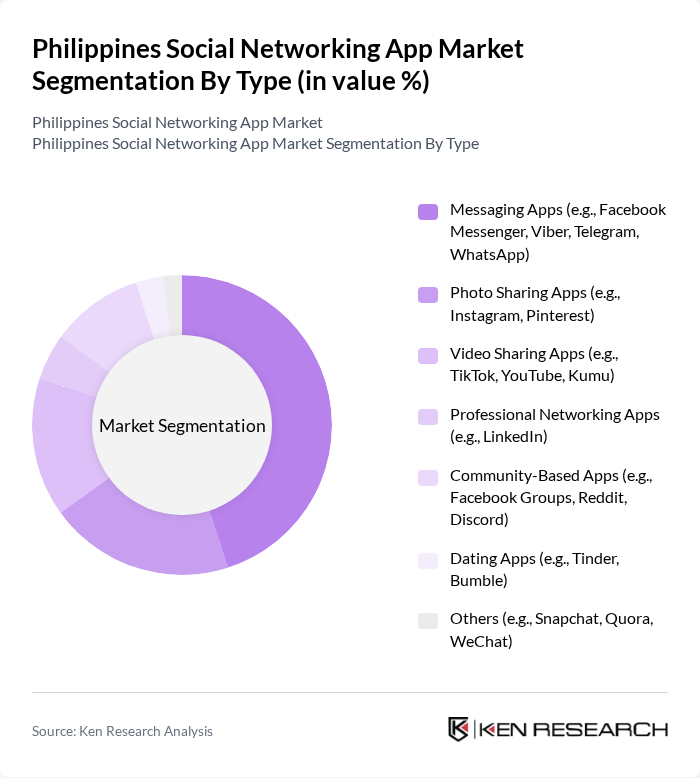

By Type:The market is segmented into various types of social networking applications, each catering to different user needs and preferences. The dominant sub-segment is Messaging Apps, which have gained immense popularity due to their real-time communication features and user-friendly interfaces. Photo Sharing Apps and Video Sharing Apps also hold significant market shares, driven by the increasing trend of visual content consumption among users. Community-Based Apps are gaining traction as they foster user engagement through shared interests and discussions. Messaging and video-sharing platforms such as Facebook Messenger, TikTok, and YouTube are among the most widely used, reflecting the Filipino preference for instant communication and short-form video content .

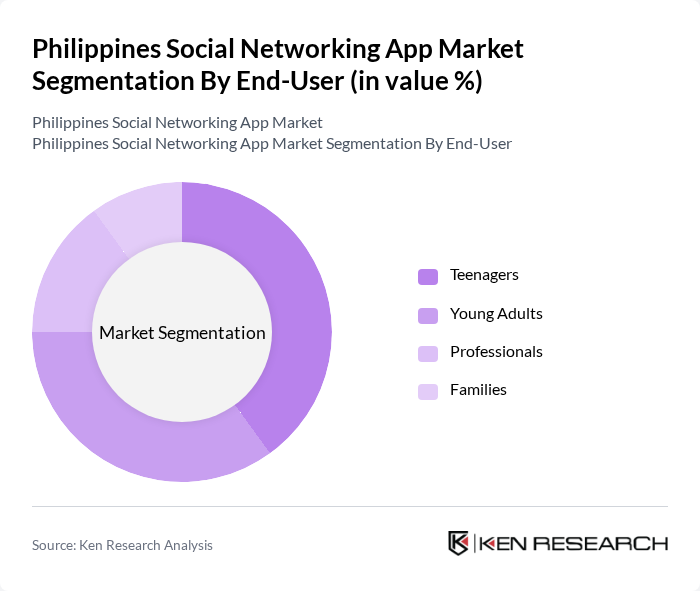

By End-User:The end-user segmentation highlights the diverse demographics engaging with social networking apps. Teenagers and Young Adults are the primary users, driven by their inclination towards social interaction and content sharing. Professionals utilize these platforms for networking and career advancement, while Families engage for communication and sharing family moments. The increasing digital literacy among all age groups is contributing to the overall growth of the market. The Philippines' youthful population and mobile-first habits drive high engagement rates, with teenagers and young adults accounting for the majority of active users .

The Philippines Social Networking App Market is characterized by a dynamic mix of regional and international players. Leading participants such as Meta Platforms, Inc. (Facebook, Messenger, Instagram, WhatsApp), TikTok Pte. Ltd., Snap Inc. (Snapchat), LinkedIn Corporation, Pinterest, Inc., Kumu, Inc., Viber Media S.à r.l., Telegram Messenger LLP, Discord, Inc., Reddit, Inc., Quora, Inc., Tencent Holdings Ltd. (WeChat), Match Group, Inc. (Tinder, Bumble), Bigo Technology Pte. Ltd. (Bigo Live), YouTube LLC (Google) contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines social networking app market is poised for significant evolution, driven by technological advancements and changing user preferences. As video content continues to dominate, platforms that integrate innovative features such as augmented reality will likely attract more users. Additionally, the increasing demand for localized content will encourage developers to tailor their offerings, enhancing user engagement. These trends indicate a dynamic market landscape, where adaptability and user-centric strategies will be essential for success.

| Segment | Sub-Segments |

|---|---|

| By Type | Messaging Apps (e.g., Facebook Messenger, Viber, Telegram, WhatsApp) Photo Sharing Apps (e.g., Instagram, Pinterest) Video Sharing Apps (e.g., TikTok, YouTube, Kumu) Professional Networking Apps (e.g., LinkedIn) Community-Based Apps (e.g., Facebook Groups, Reddit, Discord) Dating Apps (e.g., Tinder, Bumble) Others (e.g., Snapchat, Quora, WeChat) |

| By End-User | Teenagers Young Adults Professionals Families |

| By User Engagement Level | Active Users Inactive Users New Users |

| By Monetization Model | Subscription-Based Ad-Supported Freemium |

| By Geographic Reach | National Regional Local |

| By Content Type | Text-Based Content Visual Content Audio Content |

| By Device Type | Mobile Devices Tablets Desktops |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| General User Engagement | 100 | Active Social Media Users, Ages 18-35 |

| Business Use of Social Networking | 60 | Small Business Owners, Marketing Managers |

| Influencer Marketing Insights | 50 | Social Media Influencers, Content Creators |

| Advertising Effectiveness | 70 | Digital Marketing Professionals, Brand Managers |

| User Experience Feedback | 40 | Casual Users, Tech-Savvy Individuals |

The Philippines Social Networking App Market is valued at approximately USD 730 million, driven by factors such as increasing smartphone penetration, rising internet accessibility, and a growing youth demographic actively engaging in social media platforms.