Region:Asia

Author(s):Shubham

Product Code:KRAC2219

Pages:89

Published On:October 2025

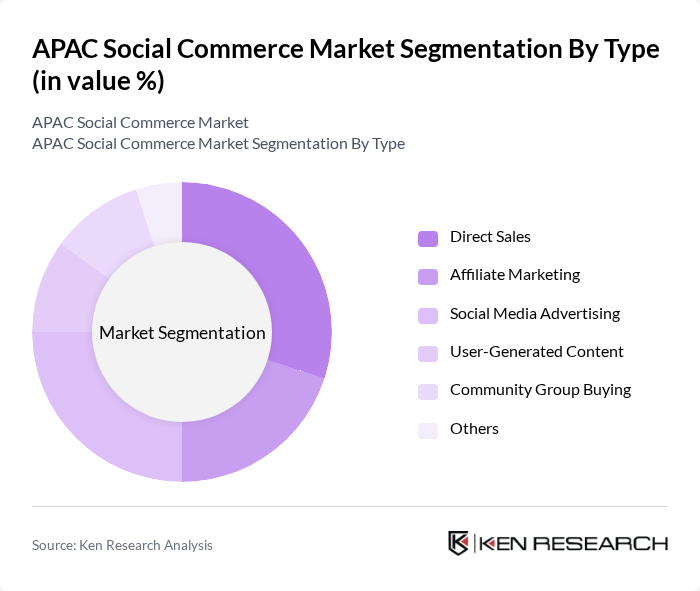

By Type:The segmentation by type includes various methods through which social commerce is conducted. The subsegments are Direct Sales, Affiliate Marketing, Social Media Advertising, User-Generated Content, Community Group Buying, and Others. Each of these subsegments plays a crucial role in shaping the market dynamics, with specific trends and consumer behaviors influencing their growth. Direct sales and social media advertising are particularly prominent, driven by influencer partnerships and integrated shopping features on leading platforms .

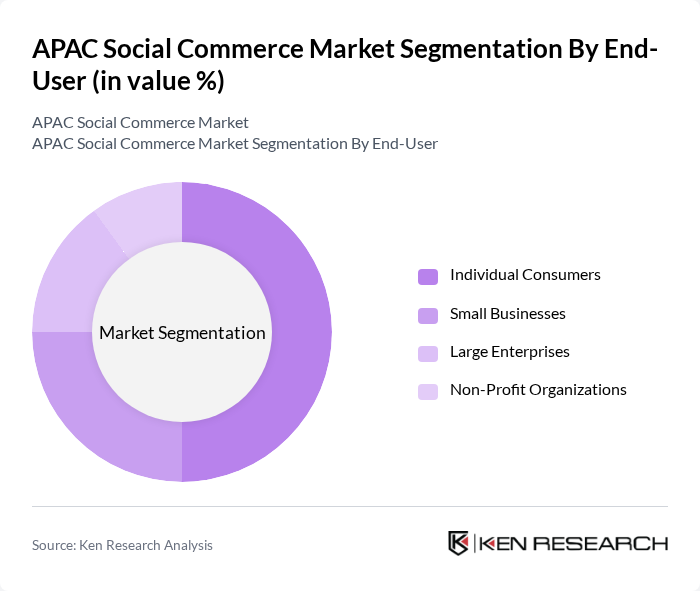

By End-User:The end-user segmentation includes Individual Consumers, Small Businesses, Large Enterprises, and Non-Profit Organizations. Each of these segments has unique needs and behaviors that influence their engagement with social commerce platforms, driving the overall market growth. Individual consumers represent the largest segment, reflecting the consumer-centric nature of social commerce, while small businesses increasingly leverage these platforms for cost-effective customer acquisition .

The APAC Social Commerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alibaba Group, Meta Platforms, Inc. (Facebook), Instagram (Meta Platforms, Inc.), TikTok (ByteDance Ltd.), Pinterest, Inc., WeChat (Tencent Holdings Ltd.), Shopee (Sea Limited), Lazada (Alibaba Group), LINE Corporation, Kuaishou Technology, Zalo (VNG Corporation), Grab Holdings Limited, Meituan, Rakuten Group, Inc., JD.com, Inc., Pinduoduo (PDD Holdings), Douyin (ByteDance Ltd.), Kakao Corp., Coupang, Inc., Myntra (Flipkart Group) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the APAC social commerce market appears promising, driven by technological advancements and evolving consumer preferences. As mobile penetration continues to rise, businesses are likely to invest in innovative solutions such as augmented reality and live shopping events. Additionally, the integration of artificial intelligence will enhance personalization, allowing brands to tailor their offerings to individual consumer needs. This dynamic environment will foster growth and create new avenues for engagement and sales in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Direct Sales Affiliate Marketing Social Media Advertising User-Generated Content Community Group Buying Others |

| By End-User | Individual Consumers Small Businesses Large Enterprises Non-Profit Organizations |

| By Region | China Southeast Asia East Asia South Asia Oceania |

| By Sales Channel | Social Media Platforms E-commerce Websites Mobile Applications Livestream Commerce Others |

| By Product Category | Fashion and Apparel Beauty and Personal Care Electronics Home and Living Food & Grocery Others |

| By Payment Method | Credit/Debit Cards Digital Wallets Bank Transfers Cash on Delivery Buy Now, Pay Later (BNPL) |

| By Marketing Strategy | Influencer Collaborations Content Marketing Paid Advertising Organic Social Media Growth Livestream Shopping Events |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Social Commerce Platform Users | 120 | Active Users, Digital Marketing Managers |

| SME Retailers Engaged in Social Commerce | 90 | Business Owners, Marketing Executives |

| Consumer Behavior in Social Commerce | 140 | General Consumers, Online Shoppers |

| Influencers and Content Creators | 80 | Social Media Influencers, Brand Ambassadors |

| Logistics and Supply Chain Managers | 60 | Logistics Coordinators, Supply Chain Analysts |

The APAC Social Commerce Market is valued at approximately USD 625 billion, driven by smartphone penetration, social media growth, and online shopping trends. This market is expected to continue expanding as social commerce integrates more with e-commerce platforms.