Region:Global

Author(s):Geetanshi

Product Code:KRAE1963

Pages:97

Published On:February 2026

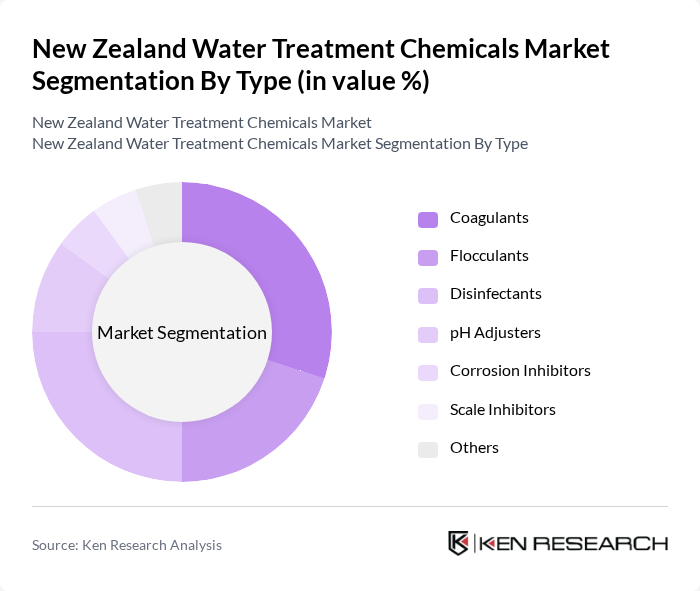

By Type:The market is segmented into various types of water treatment chemicals, including coagulants, flocculants, disinfectants, pH adjusters, corrosion inhibitors, scale inhibitors, and others. Among these, coagulants and disinfectants are the most widely used due to their critical roles in ensuring water safety and quality. The demand for these chemicals is driven by municipal and industrial water treatment needs, as well as regulatory compliance.

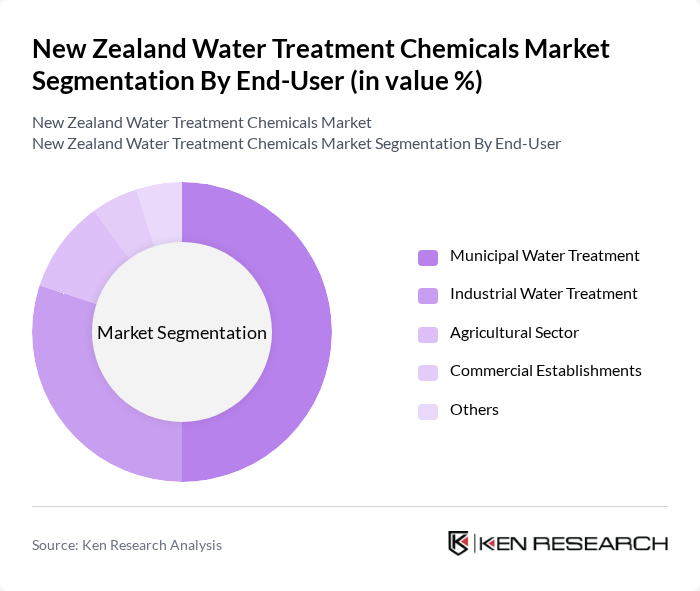

By End-User:The end-user segmentation includes municipal water treatment, industrial water treatment, agricultural sector, commercial establishments, and others. Municipal water treatment is the leading segment, driven by the need for safe drinking water and compliance with health regulations. Industrial water treatment follows closely, as industries require effective water management solutions to meet operational and environmental standards.

The New Zealand Water Treatment Chemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Orica Watercare, Chemtrade Logistics, Kurita Water Industries, Ecolab, BASF, Veolia Water Technologies, SUEZ Water Technologies, Xylem Inc., AkzoNobel, Dow Chemical Company, SNF Floerger, Solenis, AECOM, Pentair, Nalco Water contribute to innovation, geographic expansion, and service delivery in this space.

The future of the New Zealand water treatment chemicals market appears promising, driven by increasing investments in infrastructure and a growing emphasis on sustainability. As the government continues to prioritize clean water initiatives, the market is likely to see enhanced collaboration between public and private sectors. Additionally, the adoption of smart water management technologies is expected to streamline operations, improve efficiency, and reduce costs, positioning the market for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Coagulants Flocculants Disinfectants pH Adjusters Corrosion Inhibitors Scale Inhibitors Others |

| By End-User | Municipal Water Treatment Industrial Water Treatment Agricultural Sector Commercial Establishments Others |

| By Application | Drinking Water Treatment Wastewater Treatment Process Water Treatment Cooling Water Treatment Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Outlets Others |

| By Region | North Island South Island Others |

| By Chemical Composition | Organic Chemicals Inorganic Chemicals Biochemical Treatments Others |

| By Regulatory Compliance | Local Regulations International Standards Environmental Compliance Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Municipal Water Treatment Facilities | 45 | Water Treatment Managers, Environmental Engineers |

| Industrial Water Treatment Applications | 40 | Plant Managers, Chemical Procurement Officers |

| Water Quality Regulatory Bodies | 25 | Regulatory Compliance Officers, Policy Makers |

| Water Treatment Chemical Suppliers | 35 | Sales Managers, Product Development Specialists |

| Environmental Consultants | 30 | Consultants, Sustainability Advisors |

The New Zealand Water Treatment Chemicals Market is valued at approximately USD 140 million, reflecting a five-year historical analysis. This growth is driven by increasing environmental regulations, urbanization, and the demand for safe drinking water.