Region:Asia

Author(s):Geetanshi

Product Code:KRAE1957

Pages:96

Published On:February 2026

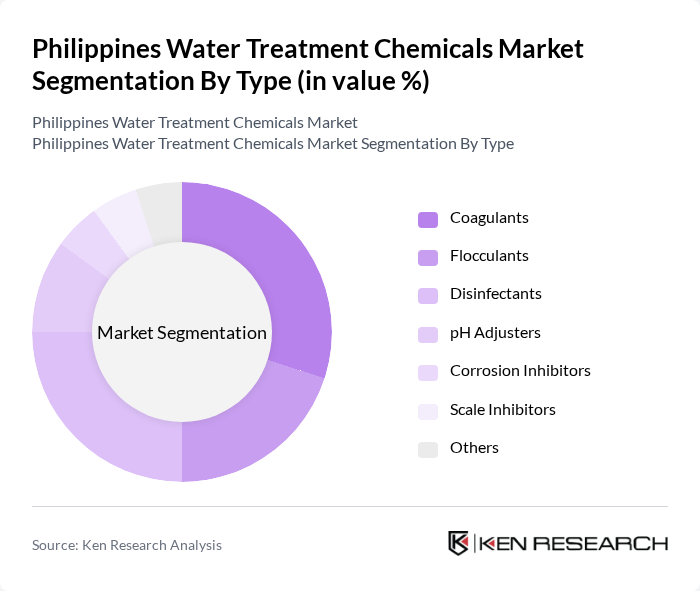

By Type:The market is segmented into various types of water treatment chemicals, including coagulants, flocculants, disinfectants, pH adjusters, corrosion inhibitors, scale inhibitors, and others. Among these, coagulants and disinfectants are the most widely used due to their essential roles in ensuring water quality and safety. The increasing focus on public health and environmental sustainability has led to a surge in the adoption of these chemicals across various sectors.

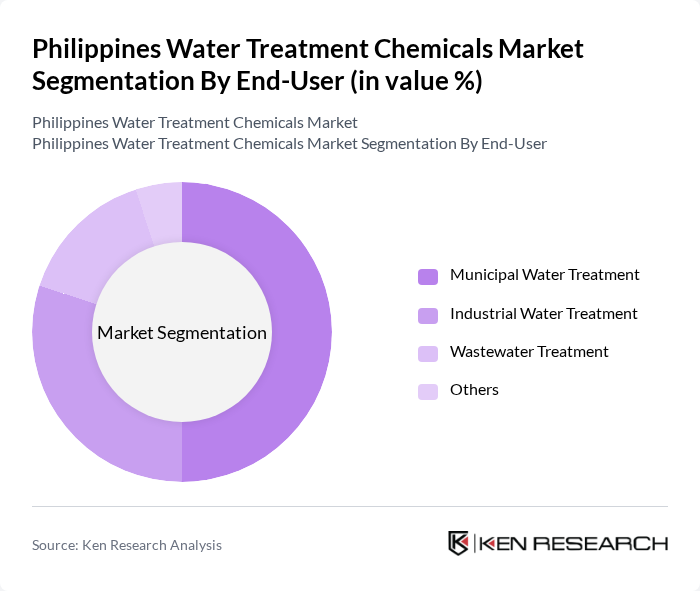

By End-User:The end-user segmentation includes municipal water treatment, industrial water treatment, wastewater treatment, and others. Municipal water treatment is the leading segment, driven by the need for safe drinking water and compliance with government regulations. The industrial sector also plays a significant role, as industries require treated water for various processes, further boosting the demand for water treatment chemicals.

The Philippines Water Treatment Chemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF Philippines, Ecolab Philippines, Chemtrade Logistics, Kurita Water Industries, SNF Floerger, Solenis, Veolia Water Technologies, Dow Chemical Company, AkzoNobel, SUEZ Water Technologies, Nalco Water, Orion Engineered Carbons, American Vanguard Corporation, AECOM, Hach Company contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines water treatment chemicals market is poised for growth as the government intensifies efforts to combat water pollution and improve public health. With increasing investments in infrastructure and a shift towards sustainable practices, companies are likely to adopt eco-friendly chemicals and advanced technologies. The integration of IoT in water management systems will enhance efficiency and monitoring capabilities, driving innovation. As urbanization continues, the demand for customized water treatment solutions will also rise, creating a dynamic market landscape in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Coagulants Flocculants Disinfectants pH Adjusters Corrosion Inhibitors Scale Inhibitors Others |

| By End-User | Municipal Water Treatment Industrial Water Treatment Wastewater Treatment Others |

| By Application | Drinking Water Treatment Industrial Process Water Treatment Wastewater Treatment Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Luzon Visayas Mindanao |

| By Technology | Membrane Filtration Chemical Treatment Biological Treatment Others |

| By Policy Support | Government Subsidies Tax Incentives Grants for Research and Development Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Municipal Water Treatment Facilities | 120 | Water Treatment Plant Managers, Chemical Procurement Officers |

| Industrial Water Treatment Applications | 100 | Facility Managers, Environmental Compliance Officers |

| Chemical Suppliers and Distributors | 80 | Sales Managers, Product Development Specialists |

| Regulatory Bodies and Environmental Agencies | 60 | Policy Makers, Environmental Scientists |

| Research Institutions and Academia | 40 | Researchers, Professors in Environmental Science |

The Philippines Water Treatment Chemicals Market is valued at approximately USD 45 million, driven by urbanization, industrial activities, and the increasing need for clean drinking water, alongside stringent environmental regulations and rising concerns over water scarcity and contamination.