Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7346

Pages:92

Published On:December 2025

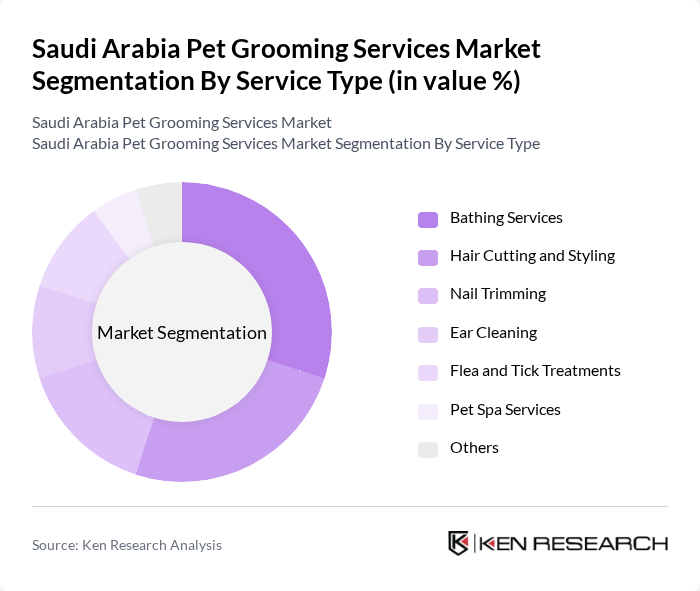

By Service Type:The service type segmentation includes various grooming services that cater to the needs of pets. The primary services offered in this market are bathing services, hair cutting and styling, nail trimming, ear cleaning, flea and tick treatments, pet spa services, and others. Among these, bathing services and hair cutting and styling are the most sought-after, as they are essential for maintaining pet hygiene and appearance, particularly for dogs which dominate the segment. The demand for specialized services like pet spa treatments is also on the rise, reflecting a growing trend towards pampering pets.

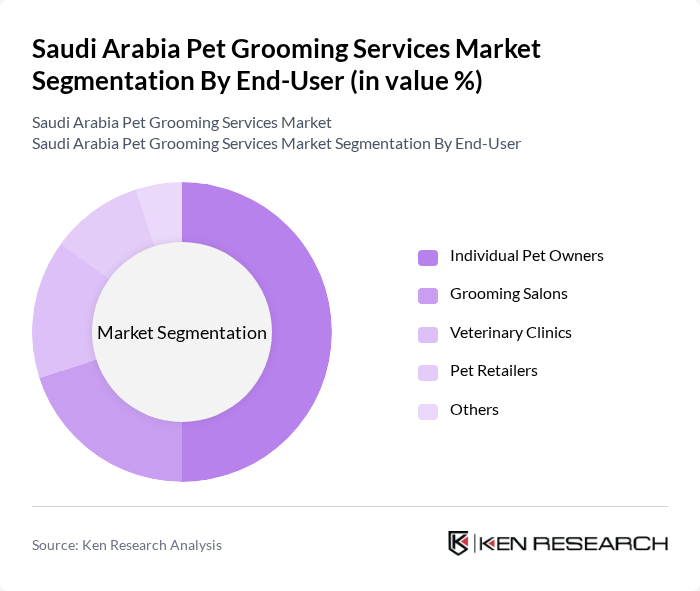

By End-User:The end-user segmentation encompasses various customer categories utilizing pet grooming services. This includes individual pet owners, grooming salons, veterinary clinics, pet retailers, and others. Individual pet owners represent the largest segment, driven by the increasing number of households owning pets and their willingness to invest in professional grooming services. Grooming salons and veterinary clinics also play a significant role, providing specialized services and attracting a loyal customer base.

The Saudi Arabia Pet Grooming Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Pet Arabia, Maskan Arabia, Pet Oasis, Al Hayat Veterinary Supplies, Pet Line, LucaLand, VetPlus, Beaphar, Bio-Groom, TropiClean, FURminator, Wahl Clipper Corporation, Hartz Mountain Corporation, John Paul Pet, Burt's Bees for Pets contribute to innovation, geographic expansion, and service delivery in this space.

The future of the pet grooming services market in Saudi Arabia appears promising, driven by increasing pet ownership and rising disposable incomes. As consumers become more aware of the importance of pet health and hygiene, the demand for professional grooming services is expected to grow. Additionally, the integration of technology in grooming services, such as online booking and mobile apps, will enhance customer convenience and engagement, further propelling market expansion in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Bathing Services Hair Cutting and Styling Nail Trimming Ear Cleaning Flea and Tick Treatments Pet Spa Services Others |

| By End-User | Individual Pet Owners Grooming Salons Veterinary Clinics Pet Retailers Others |

| By Pet Type | Dogs Cats Others |

| By Service Frequency | Regular Grooming Occasional Grooming One-time Grooming Others |

| By Geographic Distribution | Central Region (Riyadh) Western Region (Jeddah, Mecca) Eastern Region (Dammam, Khobar) Northern Region (Tabuk, others) Southern Region (Abha, others) |

| By Pricing Model | Fixed Pricing Subscription-Based Pricing Pay-Per-Service Pricing Others |

| By Distribution Channel | Online Retail Specialty Stores Supermarkets & Hypermarkets Veterinary Clinics Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pet Grooming Service Providers | 100 | Business Owners, Service Managers |

| Pet Owners in Urban Areas | 120 | Pet Owners, Caregivers |

| Veterinarians and Pet Care Professionals | 80 | Veterinarians, Pet Trainers |

| Pet Supply Retailers | 70 | Store Managers, Product Buyers |

| Pet Industry Experts | 50 | Market Analysts, Consultants |

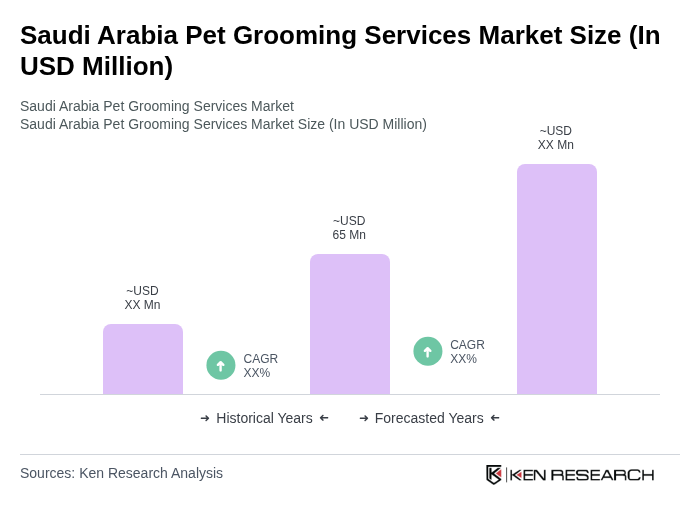

The Saudi Arabia Pet Grooming Services Market is valued at approximately USD 65 million, reflecting a significant growth driven by increasing pet ownership, rising disposable incomes, and heightened awareness of pet health and hygiene among consumers.