Region:Asia

Author(s):Rebecca

Product Code:KRAB1766

Pages:97

Published On:October 2025

By Product Type:The market is segmented into various product types, including fitness equipment, sports apparel, footwear, accessories, team sports equipment, individual sports equipment, and outdoor & adventure equipment. Among these, fitness equipment and sports apparel are the leading segments, driven by the increasing trend of home workouts and the growing popularity of athleisure wear. The demand for fitness equipment has surged as more individuals opt for home-based fitness solutions, while sports apparel continues to gain traction due to its versatility and comfort. Sports apparel is particularly dominant in urban markets, with synthetic materials and men’s categories leading sales.

By End-User:The end-user segmentation includes individual consumers, gyms and fitness centers, schools and educational institutions, corporate offices, and sports clubs & associations. Individual consumers represent the largest segment, driven by the increasing number of health-conscious individuals investing in personal fitness. Gyms and fitness centers also play a significant role, as they require a wide range of equipment to cater to their clientele, further boosting the market. The youth segment, in particular, is a major driver for sports apparel and accessories, with urban online channels seeing robust growth.

The Indonesia Sports Equipment and Fitness Gear Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT. League Indonesia (League), PT. Eagle Indo Pharma (Eagle), PT. Berca Sportindo (Specs), PT. Panarub Industry (Ardiles), PT. Mitra Adiperkasa Tbk (MAP Active), PT. Planet Sports Asia, Adidas AG, Nike Inc., Puma SE, Decathlon S.A., Under Armour Inc., Asics Corporation, Wilson Sporting Goods, Mizuno Corporation, New Balance Athletics, Inc., The North Face, Inc., Reebok International Ltd., Skechers USA, Inc., Columbia Sportswear Company, Li-Ning Company Limited, Anta Sports Products Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesian sports equipment and fitness gear market appears promising, driven by increasing health consciousness and a vibrant fitness culture. As more consumers seek innovative and technologically advanced products, companies are likely to invest in smart fitness solutions and eco-friendly materials. Additionally, the expansion of e-commerce platforms will facilitate greater access to a wider range of products, enhancing consumer engagement and driving sales growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Fitness Equipment (e.g., treadmills, stationary bikes, ellipticals, free weights) Sports Apparel (e.g., jerseys, shorts, leggings, compression wear) Footwear (e.g., running shoes, training shoes, sports-specific shoes) Accessories (e.g., yoga mats, resistance bands, water bottles, gloves) Team Sports Equipment (e.g., footballs, basketballs, volleyballs, nets, goalposts) Individual Sports Equipment (e.g., badminton rackets, tennis rackets, golf clubs, table tennis bats) Outdoor & Adventure Equipment (e.g., bicycles, hiking gear, camping equipment) |

| By End-User | Individual Consumers Gyms and Fitness Centers Schools and Educational Institutions Corporate Offices Sports Clubs & Associations |

| By Sales Channel | Online Retail (e-commerce platforms, brand websites) Offline Retail (specialty stores, department stores, hypermarkets/supermarkets) Direct Sales (brand outlets, pop-up stores) Distributors & Dealers |

| By Price Range | Budget Mid-range Premium |

| By Brand Origin | Local Brands International Brands Emerging/Private Label Brands |

| By Usage | Professional Use Recreational Use Training & Wellness Use |

| By Distribution Mode | Direct Distribution Indirect Distribution E-commerce Platforms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sports Equipment Sales | 100 | Store Managers, Sales Representatives |

| Fitness Center Equipment Procurement | 80 | Fitness Center Owners, Equipment Buyers |

| Consumer Fitness Gear Purchases | 120 | Fitness Enthusiasts, Casual Gym Goers |

| Online Sports Equipment Retail | 60 | E-commerce Managers, Digital Marketing Specialists |

| Sports Equipment Manufacturing Insights | 50 | Production Managers, Quality Control Officers |

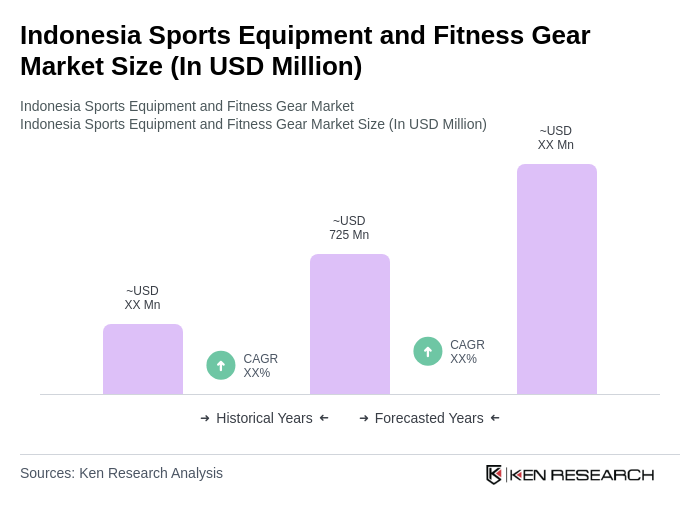

The Indonesia Sports Equipment and Fitness Gear Market is valued at approximately USD 725 million, driven by increasing health consciousness, rising disposable incomes, and a growing trend towards fitness and wellness activities among the population.