Region:Europe

Author(s):Geetanshi

Product Code:KRAB5725

Pages:97

Published On:October 2025

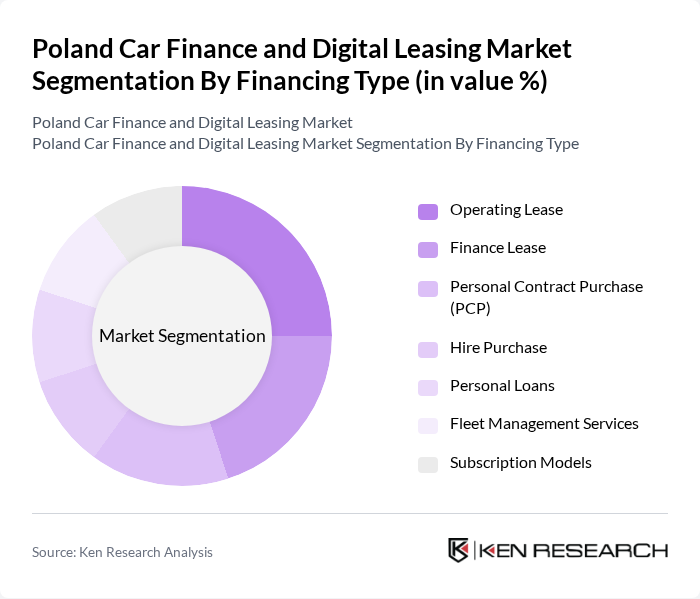

By Financing Type:The financing type segmentation includes various methods through which consumers and businesses can finance their vehicle acquisitions. The subsegments are Operating Lease, Finance Lease, Personal Contract Purchase (PCP), Hire Purchase, Personal Loans, Fleet Management Services, and Subscription Models. Each of these financing types caters to different consumer needs and preferences, with varying levels of flexibility and commitment. Personal car loans and operating leases have gained particular popularity among consumers due to their flexibility and affordability, while car subscription services are experiencing growing traction, especially among younger consumers who prefer access over ownership.

The Operating Lease segment is currently dominating the market due to its flexibility and lower upfront costs, making it an attractive option for both individuals and businesses. This financing type allows users to lease vehicles for a specified period without the burden of ownership, which is particularly appealing in urban areas where mobility needs are dynamic. The trend towards digital leasing platforms has further enhanced the appeal of operating leases, as they streamline the application and approval processes, making it easier for consumers to access these services.

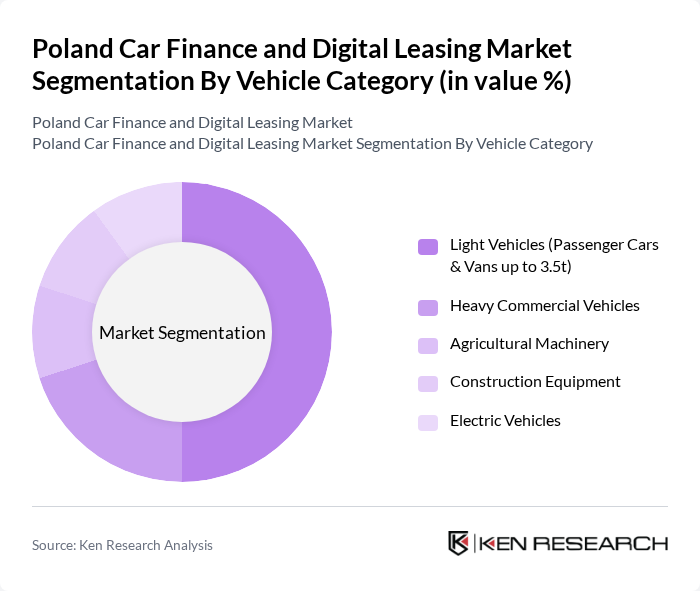

By Vehicle Category:The vehicle category segmentation encompasses various types of vehicles financed or leased in the market. The subsegments include Light Vehicles (Passenger Cars & Vans up to 3.5t), Heavy Commercial Vehicles, Agricultural Machinery, Construction Equipment, and Electric Vehicles. Each category serves distinct consumer needs, with light vehicles being the most popular due to their versatility and widespread use. Light vehicle financing has particularly benefited from resolved production and delivery issues, with passenger car sales reaching 551,500 units, the highest in five years, supported by dealer and manufacturer discounts.

Light Vehicles dominate the market, accounting for a significant share due to their high demand among individual consumers and small businesses. The increasing urbanization and the need for personal mobility have led to a surge in the acquisition of passenger cars and vans. Additionally, the growing trend towards electric vehicles is gradually reshaping the landscape, as consumers become more environmentally conscious and seek sustainable options. However, heavy vehicle financing has experienced decline due to challenging conditions for transport companies, with trailer and semi-trailer financing down by 22% and tractor-trailer financing falling by 25%, while construction equipment financing has shown resilience with 22% growth.

The Poland Car Finance and Digital Leasing Market is characterized by a dynamic mix of regional and international players. Leading participants such as PKO Leasing S.A., Santander Consumer Bank S.A., mLeasing Sp. z o.o., Getin Noble Bank S.A., Raiffeisen Leasing Polska S.A., Alior Bank S.A., Volkswagen Financial Services Polska Sp. z o.o., BMW Financial Services Polska Sp. z o.o., Mercedes-Benz Financial Services Polska Sp. z o.o., Toyota Bank Polska S.A. / Toyota Leasing Polska Sp. z o.o., LeasePlan Polska Sp. z o.o., Arval Service Lease Polska Sp. z o.o., Cetelem Bank S.A. Oddzia? w Polsce, BNP Paribas Leasing Services Polska Sp. z o.o., ING Lease Polska Sp. z o.o. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Poland car finance and digital leasing market appears promising, driven by technological advancements and changing consumer preferences. As digital platforms continue to evolve, the integration of AI and data analytics will enhance customer experiences and streamline financing processes. Furthermore, the increasing focus on sustainability will likely accelerate the adoption of electric vehicles, supported by government incentives. These trends indicate a dynamic market landscape, fostering innovation and growth opportunities for financial institutions and consumers alike.

| Segment | Sub-Segments |

|---|---|

| By Financing Type | Operating Lease Finance Lease Personal Contract Purchase (PCP) Hire Purchase Personal Loans Fleet Management Services Subscription Models |

| By Vehicle Category | Light Vehicles (Passenger Cars & Vans up to 3.5t) Heavy Commercial Vehicles Agricultural Machinery Construction Equipment Electric Vehicles |

| By End-User Segment | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporates Government and Public Sector |

| By Asset Type | New Vehicles Used Vehicles Green Assets (Electric/Hybrid) |

| By Contract Duration | Short-term (12-24 months) Medium-term (25-48 months) Long-term (49+ months) |

| By Distribution Channel | Direct Online Platforms Automotive Dealerships Bank Branches Broker Networks |

| By Service Model | Full-Service Leasing Finance-Only Leasing Maintenance Packages Insurance Integration |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Car Financing | 150 | Car Buyers, Financial Advisors |

| Digital Leasing Platforms | 100 | Platform Managers, IT Specialists |

| Automotive Dealership Financing | 80 | Dealership Owners, Sales Managers |

| Leasing Company Operations | 70 | Operations Managers, Risk Analysts |

| Consumer Attitudes towards Leasing | 90 | Leasing Customers, Market Researchers |

The Poland Car Finance and Digital Leasing Market is valued at approximately USD 28 billion, driven by increasing consumer demand for flexible financing options and the rise of digital platforms facilitating leasing processes.