Region:Asia

Author(s):Shubham

Product Code:KRAD0967

Pages:84

Published On:November 2025

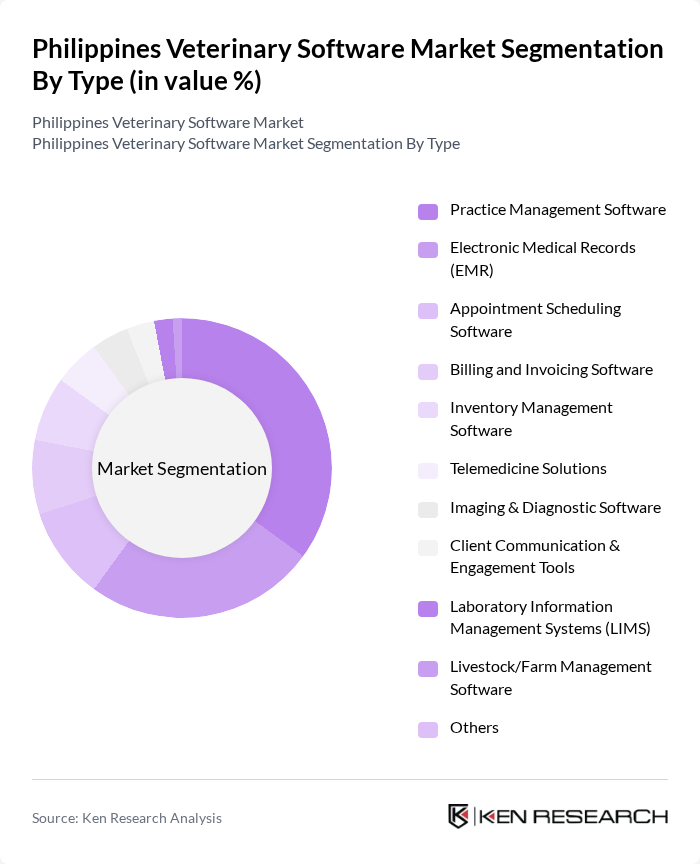

By Type:The market is segmented into various types of software solutions that cater to the diverse needs of veterinary practices. The leading sub-segment is Practice Management Software, which streamlines operations, enhances client communication, and improves overall efficiency. Electronic Medical Records (EMR) are also gaining traction as they facilitate better patient data management. The increasing adoption of telemedicine solutions is reshaping the landscape, allowing veterinarians to provide remote consultations and follow-ups. Cloud-based platforms, mobile-enabled solutions, and interoperability with diagnostic partners are key trends driving adoption among small and mid-sized clinics .

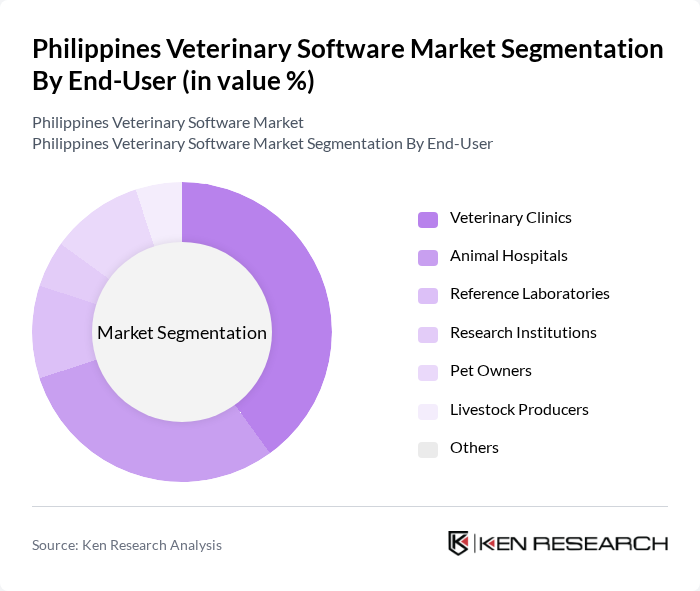

By End-User:The end-user segmentation highlights the various stakeholders utilizing veterinary software solutions. Veterinary Clinics represent the largest segment, driven by the increasing number of small to medium-sized practices seeking efficient management tools. Animal Hospitals follow closely, as they require comprehensive software for patient management and record-keeping. The growing trend of pet ownership has also led to a rise in software adoption among Pet Owners, who seek better health management for their pets. Reference laboratories and research institutions are increasingly adopting laboratory information management systems and diagnostic platforms to support advanced testing and reporting .

The Philippines Veterinary Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as IDEXX Laboratories, Covetrus (AVImark, eVetPractice, Cornerstone), Vetter Software, Vetstoria, PetDesk, Vetspire, ClienTrax, Animal Intelligence Software, VIA Information Systems, DaySmart Vet (formerly Vetter Software), Shepherd Veterinary Software, PetPro Connect, VetSuccess, Pawfinity, VetCheck contribute to innovation, geographic expansion, and service delivery in this space.

The future of the veterinary software market in the Philippines appears promising, driven by increasing pet ownership and a growing emphasis on animal health. As more veterinary practices recognize the importance of technology in enhancing service delivery, the adoption of software solutions is expected to rise. Additionally, the integration of telemedicine and AI technologies will likely transform veterinary care, making it more accessible and efficient, thus fostering a more robust market environment in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Practice Management Software Electronic Medical Records (EMR) Appointment Scheduling Software Billing and Invoicing Software Inventory Management Software Telemedicine Solutions Imaging & Diagnostic Software Client Communication & Engagement Tools Laboratory Information Management Systems (LIMS) Livestock/Farm Management Software Others |

| By End-User | Veterinary Clinics Animal Hospitals Reference Laboratories Research Institutions Pet Owners Livestock Producers Others |

| By Size of Practice | Small Practices (1-3 veterinarians) Medium Practices (4-9 veterinarians) Large Practices (10+ veterinarians) Corporate Veterinary Groups Others |

| By Deployment Type | On-Premise Solutions Cloud-Based Solutions Hybrid Solutions Mobile-Based Solutions Others |

| By Geographic Coverage | Metro Manila Luzon (excluding NCR) Visayas Mindanao Others |

| By Customer Type | Individual Practitioners Corporate Veterinary Groups Non-Profit Organizations Government Agencies Others |

| By Service Type | Consultation Services Emergency Services Routine Care Services Specialty Services (e.g., Surgery, Imaging) Telehealth/Remote Consultation Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Veterinary Clinics | 100 | Veterinarians, Clinic Managers |

| Animal Hospitals | 60 | Veterinary Technicians, Administrative Staff |

| Pet Care Providers | 40 | Pet Groomers, Trainers |

| Veterinary Software Vendors | 40 | Product Managers, Sales Executives |

| Veterinary Associations | 20 | Association Leaders, Policy Makers |

The Philippines Veterinary Software Market is valued at approximately USD 5 million, reflecting a growing demand for efficient veterinary practices and advanced healthcare solutions for animals, driven by increased pet ownership and technological integration in veterinary services.