Region:Asia

Author(s):Rebecca

Product Code:KRAB5865

Pages:82

Published On:October 2025

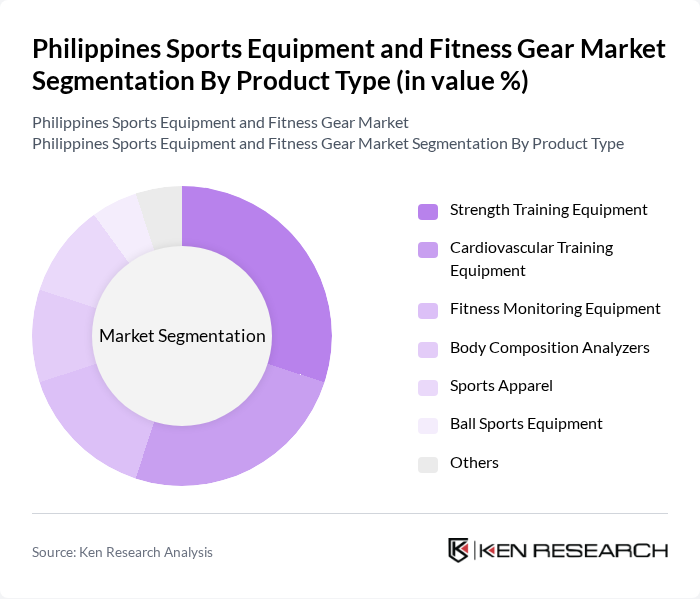

By Product Type:The market is segmented into various product types, including Strength Training Equipment, Cardiovascular Training Equipment, Fitness Monitoring Equipment, Body Composition Analyzers, Sports Apparel, Ball Sports Equipment, and Others. Among these, Strength Training Equipment is currently dominating the market due to the increasing popularity of weight training and bodybuilding among fitness enthusiasts. The growing preference for multifunctional and smart fitness equipment, as well as the rising demand for sustainable and performance-oriented sports apparel, are also notable trends shaping the product landscape .

By End-User:The end-user segmentation includes Health Clubs/Gyms, Home Consumers, Corporates, Hotels, Public Institutions, and Hospital & Medical Centers. Health Clubs/Gyms are the leading segment, driven by the increasing number of fitness centers and the growing trend of group fitness classes. Individual consumers and educational institutions also represent significant segments, reflecting the broadening appeal of fitness and sports activities across different demographics .

The Philippines Sports Equipment and Fitness Gear Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nike Philippines, Adidas Philippines, Decathlon Philippines, Under Armour Philippines, PUMA Philippines, ASICS Philippines, New Balance Philippines, Reebok Philippines, Mizuno Philippines, Skechers Philippines, Columbia Sportswear Philippines, The North Face Philippines, Wilson Sporting Goods Philippines, Toby's Sports, Sports Central contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Philippines sports equipment and fitness gear market appears promising, driven by increasing health awareness and the expansion of fitness facilities. As more Filipinos embrace active lifestyles, the demand for innovative and sustainable fitness products is expected to rise. Additionally, the integration of technology in fitness gear will likely enhance user experiences, making workouts more engaging. The market is poised for growth as local manufacturers adapt to these trends and capitalize on emerging opportunities.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Strength Training Equipment Cardiovascular Training Equipment Fitness Monitoring Equipment Body Composition Analyzers Sports Apparel Ball Sports Equipment Others |

| By End-User | Health Clubs/Gyms Home Consumers Corporates Hotels Public Institutions Hospital & Medical Centers |

| By Distribution Channel | Retail Stores Specialty & Sports Shops Online Supermarket/Hypermarket Departmental & Discount Stores |

| By Usage | Commercial Residential |

| By Type | Indoor Outdoor |

| By Buyer | Individuals Institutions |

| By Gender | Male Female |

| By Material (Sports Apparel) | Synthetic Natural |

| By Application | Body Building Physical Fitness Weight Loss Mental Fitness |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sports Equipment Sales | 120 | Store Managers, Sales Representatives |

| Fitness Center Equipment Usage | 100 | Gym Owners, Fitness Instructors |

| Consumer Fitness Gear Purchases | 120 | Fitness Enthusiasts, Casual Gym Goers |

| Online Fitness Equipment Market | 100 | E-commerce Managers, Digital Marketing Specialists |

| Health and Fitness Trends | 80 | Health Coaches, Nutritionists |

The Philippines Sports Equipment and Fitness Gear Market is valued at approximately USD 570 million, reflecting a significant growth trend driven by increasing health consciousness and the expansion of fitness facilities across the country.